Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

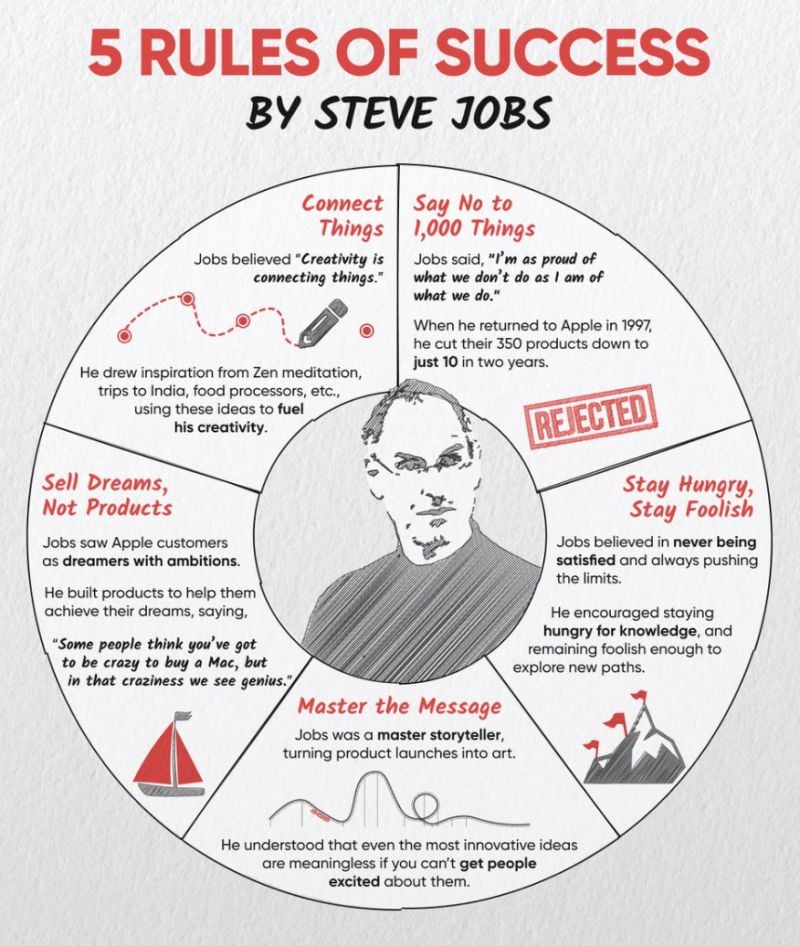

5 rules of success by Steve Jobs:

#1: Say no to 1,000 things. #2: Never be satisfied, Stay hungry for knowledge, explore new paths. #: Master the Message: be a story teller and get people excited about your ideas #4: Sell Dreams, Not Products #5: Connect things Source: Investment Books (Dhaval)

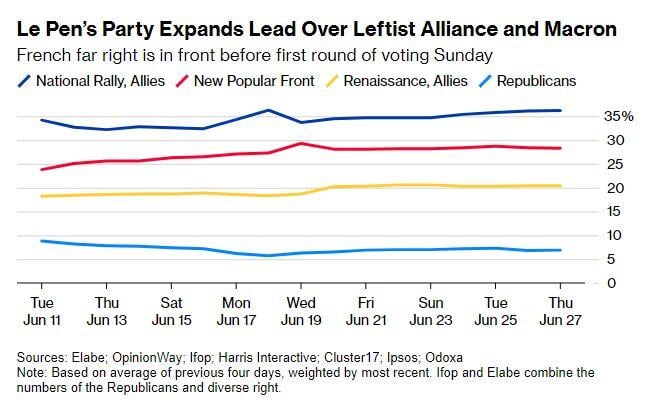

France | Macron’s Approval Drops Two Days Ahead of French Election

President Emmanuel Macron’s approval rating fell to the lowest level in three months, delivering a boost to Marine Le Pen’s far-right National Rally party just two days before voting starts in France’s legislative election. Support for Macron dropped six points to 36%, the worst showing since March, according to a Toluna-Harris Interactive poll for LCI TV published on Friday. Source: Bloomberg

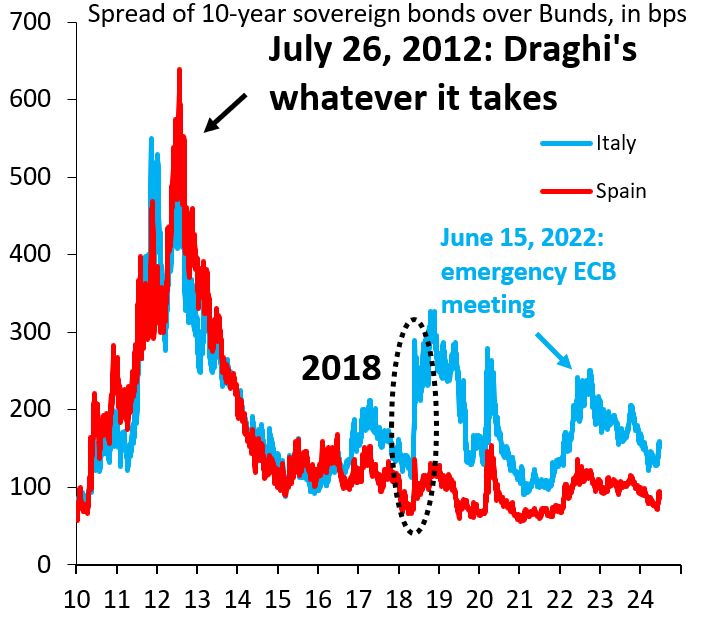

A 2nd Trump term is a problem for the Euro periphery. US deficits will widen, putting upward pressure on global yields as the US sucks in capital.

