Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

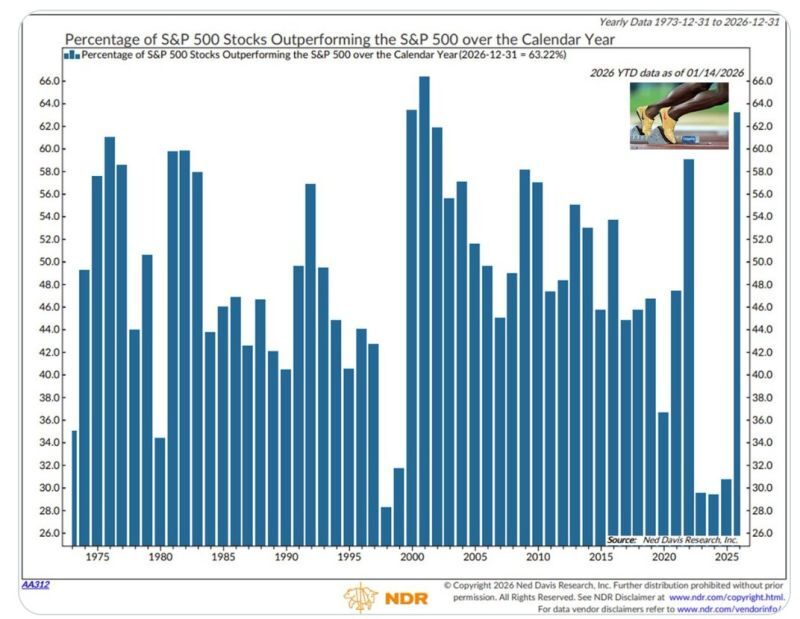

Everyone’s Winning. 63% of S&P 500 stocks are beating the index YTD (from NDR, as of Jan 14).

This is the best market participation since 2001. As of yesterday’s close, this number is now up to 65% the second best in 50 years. *Will the market’s strength continue? Source: Macro Charts @MacroCharts NDR

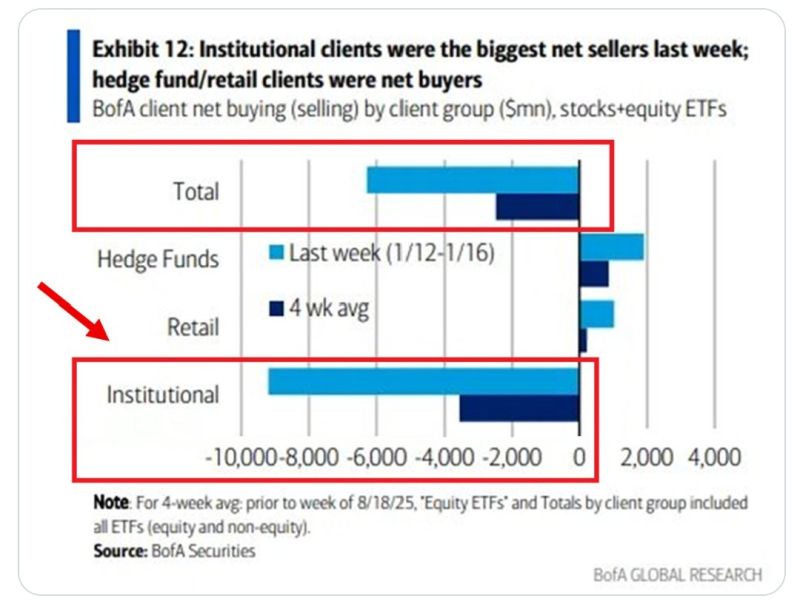

Institutional investors sold -$9.2 billion in US equities last week, marking the 5th straight week of selling.

They dumped -$8.1 billion in single stocks and $1.1 billion in ETFs, bringing the 4-week average to -$3.5 billion. On the other hand, hedge funds bought for a 5th consecutive week, while retail investors bought for the 2nd straight week. As a result, net selling rose to -$6.3 billion, from -$2.6 billion in the prior week. Source: BofA, Global Markets Investor

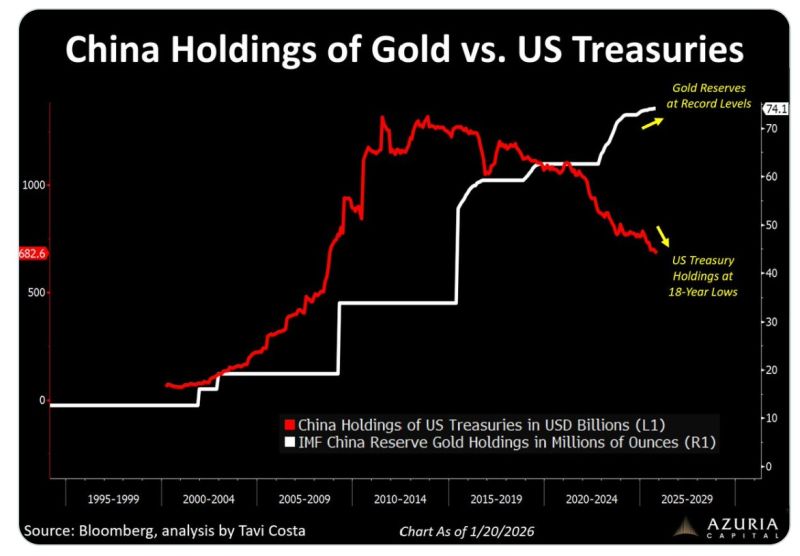

Gold is making new highs as a monetary realignment unfolds in real time

One chart says it all china’s Treasury holdings are at 18-year lows, while gold reserves are at all-time highs. Source: Tavi Costa, Bloomberg

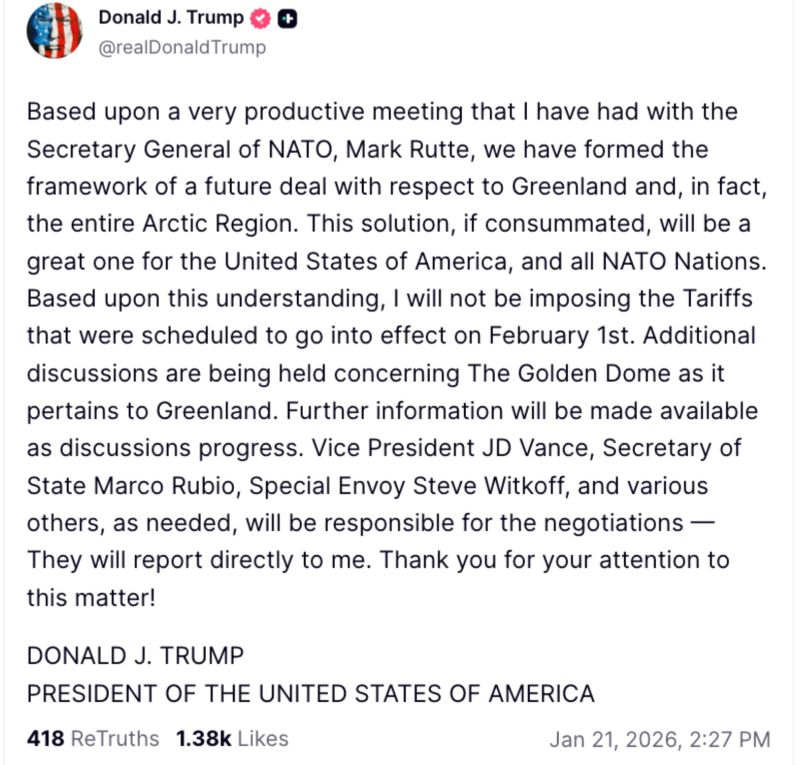

Trump says he reached Greenland deal ‘framework’ with NATO, backs off Europe tariffs

President Trump just said: "We have formed the framework of a future deal with respect to Greenland and, in fact, the entire Arctic Region" ... "Based upon this understanding, I will not be imposing the Tariffs that were scheduled to go into effect on February 1st." Dow rallies 750 points. Dollar up. 10-year US Treasury yield down. Silver down. Cryptos up. Source: @realDonaldTrump

