Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

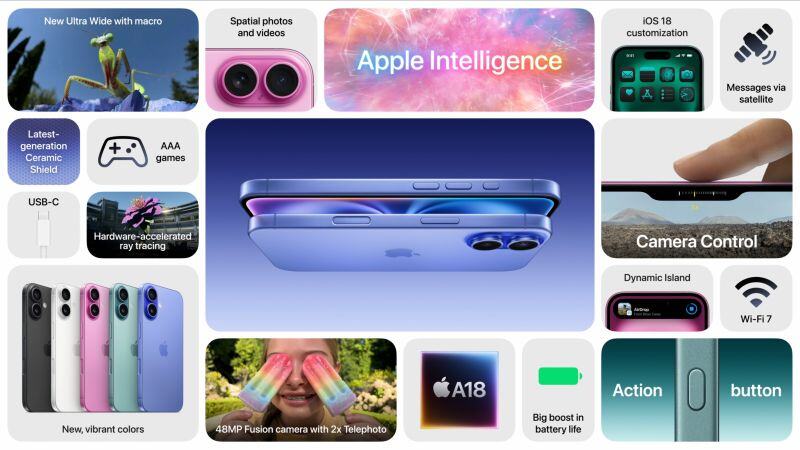

Here’s a full breakdown of the $AAPL iPhone 16 and 16 Plus Price starts at $799 and $899 for the Plus

Source: Stocktwits

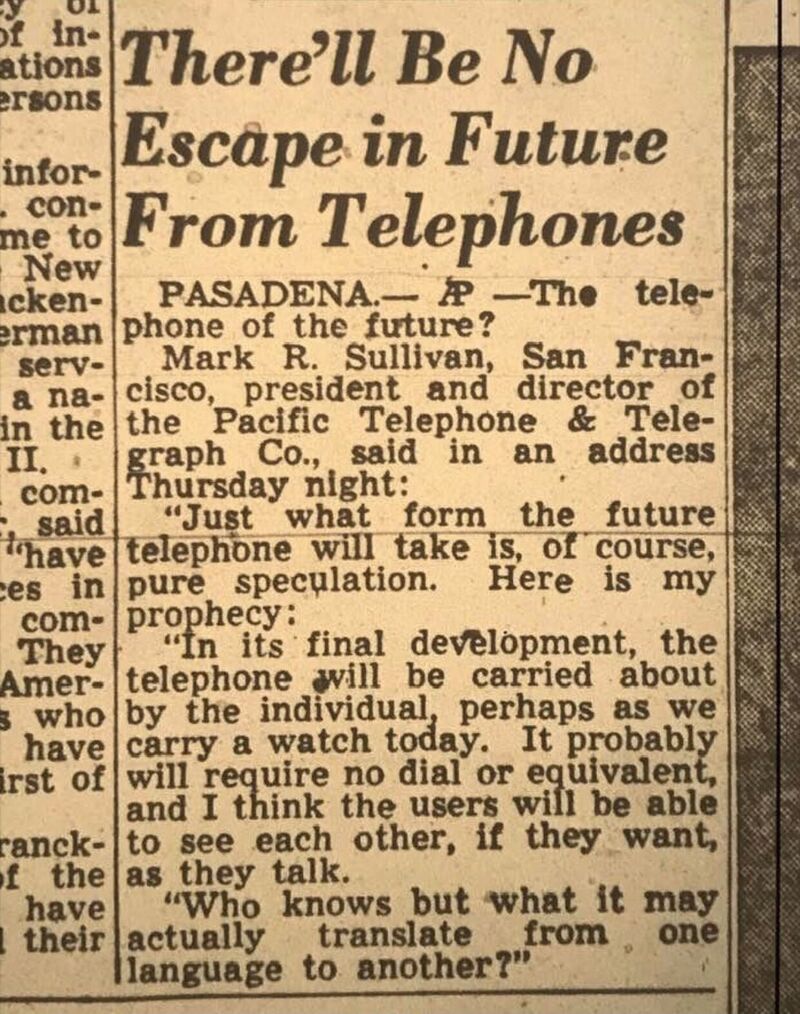

"Doubt is the origin of wisdom" - Rene Descartes

Source: Wise Wonderer

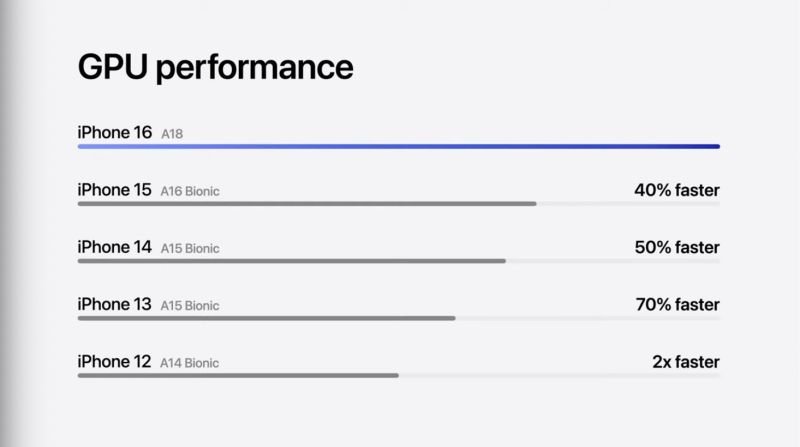

Apple's $AAPL new A18 chip for the iPhone 16 has 40% faster GPU performance than the iPhone 15

Source: Evan

It seems that the EU finally realizes that their de-industrialization process has been going too far and put them at a huge competitive disadvantage vs. the US.

The European Union requires radical reforms through a new industrial strategy to ensure its competitiveness, to boost social equality and to meet climate targets, according to a keenly awaited report from economist and politician Mario Draghi. The proposals laid out in the report would require between 750 billion and 800 billion euros in additional investment each year, the European Commission estimates. Other areas of concern include supply chain security and defense spending, the report states. BOTTOM-LINE: This could mean more debt, more money printing, more inflation, higher nominal growth. Source: CNBC

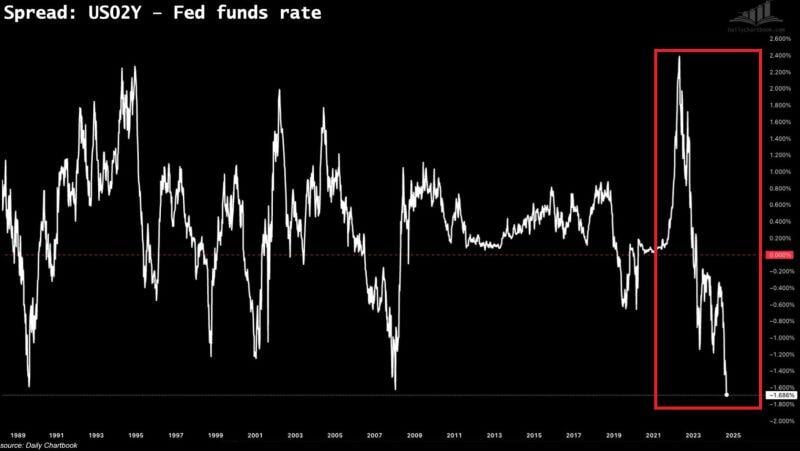

‼️THIS HAS NOT HAPPENED IN AT LEAST 35 YEARS‼️

The spread between the 2-year US government bonds and Fed's rates FELL to -1.686%, the most in over 3 decades. In other words, bond market expects the Fed to cut BIG in the next months. Question: Is the bond market too dovish? Or is the Fed too much behind the curve? Source: Global Markets Investor, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks