Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Donald Trump Trump threatens to impose a 100% tariff on countries that conduct business in currency other than the USDollar, adding a new pillar to his tariff platform.

Trump, who has long embraced protectionist trade policies, said the dollar has been “under major siege” for 8yrs. China, India, Brazil, Russia, and South Africa discussed de-dollarization at a summit last year. By contrast, Trump has said he wants the dollar to remain the world’s reserve currency, a pledge he renewed at Saturday’s rally. While Dollar dominance has lessened in recent decades, the US currency still accounted for 59% of official FX reserves in Q1 2024, w/Euro 2nd at almost 20%. Source: Bloomberg, HolgerZ

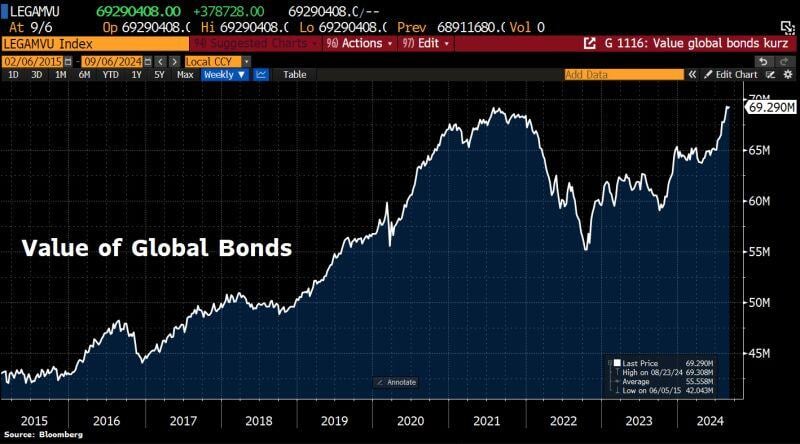

The global bond rally has regained momentum due to econ concerns in the US and weak figures in the Eurozone.

Value of global bonds rose 0.3% this week to $69.29tn, almost a fresh ATH. Source: HolgerZ, Bloomberg

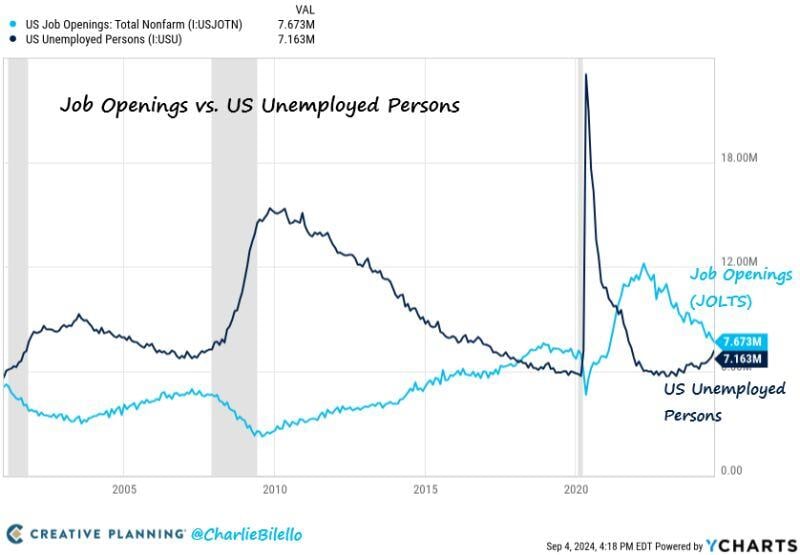

There are now 510k more Job Openings than Unemployment Persons in the US.

That's the smallest differential since April 2021, down from a peak of over 6 million in March 2022. The labor market is rapidly cooling... Source: Charlie Bilello, Y charts

Germany has significantly lagged behind the US in economic growth over the past 30yrs

Since 1980, the US econ has expanded tenfold, while Germany's has only grown fivefold. This disparity is partly due to faster population growth in the US. However, the underperformance since the 1990s is no accident. The US has capitalized on digitalization far more effectively, driving economic gains, whereas Germany has been slower to embrace technological transformation. A clear example of this is Volkswagen, which highlights Germany's cautious approach to modernization. Source: HolgerZ, Bloomberg

An important chart by J-C Parets >>> High Beta outperforming Low Volatility stocks is usually something we see in healthy market environments.

This year, however, High Beta has been struggling to make any progress vs their Low Volatility counterparts. "Beta" is essentially how volatile a stock is relative to its benchmark. So High Beta think $SMCI, $NVDA, $AMD, etc.. You have half the S&P500 High Beta Index in Technology and another 17% in Consumer Discretionary. In contrast, for Low Volatility think Berkshire Hathaway, Coca-Cola, Visa, Procter & Gamble. You'll find a lot of Financials, Consumer Staples, Utilities and Industrials in this group. Source: J-C Parets

Investing with intelligence

Our latest research, commentary and market outlooks