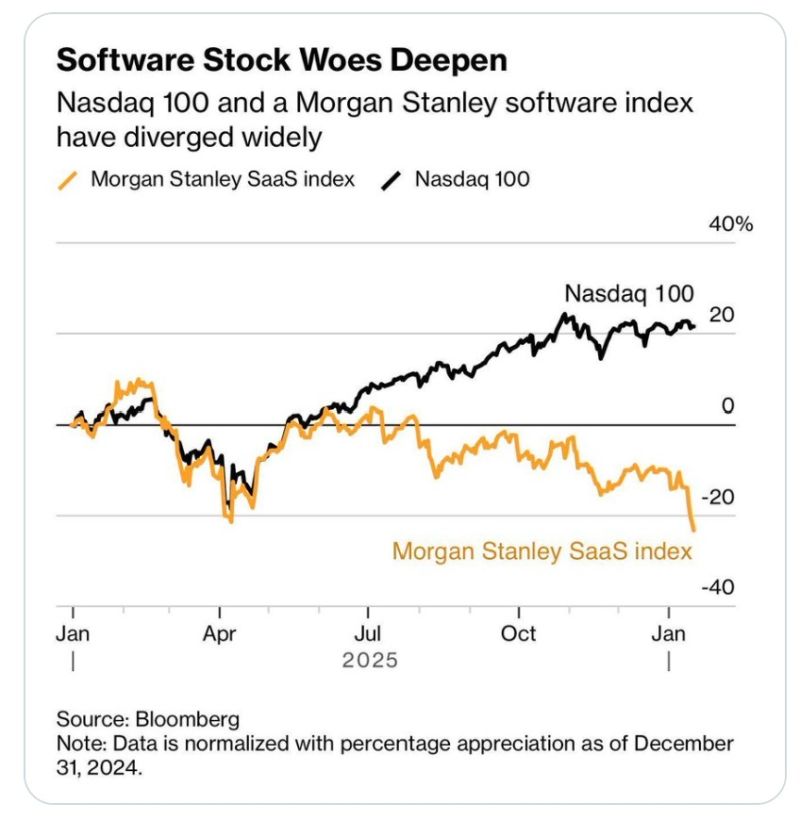

The "Great SaaS Meltdown" is here

For over a decade, tech rewarded growth over profits. That model no longer works. AI has fundamentally altered the risk calculus. High-growth, low-profit SaaS is now a liability, not a promise. AI-native competitors can undercut costs and reach scale faster, threatening legacy products before they ever achieve profitability. What once looked like a long runway now looks like a race against displacement. Investors are adapting accordingly. In private markets, VCs are pulling back from funding growth without durable moats. In public markets, profitability is no longer assumed—it must be visible and resilient. Capital is shifting from ambition to efficiency. The takeaway: selling the future is no longer enough. In an AI-native world, efficiency and resilience are prerequisites for survival. Source: Chamath Palihapitiya on X (@chamath)

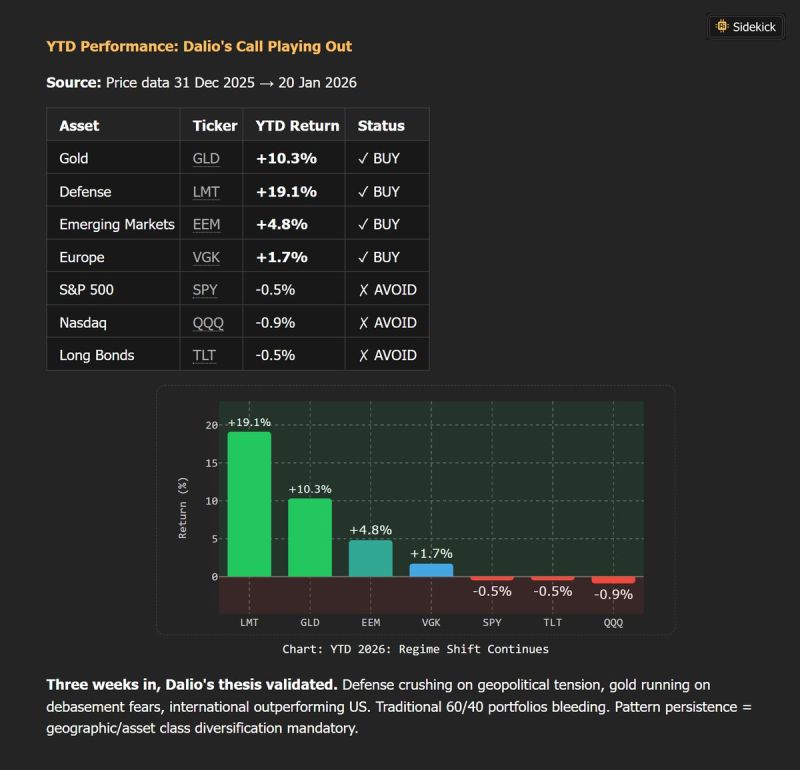

20 days into 2026 and the Dalio playbook is already crushing

Metals, Defense, EMs, Europe outperforming. US stocks and long bonds lagging. Source: TrendSpider TrendSpider LLC

S&P 500 $SPX remains stuck and continues trading the "eternal" range. Resistance 7000, supports: 6800, 6600 (futures)

Source: TME

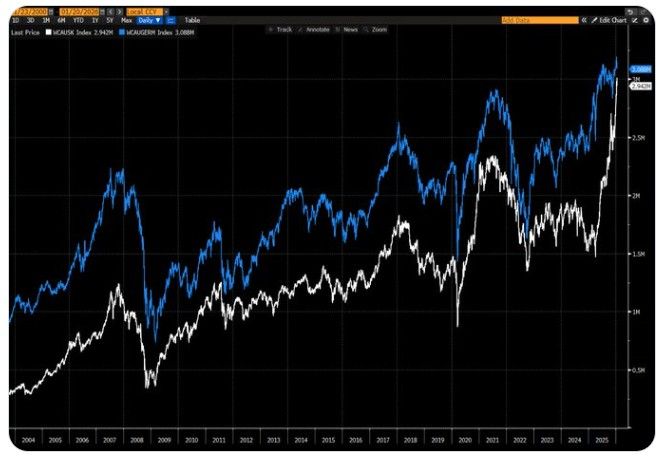

Korea's market cap (in white) is about to top Germany's (in blue) on this massive AI rally

Source: David Ingles, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks