Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

They used to be the same...

Imagine if $BTC still carries some of that aggregate investor psychology... The gap vs NASDAQ remains absolutely huge. Source: TME

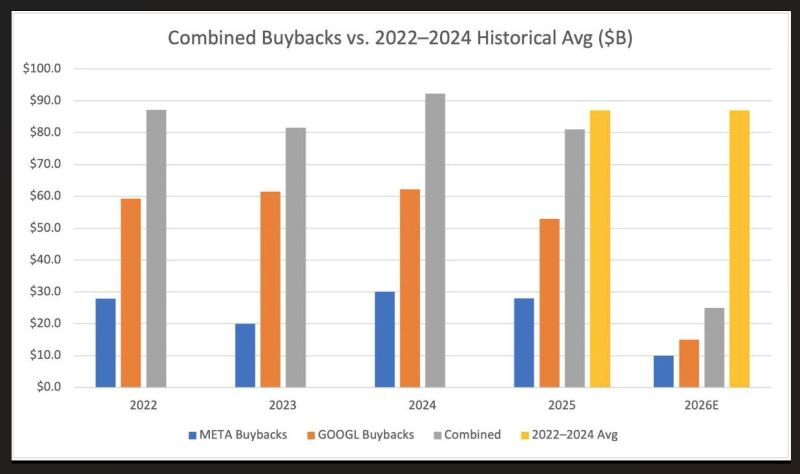

See below the drastic effects on $META and $GOOGL share buybacks trend.

Over the last few quarters, the Mag 7 have been transitioning from being asset light (high RoIC, low debt, high Free Cash Flow margins, massive share buybacks) to asset heavy (lower RoIC, rising debt, lower FCF margins, less share buybacks). This should keep weighing both on their valuation multiple and earnings growth.

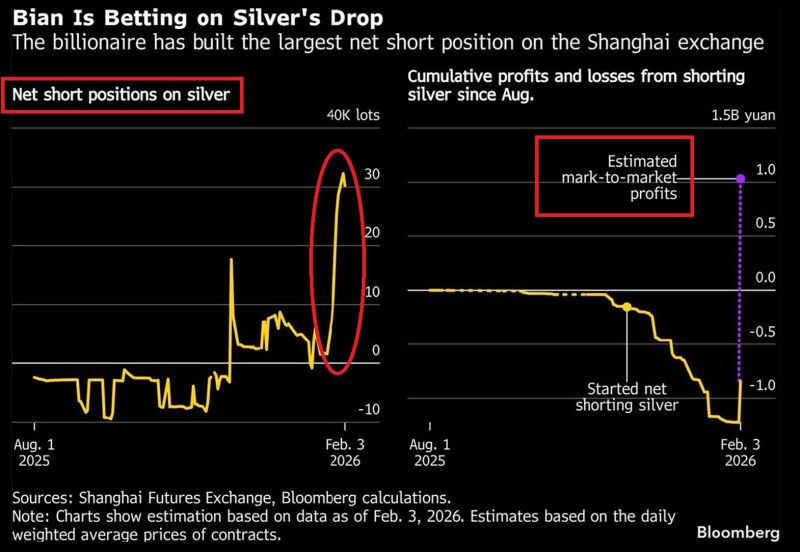

A billionaire Chinese trader has built the largest net SHORT position in silver on the Shanghai Futures Exchange, holding ~450 tons, or 30,000 contracts.

His short position is now worth ~$300 million in paper gains after silver prices collapsed. Including losses from earlier positions (he has been forced to liquidate some positions), he stands to make a net profit of ~1 billion yuan, or $144 million. Previously, he made nearly $3 BILLION from bullish gold bets on the Shanghai exchange since early 2022. A billionaire ramped up his Global Markets Investor @GlobalMktObserv

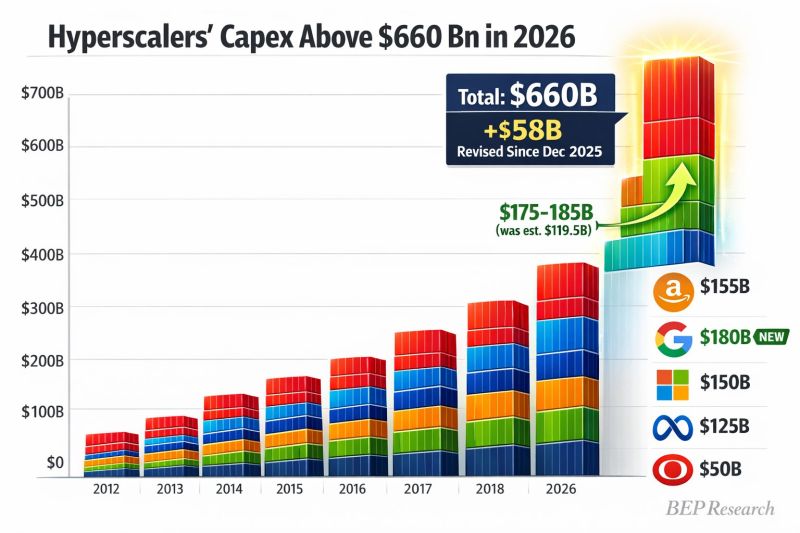

Hyperscaler capex just got revised UP $58B to $660B for 2026

Alphabet dropped a BOMB: $175-185B guidance vs $119.5B estimate That's +$55B from Google alone The AI infrastructure arms race just went nuclear ☢️ Source: Ben Pouladian @benitoz

2026 CAPEX:

$GOOGL - $175B-$185B vs $119B est $META - $115B-$135B vs $110B est $TSLA - $20B vs $11B est $AMZN - *tomorrow vs $145B est The hyperscalers are going all in on AI. Source: Geiger Capital

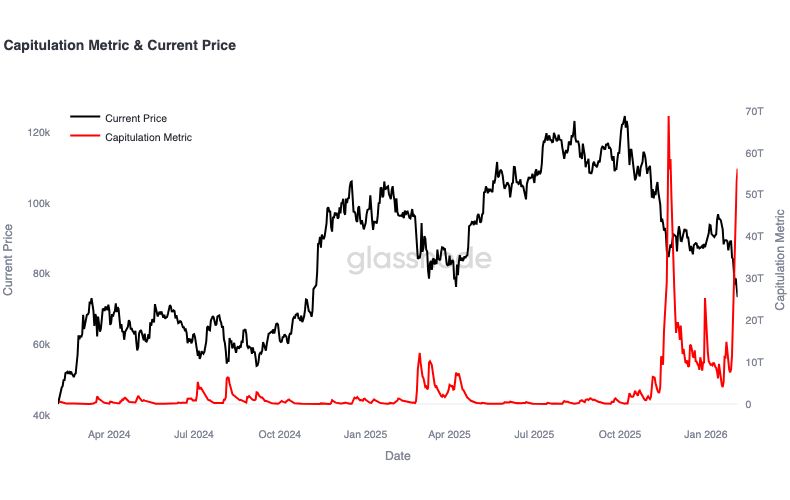

Glassnode: "The $BTC capitulation metric has printed its second-largest spike in two years, highlighting a sharp escalation in forced selling."

"These stress events typically coincide with accelerated de-risking and elevated volatility as market participants reset positioning". Source: Glassnode

