Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Meloni warns Trump: NATO, not tariffs, is the answer in Greenland and the Arctic

"Imposing higher tariffs on countries that contribute to Greenland’s security is a mistake, and I do not agree with it. I share Trump’s focus on Greenland and the Arctic as a strategic region where hostile interference must be avoided. NATO is the proper framework to organize deterrence and collective security in the Arctic." Source: Mario Nawfal on X

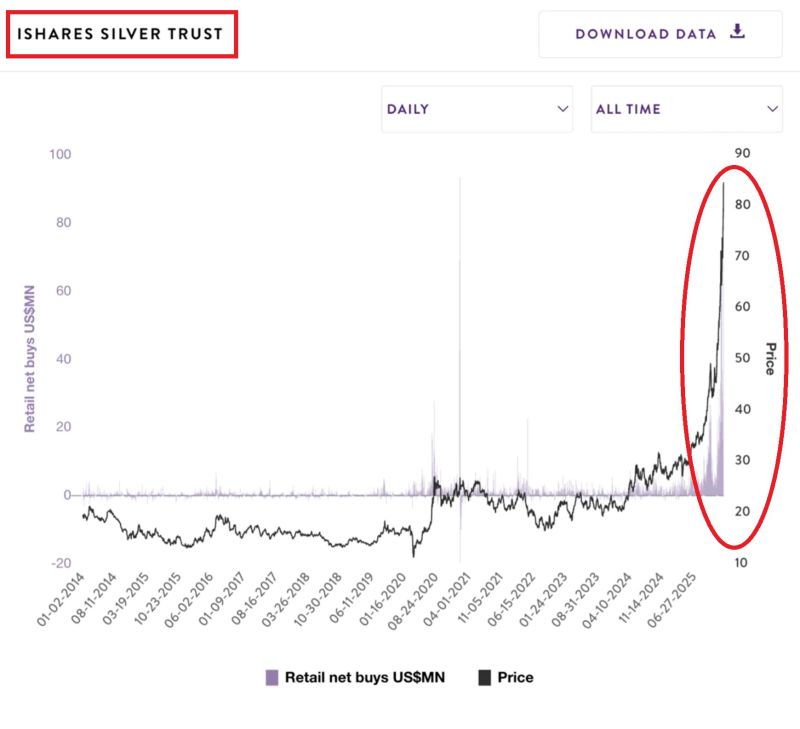

Retail investors have piled into the largest physical-backed silver ETF, $SLV, for 169 days STRAIGHT, the longest streak EVER.

All major silver-linked ETFs have attracted a record +$921.8 million in inflows over the last 30 days. Silver retail buying activity is now 2.1 TIMES higher than the 3-month moving average, and far above the 2021 silver market squeeze. Retail investors are joining the silver rally at a record pace. Source: Global Markets Investor

