Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

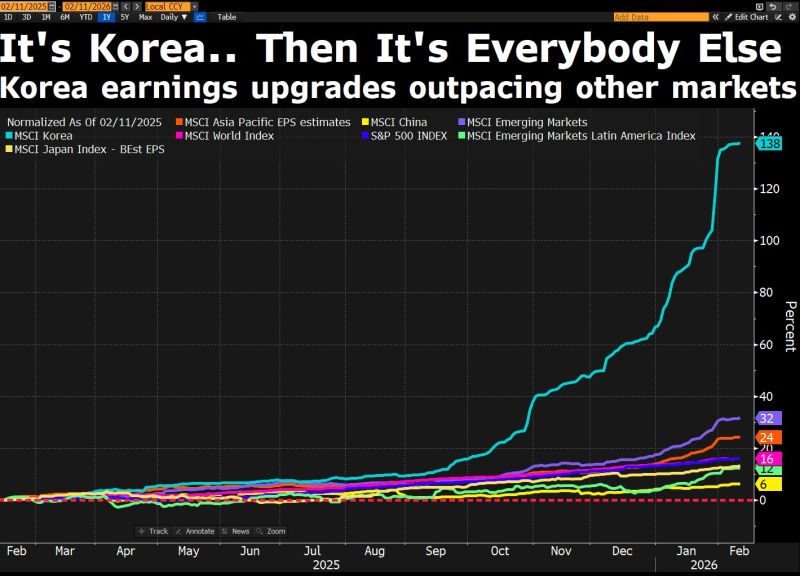

As far as the standout global earnings story is concerned, it's Korea... and then it's everybody else.

Source: David Ingles @DavidInglesTV

AI in China isn’t just "catching up"—it’s sprinting

China’s AI market is surging, fueled by government support and rapid innovation. Tech giants and startups like Zhipu AI and MiniMax are launching advanced models for coding and multimodal tasks, pushing the STAR AI Index up. The focus has shifted to agentic workflows and AI that can handle speech, visuals, and music, signaling a move beyond simple chat. With Premier Li Qiang calling for AI integration across all industries, China is narrowing the U.S. AI gap fast, making the global AI race more intense than ever. Source: CNBC

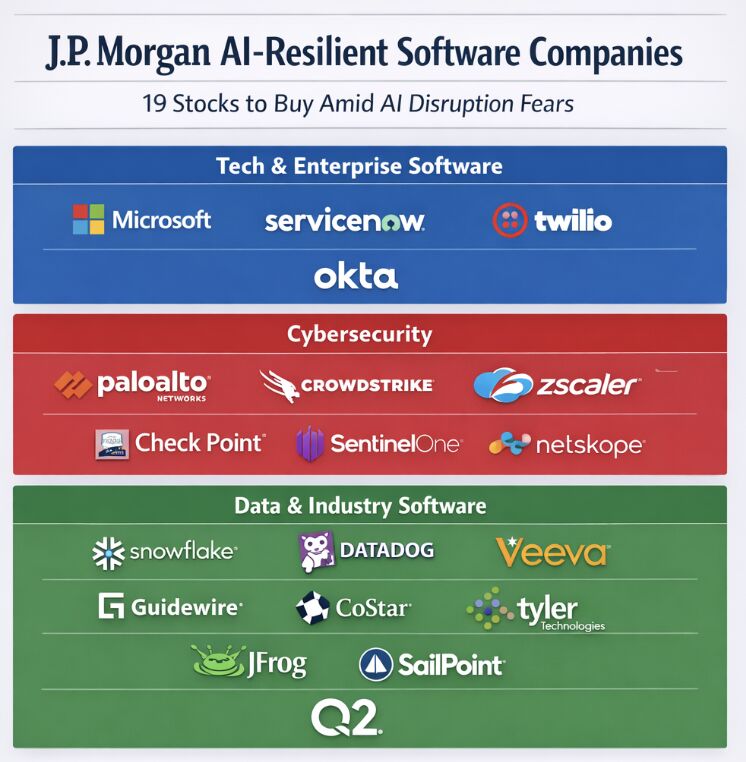

JP Morgan analysts just compiled a list of 19 software stocks that they believe 'are AI resistant'.

What do you think of their list? Source: Dividendology

TME: "Gold bounced cleanly off the 50-day and the longer-term trend line.

