Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

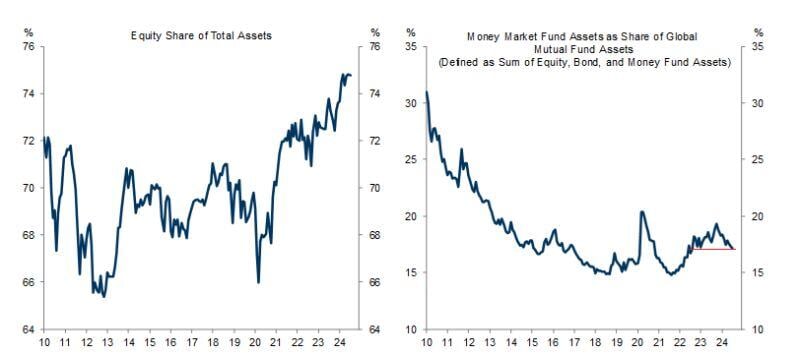

Ahead, of interest rates cut, how does the average asset allocation look like?

Are we going to see cash moving out of money markets into risk assets? Well, according to this chart by Mike Zaccardi, CFA, CMT, MBA, as a percent of total assets, money market fund holdings are now at 2-year LOWS !!!

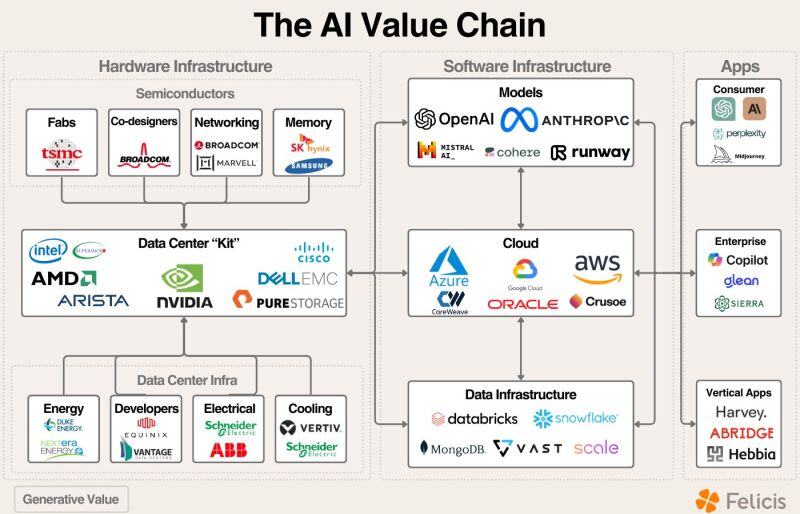

Mapping out the current state of AI markets by :

"Most value has accrued to the semiconductor ecosystem ($130B+ in revenue this year from AI) and the data center buildout (number of US data centers is expected to double in the next four years). Energy is a legitimate bottleneck to the data center buildout, and hyperscalers/developers are aggressively acquiring real estate with power availability. The cloud companies are at a ~$20B run rate, with Microsoft generating ~$5B of that. We’re seeing increasing interest in AI applications but little large scale value creation yet. The AI app layer will ultimately determine the value of the industry as the current infrastructure buildout will become a bubble without value creation on the back end". Source: @EricFlaningam, Felicis

