Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Americans make more money than they did at the end of 2019, even after adjusting for unusually high inflation since then.

Source: WSJ, Mike Zaccardi, CFA, CMT, MBA

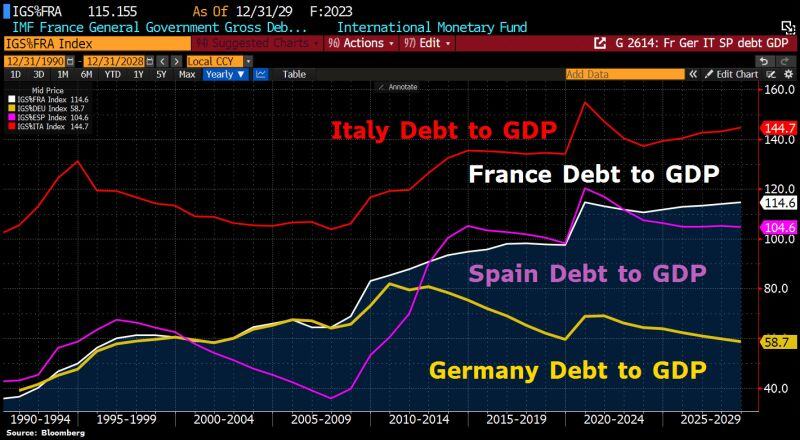

The former ECB head Mario Draghi said yesterday that unless Europe invests an extra €800BN per year, it is "doomed.

This boost in investment (which equals 5% of GDP), would be more than double the size of the Marshall Plan. In other words, Europe is about to unleash a historic orgy of debt and spending... It would most likely raises taxes (and inflation?) This announcement hits its wall of opposition in Germany, irrespective of warning that it’s the only way to make EU more competitive w/China & US. “That can be summarized briefly: Germany should pay for others. That can’t be a master plan,” FinMin Lindner said. Source: Bloomberg, HolgerZ

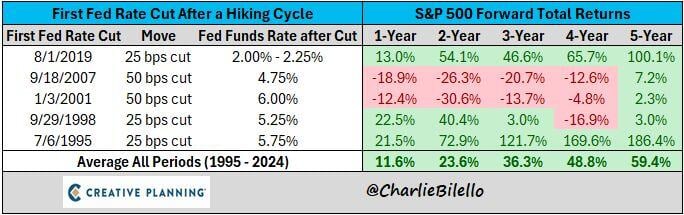

Those calling for a 50 bps rate cut next week should take a look back at January 2001 & September 2007 when the Fed started cutting cycles with a 50 bps move

If the Fed feels the need to go big because of a weakening economy, that's not bullish. Source: Charlie Bilello

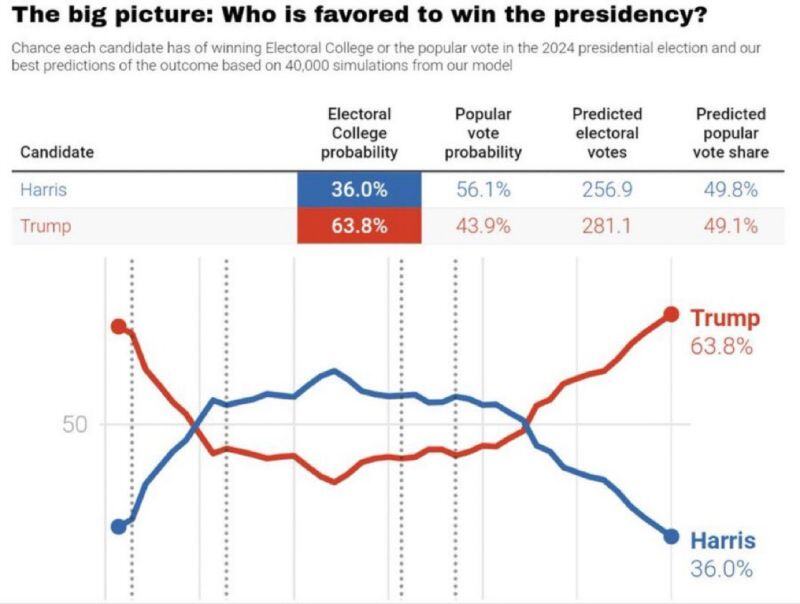

BREAKING: Trump has a whopping 27.8% lead over Harris in Nate Silver’s updated electoral college prediction poll.