That's bad news for high debt Italy and Spain. Both countries had all the time in the world to cut debt. Both countries did nothing. Source: Robin Brooks

Thursday night US presidential election debate in one image

Source: USA today

US yield curve steepens sharply after US presidential debate w/PredictIt’s live betting odds have jumped in Trump’s favor to almost 60%

US 2s/10s spread jumps by 7bps to -36bps. Source: HolgerZ, Bloomberg

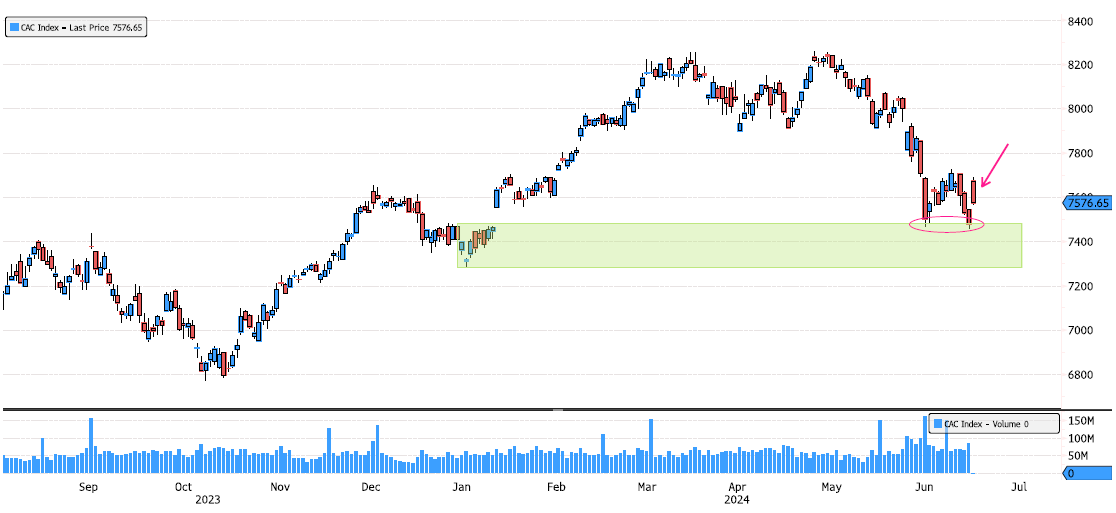

CAC 40 Index Rebounds on Major Support

The CAC 40 Index rebounded on the major support zone between 7285-7480 after posting a double bottom. It’s still a bit early to say that the consolidation is over, so keep an eye out for a close above 7725. Source: Bloomberg

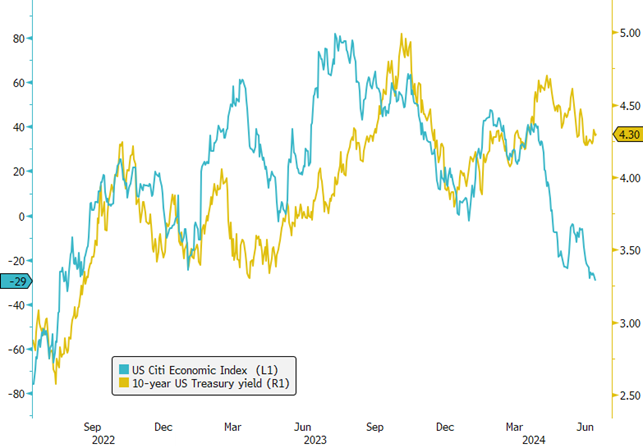

Q2 Fixed Income Review Chart: US Treasury Yields Resilient Amid Mixed Economic Signals!

As the second quarter of 2024 unfolded, a noticeable normalization of the US economy became evident, marked by a significant downturn in the US Citi Economic Index from 33 to -29, reaching its lowest level in nearly two years. Despite these economic headwinds, the 10-year US Treasury yields closed the quarter slightly higher at 4.30%, a 10-basis point increase. This apparent contradiction between economic normalization and rising yields can be largely attributed to substantial US Treasury issuances, necessary to fund the expansive US fiscal deficit. Furthermore, persistent inflationary pressures have prompted the central bank to delay the anticipated rate cut from July to November 2024, adjusting expectations amid changing economic conditions. As we approach a typically low-liquidity summer period, any shifts in interest rates could be magnified. Additionally, with the US presidential election on the horizon, market sentiments could be further influenced by electoral outcomes. The looming question is: Which will have a greater impact on third-quarter rates—the slowdown in the US economy, the ongoing inflationary and supply pressures, or the unfolding political landscape? #Finance #Economy #TreasuryYields #EconomicIndicators #Inflation #FiscalPolicy #InterestRates #USPresidentialElection #MarketAnalysis Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks