Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Cyclicals keep outperforming defensives...

The message from the market on the macro cycle sems pretty clear Source: Bloomberg

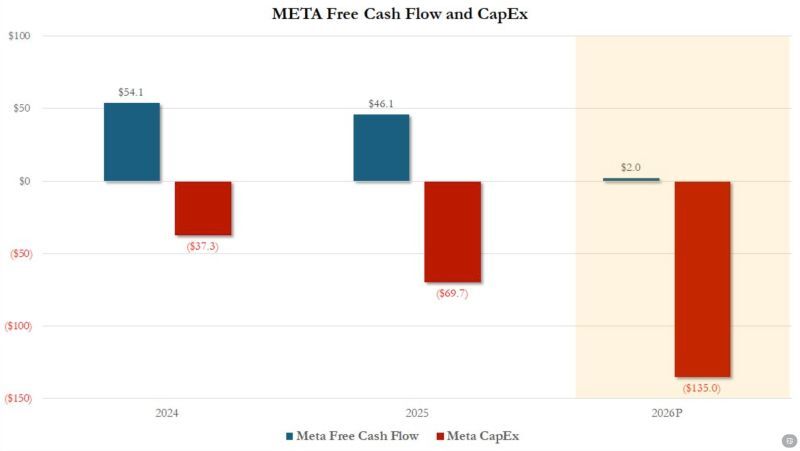

At the high end of its capex forecast ($135BN), META free cash flow in 2026 will be $0

Source: zerohedge

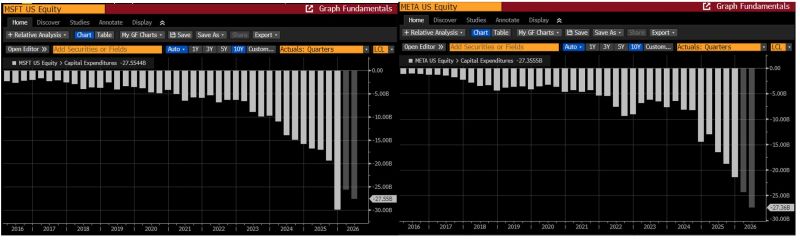

Microsoft and Meta quarterly CAPEX -realised and projected

These aren’t the old MSFT and META... Source: Bloomberg, RBC

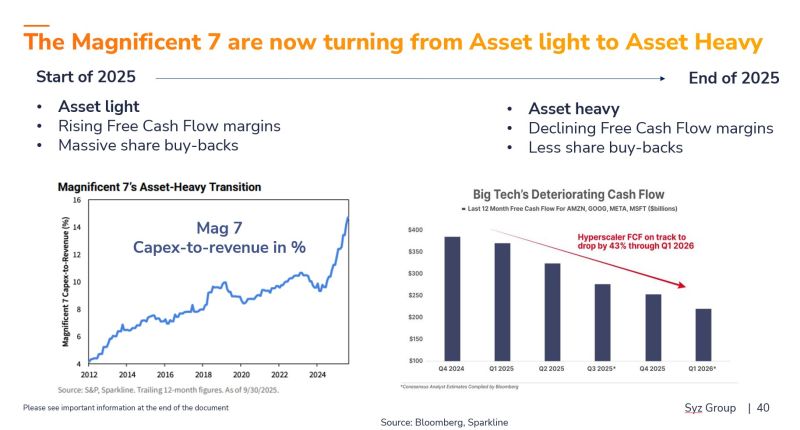

MSFT and META quarterly results (and capex projections) confirm our thesis: these are not your "old" Mag 7.

Indeed, the AI revolution has hit a major turning point as the largest U.S. tech companies embark on unprecedented AI infrastructure spending. The Magnificent 7 are now turning from Asset light to Asset Heavy. Although markets have so far rewarded this surge in investment, history shows that capex booms often lead to overbuilding, intensified competition, and disappointing stock performance. From Magnificent 7 to Magnificent risks ???

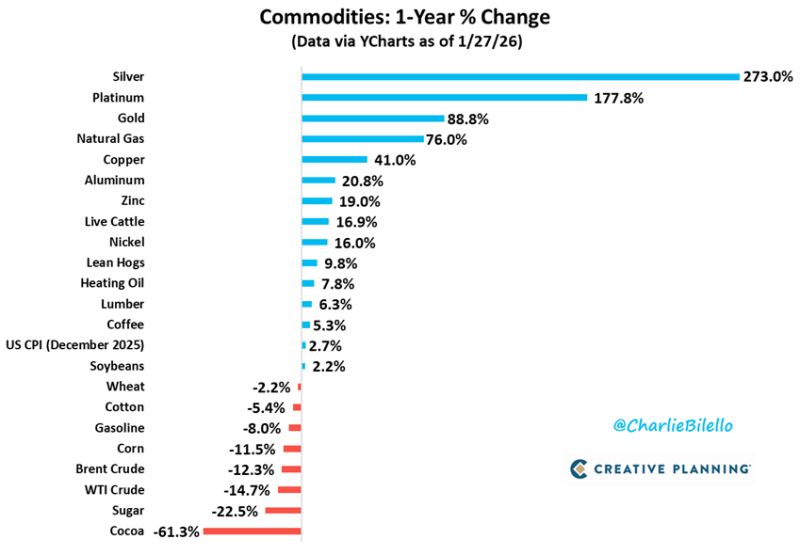

The best performing commodities over the past year:

Silver (+273%), Platinum (+178%), and Gold (+89%). These are the biggest YoY gains for these 3 precious metals since 1979-1980. Source: Charlie Bilello

Trump: He who has the gold makes the rules

European gold in US custody: - Germany: ~40% of gold holdings - Italy: ~50% - Netherlands: ~30% Not your vault, not your gold ??? Source: Lukas Ekwueme @ekwufinance

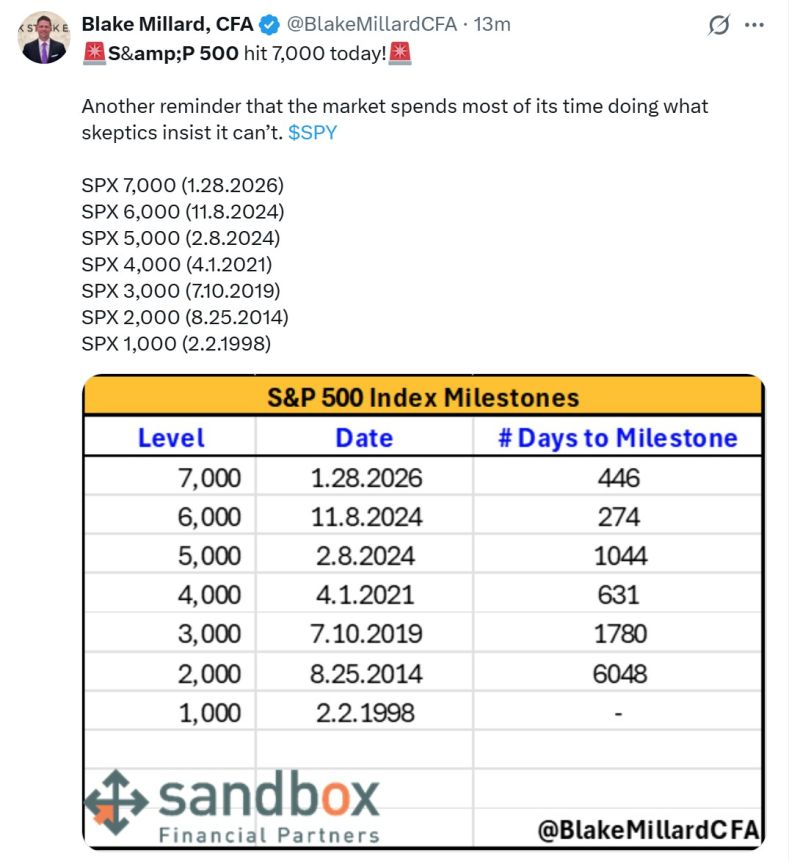

The S&P 500 just passed 7,000 for the first time ever

The index has added over $1.5 TRILLION in market cap within the past week 😳 Source: Peter Tuchman @EinsteinoWallSt Barchart

A Historic Moment for Silver

Yesterday, SLV (the world’s largest Silver ETF) traded $38 Billion in total value and 393 Million shares in total volume: - It was SLV’s highest-ever value traded (no other day in history even came close). - It was SLV’s highest-ever volume (prior records: May 5 2011, February 1 2021). To gauge the true scale of this frenzy… Let’s compare it to SPY which traded $42 Billion yesterday (chart). In its entire 20-year history, SLV traded this much relative to SPY *only once* before: On April 25 2011. Source: Macro charts

Investing with intelligence

Our latest research, commentary and market outlooks