We’re now trading at the highest levels since that bounce, hovering around the 50% retracement of the large down candle. So far, this has been a textbook rebound as positioning resets. gold likely needs more time to consolidate. $5,200 stands out as major resistance, while $4,800 marks key support". Source: TME

The "Sell First, Ask Questions Later" Era is officially here.

Markets are panicking over AI replacing jobs and businesses—a trend called AI Displacement Anxiety. Investors aren’t just worried about current earnings; they’re fearing future obsolescence from AI that doesn’t even exist yet. Example: Commercial real estate giants ($CBRE, $JLL, $CWK) saw shares drop 15%+ because of AI fears, not actual competition.

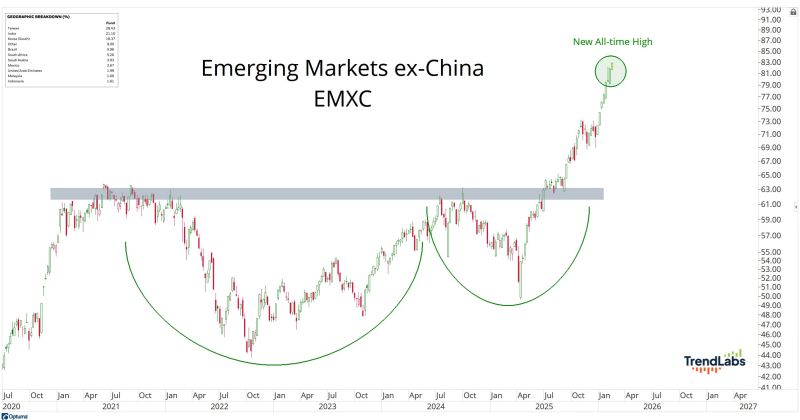

Emerging Markets Ex-China is up 50% in the past year and over 13% so far in 2026. New all-time highs again today.

Source: J.C. Parets @JC_ParetsX

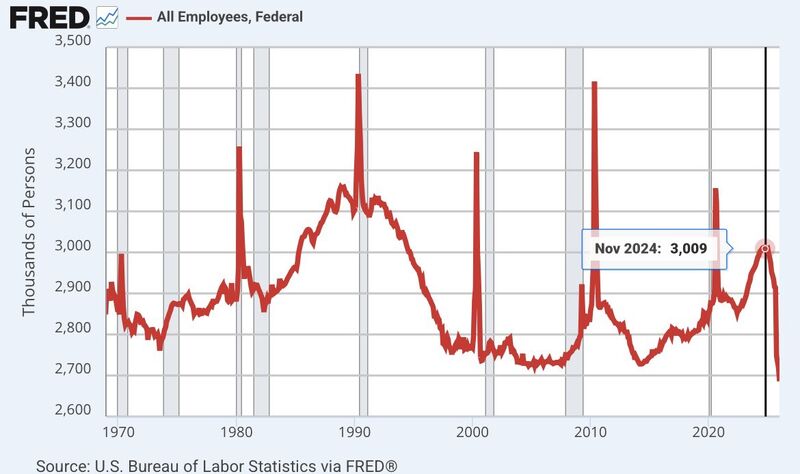

The number of federal government employees is now at it’s lowest level in 50+ years.

Dropped off a cliff after Trump was elected. Source: FRED, Geiger Capital

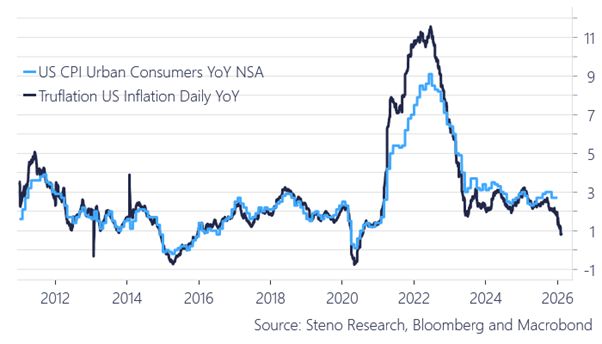

Will Truflation prove to be correct

Truflation is a digital, real-time alternative to government inflation numbers. Unlike the traditional CPI, which updates monthly and is based on a fixed “basket of goods,” Truflation tracks millions of prices daily from sources like Amazon, Zillow, and grocery stores. It’s faster, more reflective of actual spending, and transparent because it uses blockchain technology. This means you can see changes in prices almost immediately, giving a clearer picture of how your money’s value is changing in real time.

Investing with intelligence

Our latest research, commentary and market outlooks