Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

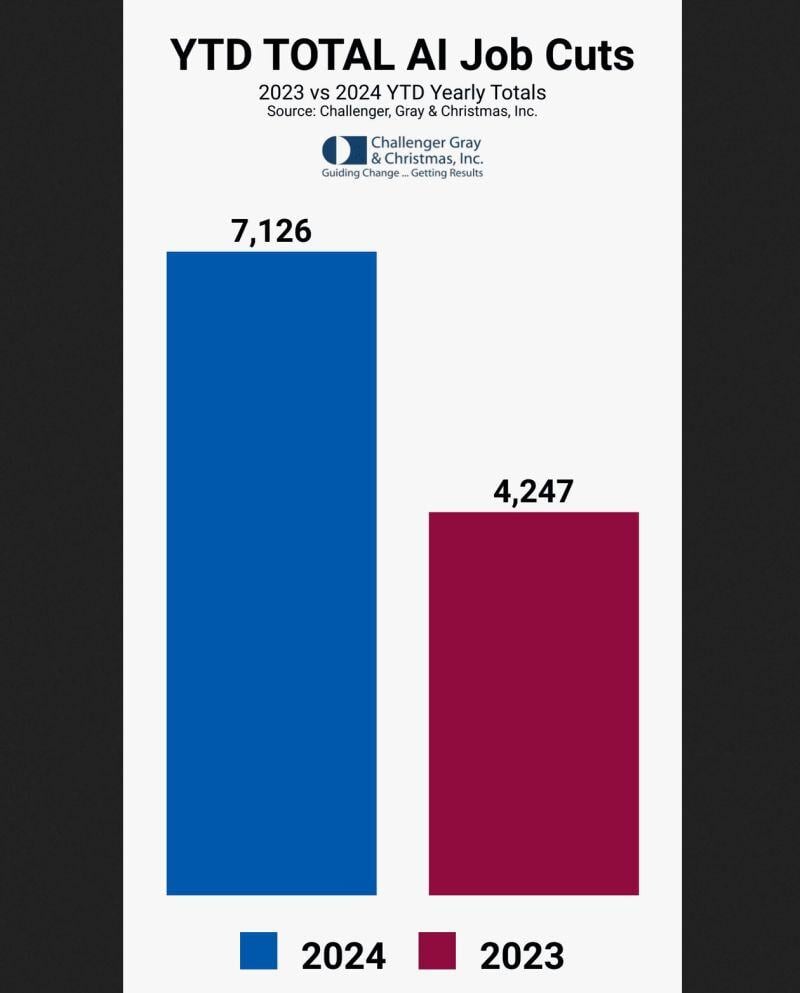

An increasing number of job cuts are also being attributed to AI in 2024 vs 2023

Source: Markets & Mayhem

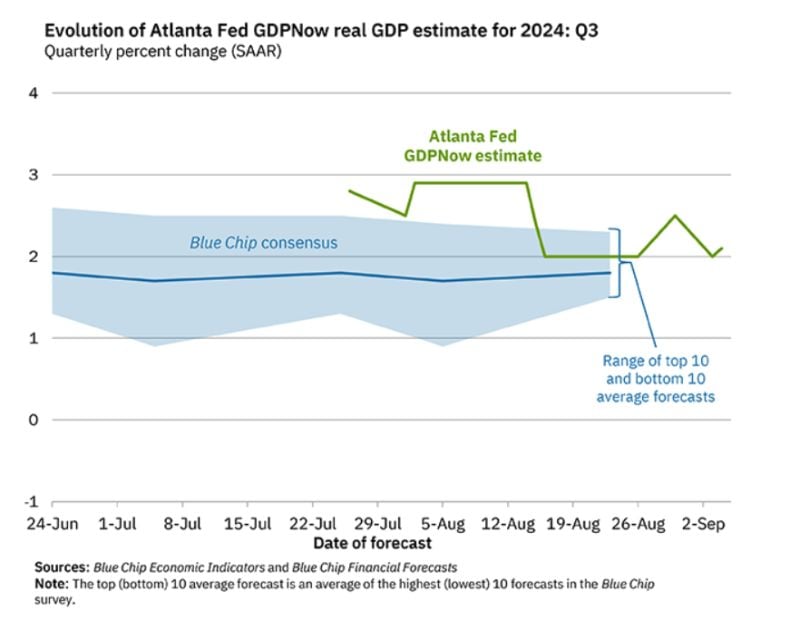

Ahead of today's Non-Farm-Payrolls print, Atlanta Fed GDPNow is forecasting just 2.1% US GDP growth for Q3

.

The current drawdowns across the Magnificent Seven:

• $AAPL Apple: 5.0% • $META Meta: 5.2% • $AMZN Amazon: 11.9% • $MSFT Microsoft: 12.3% • $GOOGL Alphabet: 17.7% • $NVDA Nvidia: 20.3% • $TSLA Tesla: 48.6% Source: Koyfin

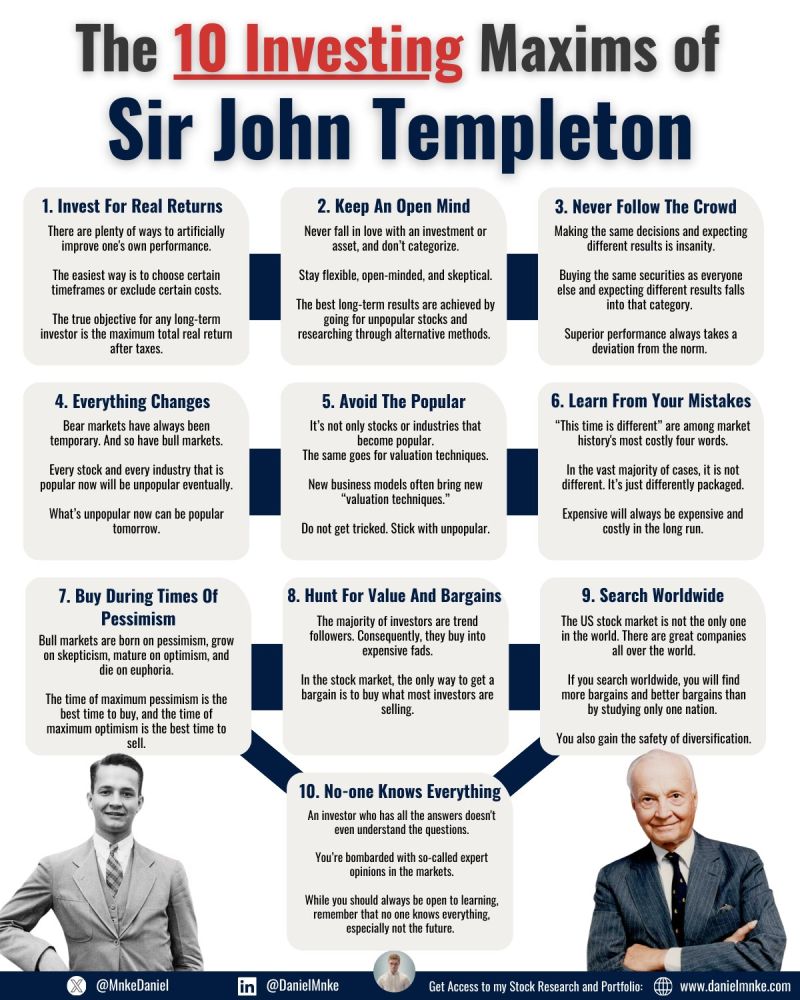

Sir John Templeton has been one of the most successful investors ever.

His investing career ranged over half a century. These were the 10 Maxims he invested by: Source: @MnkeDaniel on X

TIME's new cover: The 100 most influential people in AI

Note that Elon Musk is missing on this cover page while Scarlett Johansson appears nearby the CEO of Nvidia. Indeed, according to TIME, Scarlett Johansson is more influential in AI than Elon Musk...

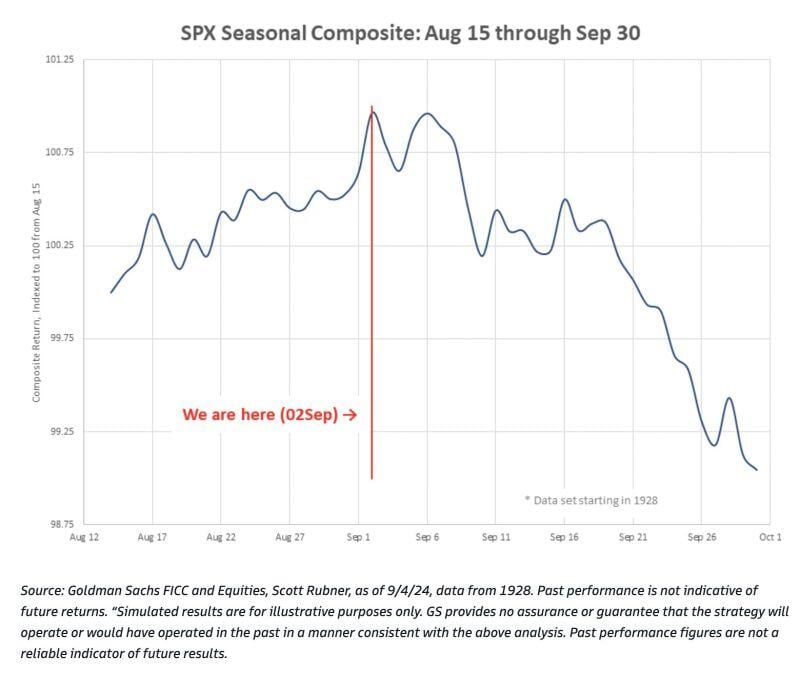

This Goldman chart shows that September is historically weak for global equities and risk assets w/avg return at -2.31%.

Sept 16th has been a seasonal turning point, w/2H Sept being the worst performing 2 weeks of the year, BUT maybe this seasonality gets pre-traded by market participants this year. Goldman says flow-of-funds, such as the quarter-end pension rebalancing can explain the annual weakness in September. Source: HolgerZ, GS

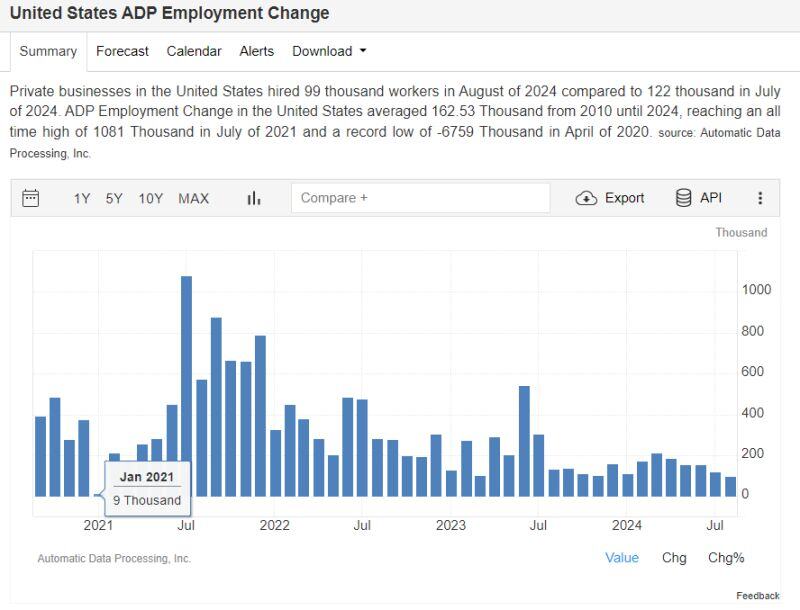

BREAKING: August private payrolls in the US rose by 99,000, well below expectations of 144,000.

This marks the smallest gain since 2021. Source: The Kobeissi Letter, ADP

Investing with intelligence

Our latest research, commentary and market outlooks