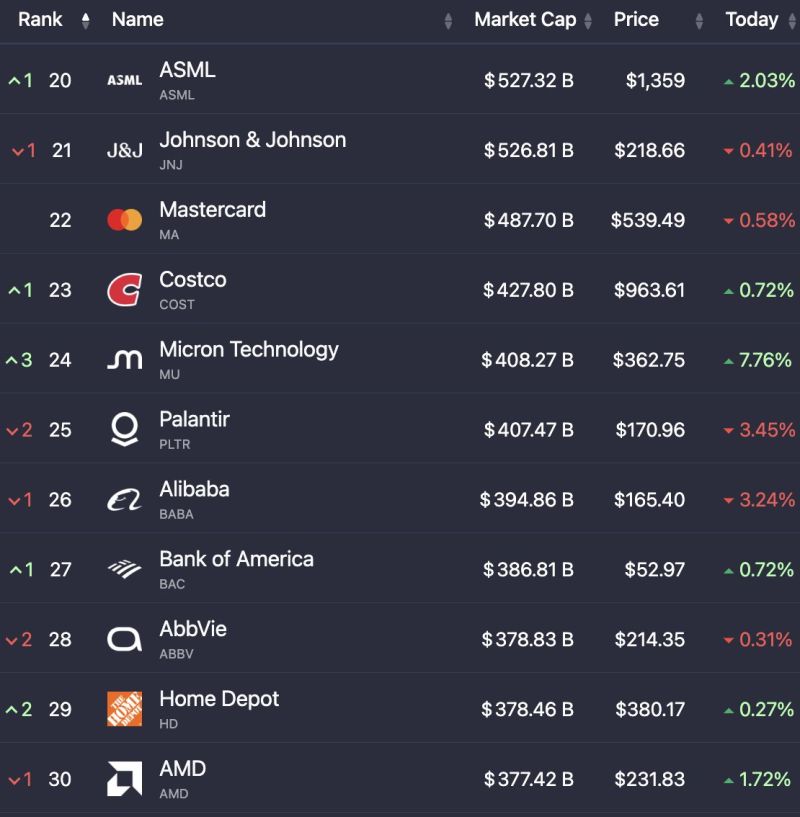

Micron $MU is now one of the top 25 largest companies in the world

Source: Evan, @StockMKTNewz

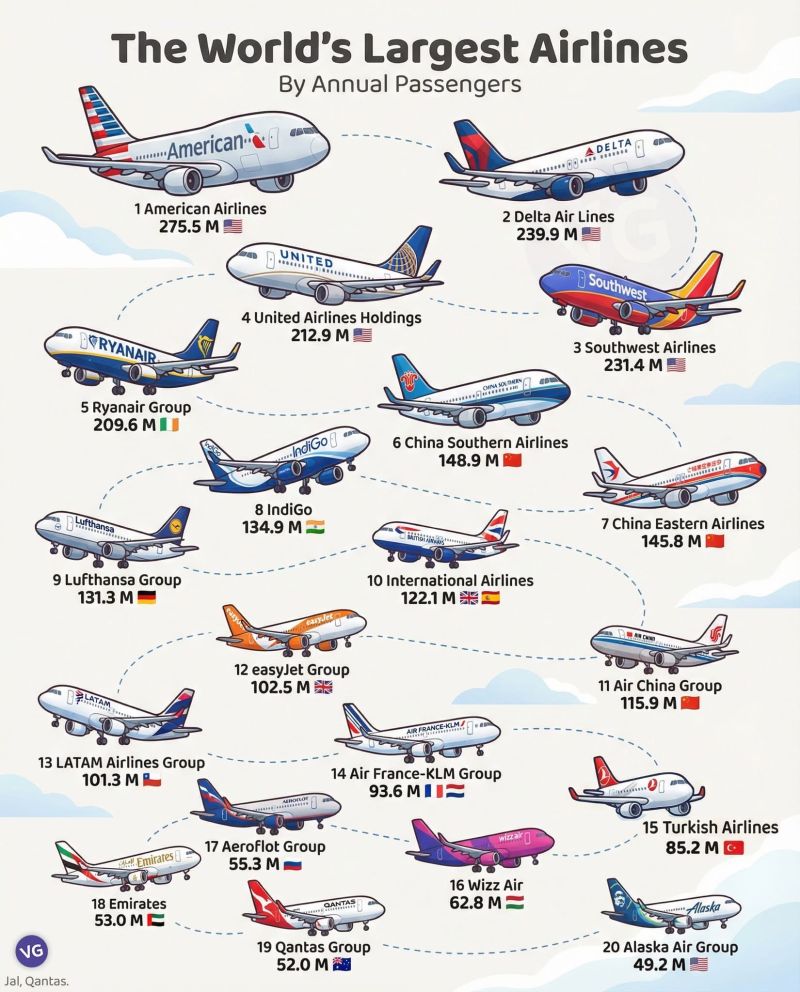

The world’s largest airlines by annual passengers

1. American Airlines — 275.5 M 2. Delta Air Lines — 239.9 M 3. Southwest Airlines — 231.4 M 4. United Airlines Holdings — 212.9 M 5. Ryanair Group — 209.6 M 6. China Southern Airlines — 148.9 M 7. China Eastern Airlines — 145.8 M 8. IndiGo — 134.9 M 9. Lufthansa Group — 131.3 M 10. International Airlines Group (IAG) — 122.1 M 11. Air China Group — 115.9 M 12. easyJet Group — 102.5 M 13. LATAM Airlines Group — 101.3 M 14. Air France–KLM Group — 93.6 M 15. Turkish Airlines — 85.2 M 16. Wizz Air — 62.8 M 17. Aeroflot Group — 55.3 M 18. Emirates — 53.0 M 19. Qantas Group — 52.0 M 20. Alaska Air Group — 49.2 M Source: Visual Capitalist (VG)