Trump - 63.8% Harris - 36% NB: The graph shows the chance of winning, not the percentage of the vote !!! Source: Leading Report, Nate Silver

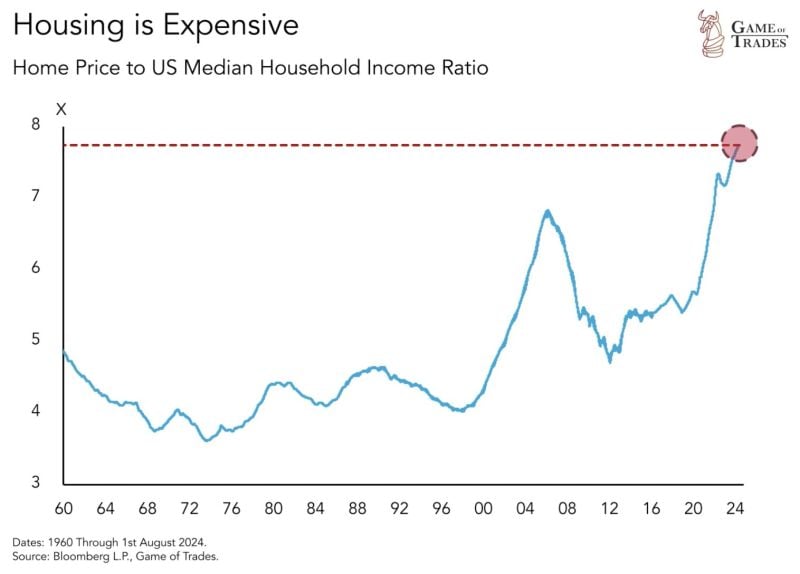

US home price relative to median income is now at the highest level ever seen

Source: Game of Trades

Dassault Systèmes Demand Building Up

Dassault Systèmes has spent 10 weeks in the major support swing zone between 32.23-34.20. On the short-term chart, there are signs of demand building up. Keep an eye on this level. Source: Bloomberg

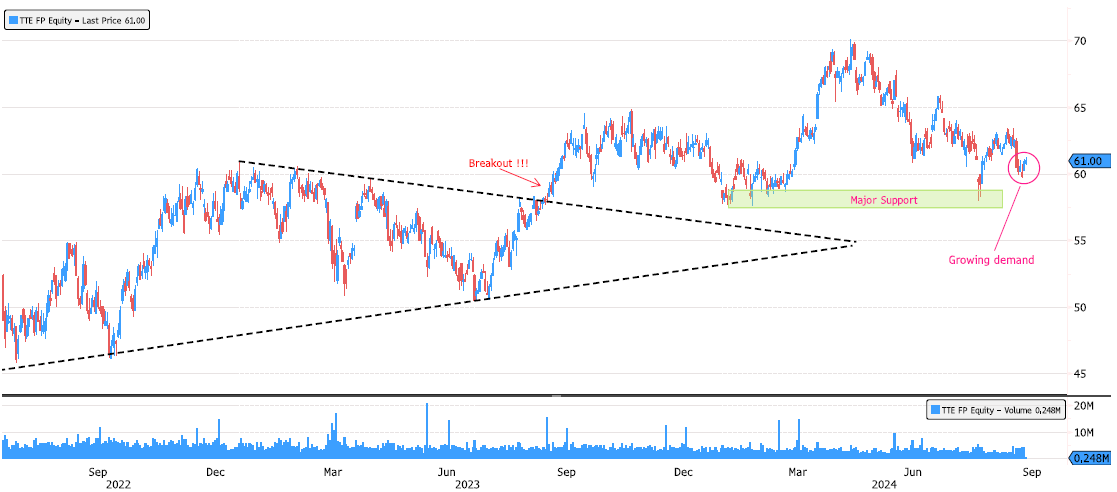

TotalEnergies Growing Demand

Since April, TotalEnergies has consolidated 17%, and the trend remains bullish. In August, it tested the major support zone between 57.45-58.76 and rebounded. We are now seeing growing demand at the 60 level. Keep an eye on this development. Source: Bloomberg

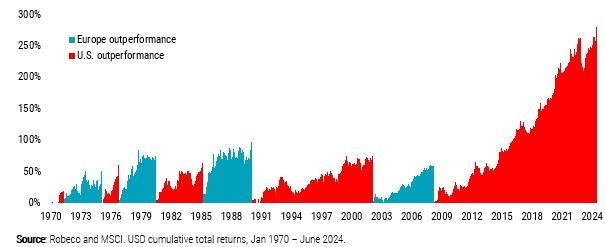

Will Europe ever outperform again?

From Robeco thru Mike Zaccardi, CFA, CMT, MBA.

Investing with intelligence

Our latest research, commentary and market outlooks