Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

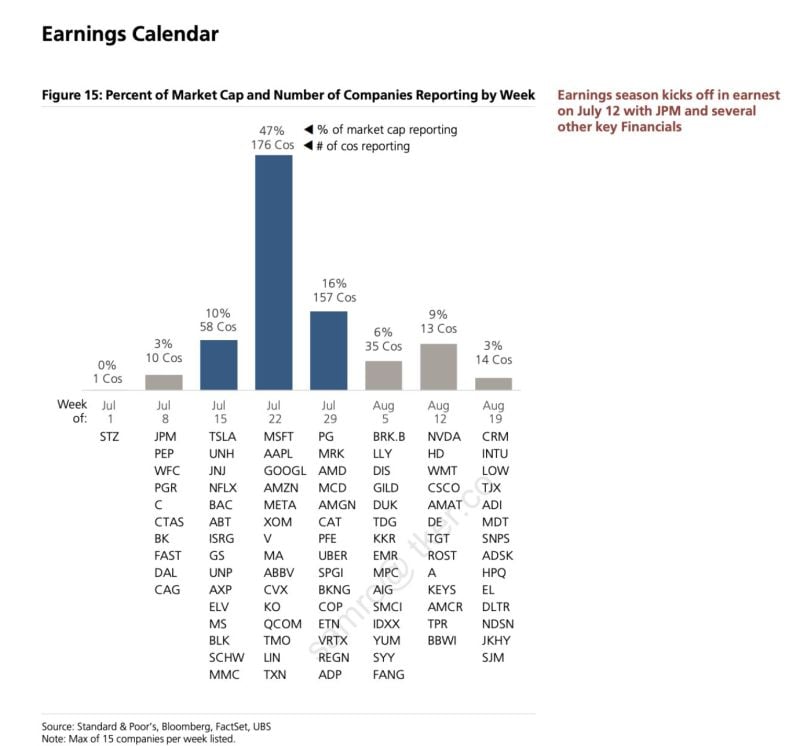

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Mind the gap: The French debt ratio is almost twice as high as the German debt ratio.

Source: HolgerZ, Bloomberg

That was another new all-time high quarterly close for both the S&P500 and Nasdaq100

That's now 3 in a row. Source: J.C. Parets @allstarcharts

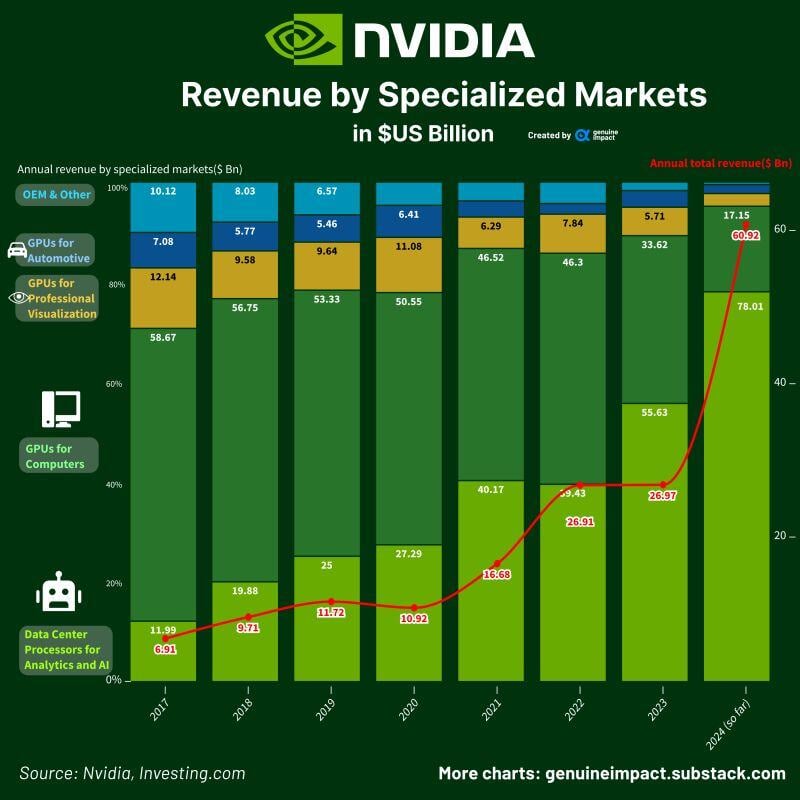

NVIDIA’s data center revenues have grown from 12% in 2017 to 78% in 2024 of total revenues.

Source: Genuine Impact

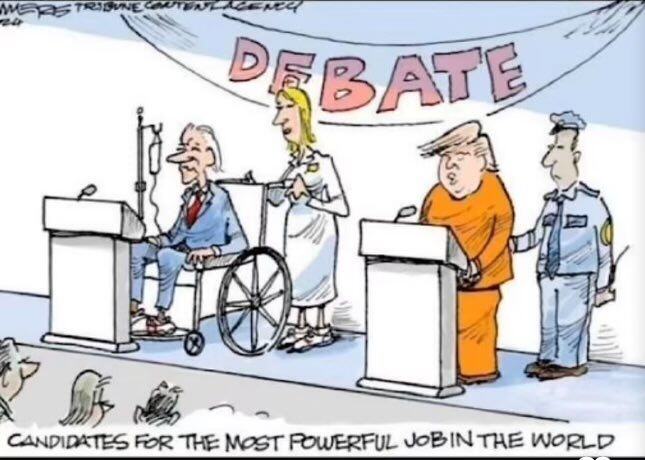

Candidates for the most powerful job on the world...

summarized in one cartoon... Maybe the US deserve better... 😅 Source: Markets & Mayhem 🤖

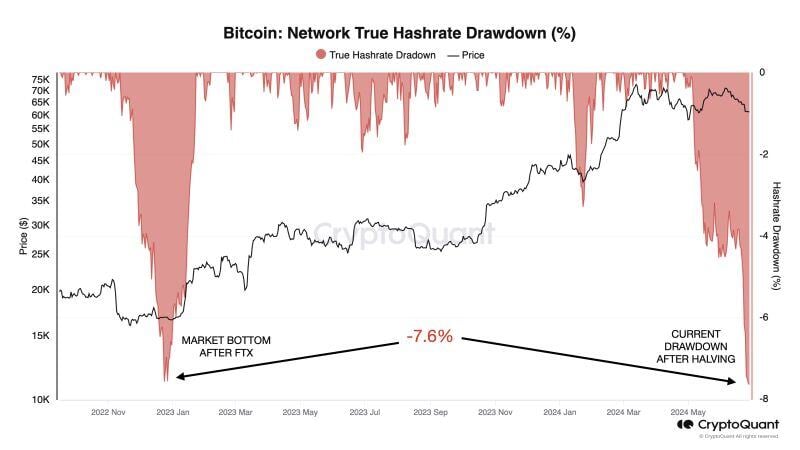

Bitcoin miner capitulation has reached levels comparable to December 2022: 7.6% drawdown.

December 2022 marked the cycle bottom after the FTX collapse. Source: Julio Moreno, Cryptoquant

Investing with intelligence

Our latest research, commentary and market outlooks