The big money is made in the waiting

Source: Invest In Assets 📈 @InvestInAssets

One channel. Six years of price action. Now testing the limits. $SPX

Source: Trend Spider

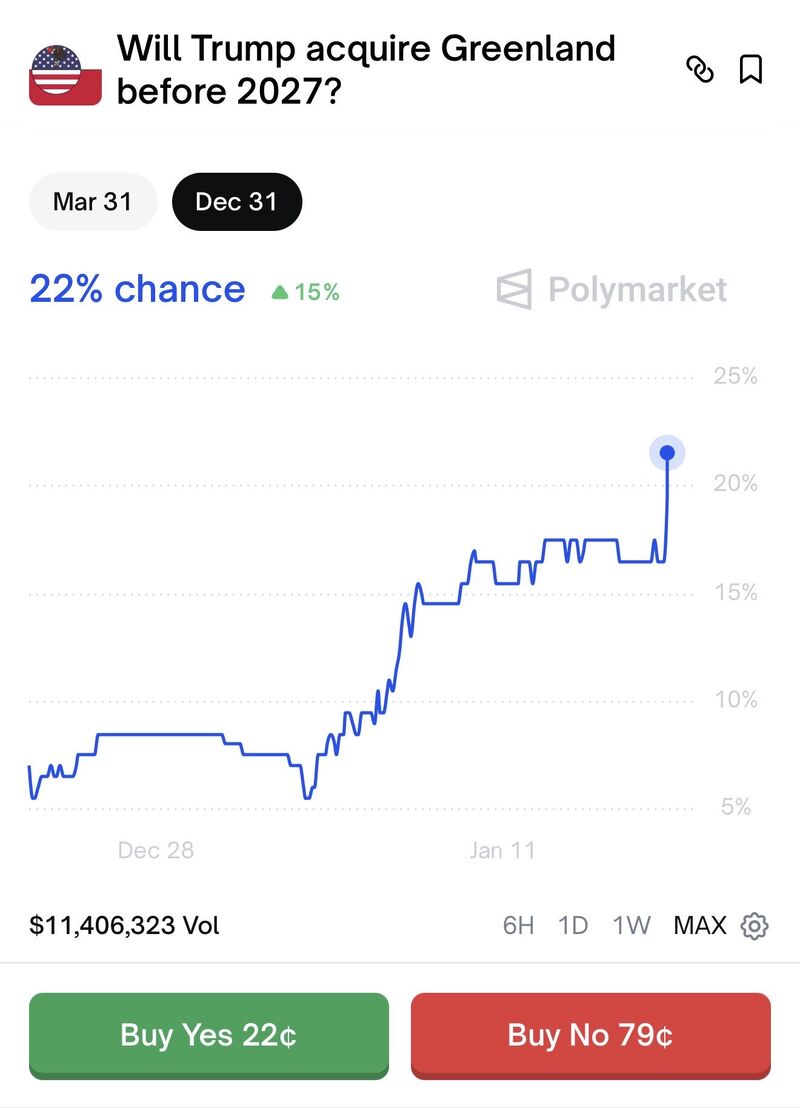

The probability of the United States acquiring Greenland reaches all-time highs. 22% chance.

Source: Polymarket

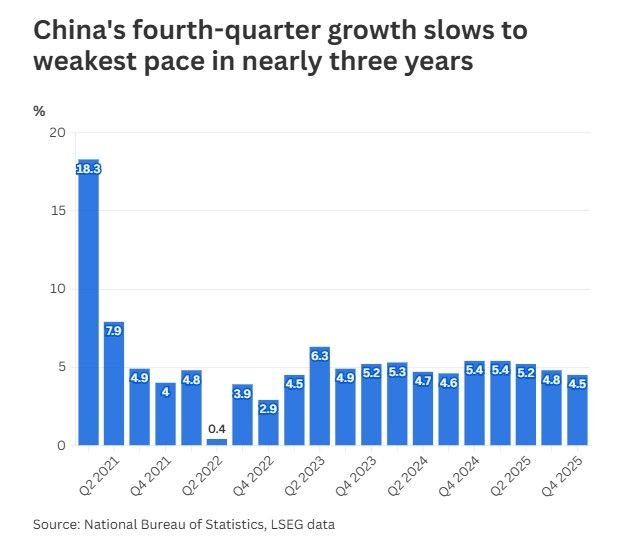

China’s GDP grew 4.5% in the October to December period, slowing from 4.8% in the third quarter, the weakest in nearly three years as consumption misses forecasts

Full-year economic output came in at 5%, meeting the official target of around 5%. Retail sales grew 0.9% in December from a year earlier, the slowest growth since late 2022. Industrial output climbed 5.2% in December, topping expectations for a 5% growth. Source: CNBC

Investing with intelligence

Our latest research, commentary and market outlooks