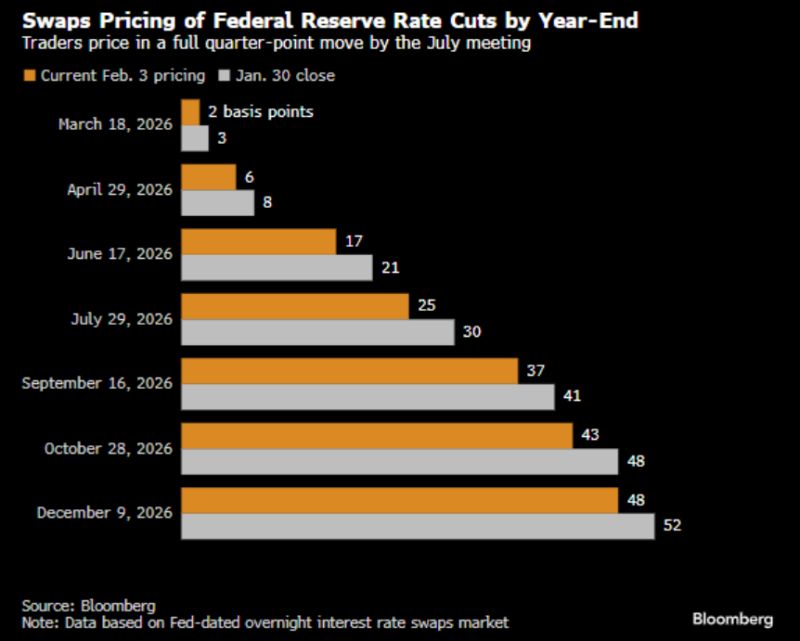

Rates Traders Target Dovish Policy Shift Under a Warsh-Led Fed

➡ Since Trump’s Friday announcement, flows in options linked to the Secured Overnight Financing Rate — which closely tracks the central bank’s path — have reflected bets on a more dovish tilt once Warsh takes his post in time for the Fed’s June meeting. Source: Christophe Barraud @C_Barraud on X, Bloomberg

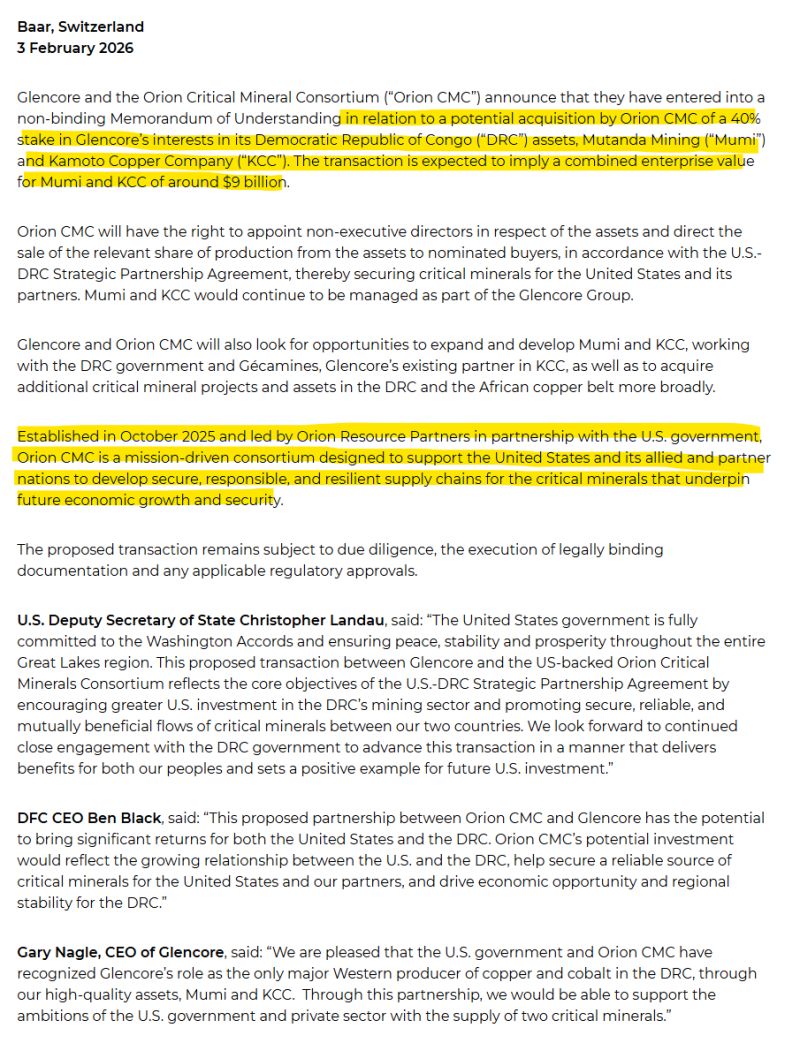

Glencore agrees to sell 40% stake on its two African copper and cobalt businesses to a US government-backed group

Washington continues to seek more control over critical minerals. The deal values the 100% of the mines at $9 billion, including debt. $GLEN Source: Javier Blas @JavierBlas

Investing with intelligence

Our latest research, commentary and market outlooks