Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Crude Oil Back on Major Support Zone

Crude Oil WTI is back once again in the major support zone between 62.43-69.23. It's also testing the March 2022 downtrend line. Keep an eye on these very important levels. Source: Bloomberg

China weighs cutting mortgage rates in two steps to shield banks

Source: Bloomberg

Traders weigh "buy the dip" opportunities on Asian tech stocks

Source: Bloomberg

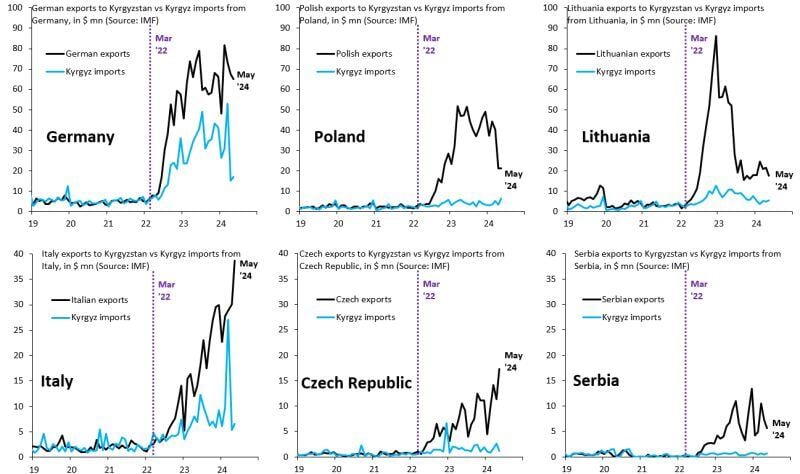

From the moment Russia invaded Ukraine, Europe was supposed to halt exports to Russia

Instead, many EU countries have been sending flood of exports to Russia that's invoiced to Kyrgyzstan. Source: Robin Brooks

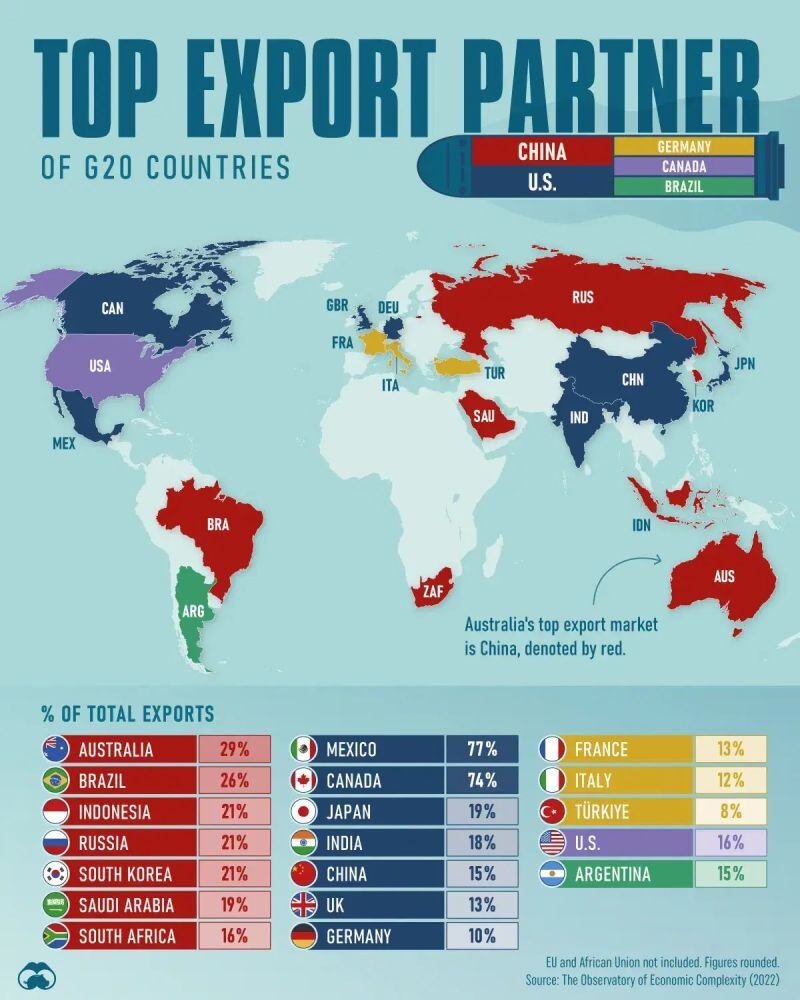

This Visual Capitalist graphic shows largest export market for each G20 member, based on share of goods exported;

data sourced from @OECtoday as of 2022 Key Takeaways •U.S. and China are primary export destinations for an equal number of G20 countries (7 each) •While U.S. is China’s top export market, reverse is not true, with U.S. sending its largest share (16% of its exports) to Canada Source: Liz Ann Sonders, Visual Capitalist

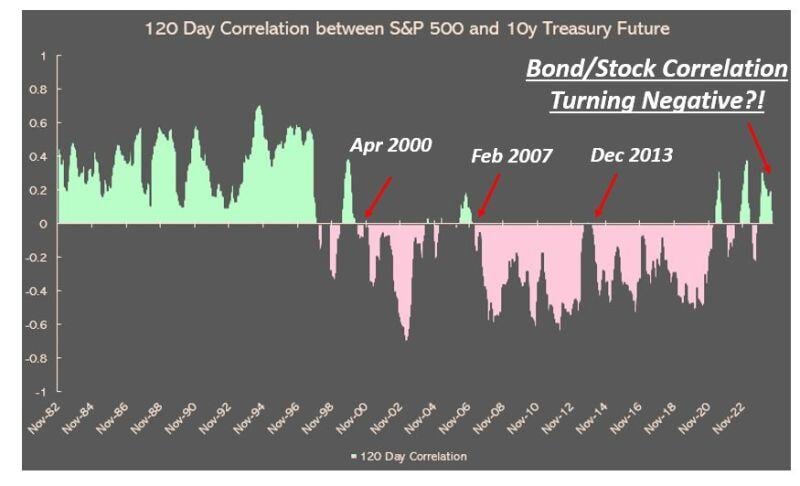

Is a massive regime change in markets taking place?

This week has again been volatile for stocks. But the big news for investors is for the first time in a few years, bonds are acting again as a hedge against stock market drawdowns. Or in other words: after a period of positive correlation which wrecked 60/40 portfolios, the stock/bond correlation is turning negative again. This is an important development. Source: Alfonso Peccatiello

Investing with intelligence

Our latest research, commentary and market outlooks