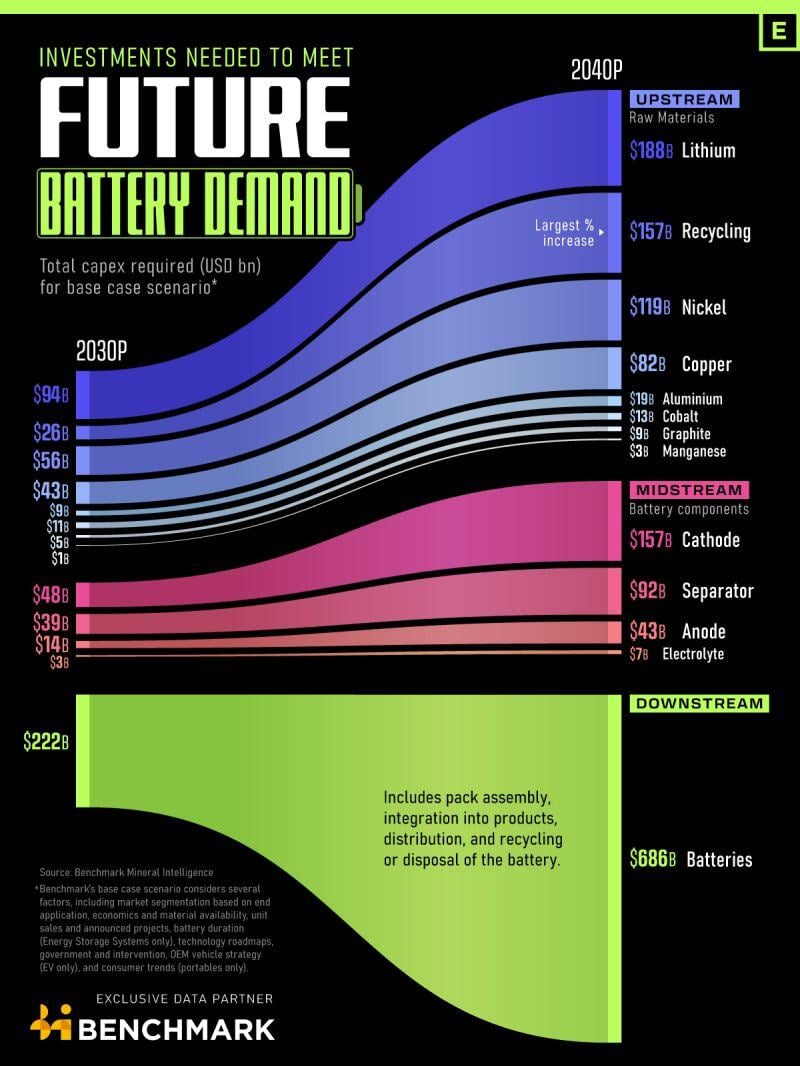

Estimated investments needed to meet battery demand

Source: Visual Capitalist

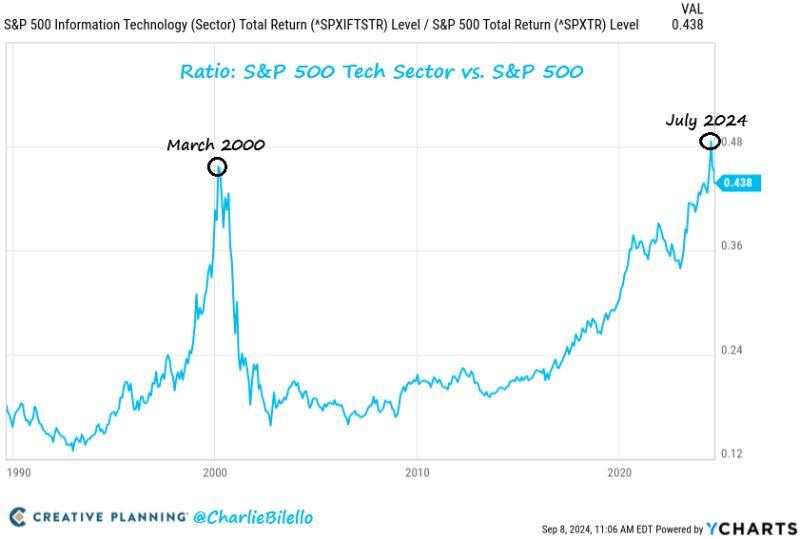

After surpassing the March 2000 relative strength high, the Tech sector has sharply underperformed over the last 2 months.

Is this the start of a secular change in leadership? Source: Charlie Bilello

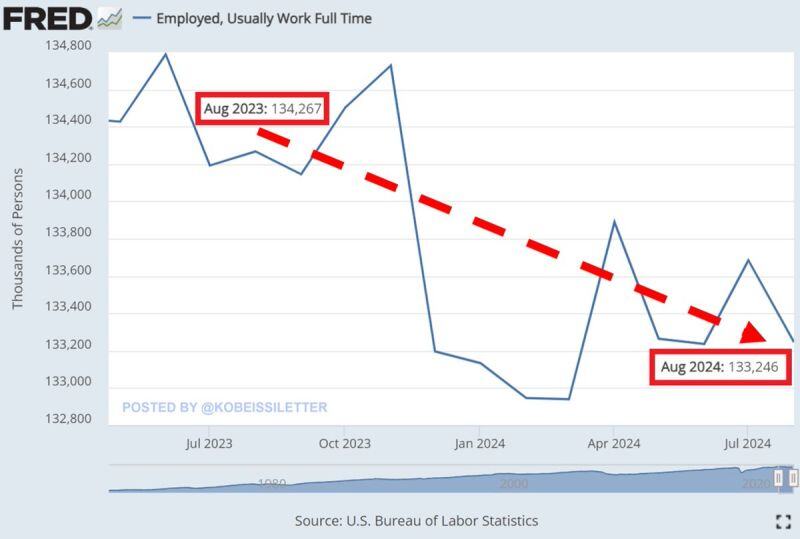

Full-time employment DROPPED by 1 million workers in August on a year-over year basis, marking the 7th consecutive monthly decline.

Since the June 2023 peak, full-time job count in the US has fallen by a whopping 1.5 million. Meanwhile, part-time employment rose by 1 million year-over-year in August. Additionally, the number of permanent job losers jumped by 324,000 year-over-year, to 2.5 million, the highest since November 2021. This was the 16th straight month of part-time job gains, the longest streak since the 2008 Financial Crisis. The US job market is cooling down. Source: FRED, The Kobeissi Letter

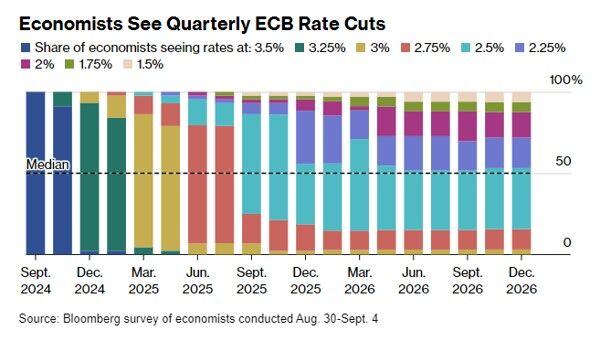

Ahead of ECB meeting, we got some mixed messages about the central bank speed and extent of rates cuts - see below.

Meanwhile, the market see quarterly ECB rate cuts - see chart below. - European Central Bank (ECB) Governing Council member Gediminas Simkus told Econostream Media that he saw a “clear case” for an interest rate cut in September but regarded the potential for another one in October was “quite unlikely.” - Executive Board member Piero Cipollone told France’s Le Monde newspaper that recent economic data so far had confirmed that inflation was slowing, giving scope for the ECB to lower borrowing costs. “There is a real risk that our stance could become too restrictive and harm the economy”. - However, Bundesbank’s Joachim Nagel continued to warn about premature easing, given elevated wage growth and services inflation, in an interview with the Faz newspaper. Source: Bloomberg, T Rowe

AstraZeneca Under Pressure but Entering Support Zone

AstraZeneca's long-term trend remains positive, though it is under pressure today and has dropped about 10% over the past week. The stock is now entering the major support zone between 11,540-12,050. Keep an eye on these levels. Source: Bloomberg

In our H2 outlook, we highlighted 5 key themes expected to unfold before year-end. As we approach the final quarter, most are materializing, albeit with some notable uncertainties:

- Global economic growth is normalizing, but recent macro data, particularly in the US and Europe, signal an increased recession risk. While a soft-landing remains the core scenario, the likelihood of a hard landing has grown since H2 began. - The US labor market is showing signs of slowing, with a looming risk of a sudden and significant increase in unemployment. - The Fed is anticipated to make cuts. The question on everyone's mind is whether we will see a substantial jumbo rate cut (50bps) initially. - While sector and style rotation is underway, the defensive lean is proving to be more pronounced than initially anticipated. - Volatility is on the rise, with some moderation thus far (aside from August 3rd). The big question is whether we will experience real market stress leading up to the elections.

Investing with intelligence

Our latest research, commentary and market outlooks