Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

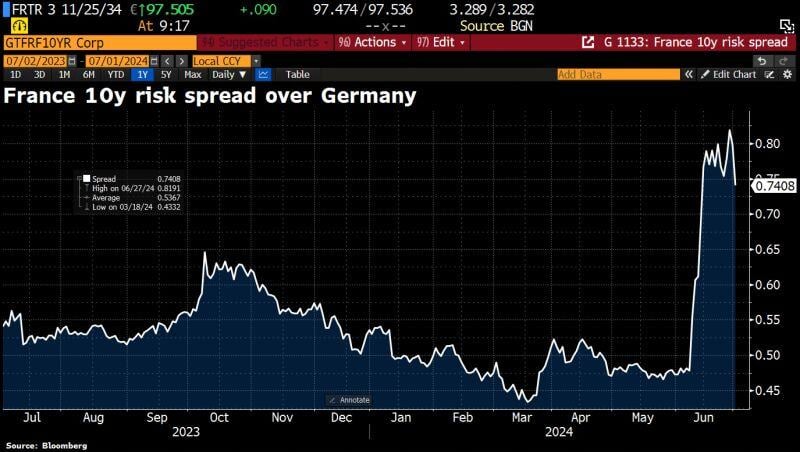

France's 10y risk spread over German bunds drops to 74bps on speculation Marine Le Pen’s far-right party will struggle to win an outright majority in French elections.

Source: HolgerZ, Bloomberg

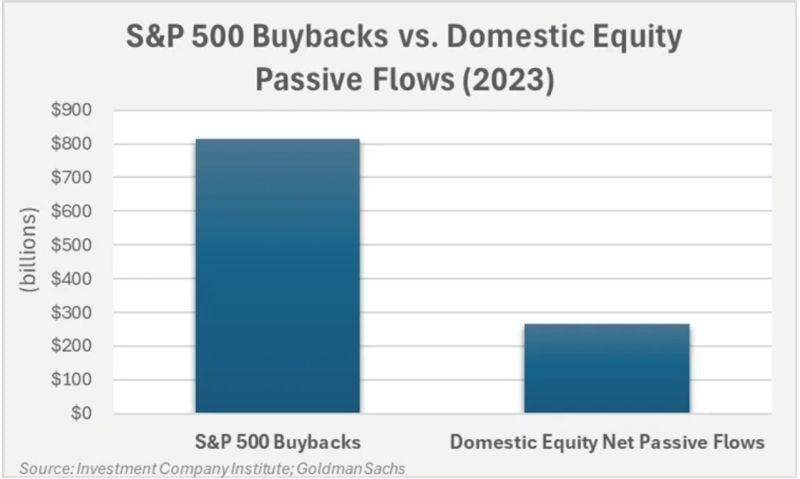

S&P 500 buybacks have been much more powerfuil than passive flows

Source: GS

The US Treasury market remains volatile

The 10-year note yield is now up over 20 basis points in since Friday's intraday low. That's 20 basis points in a matter of hours without any material news? Or is it a Trump effect? UST over-supply? Whatever the reason, for the first time in almost 5 weeks, the 10-year note yield is set to break above 4.50%... Source: The Kobeissi letter

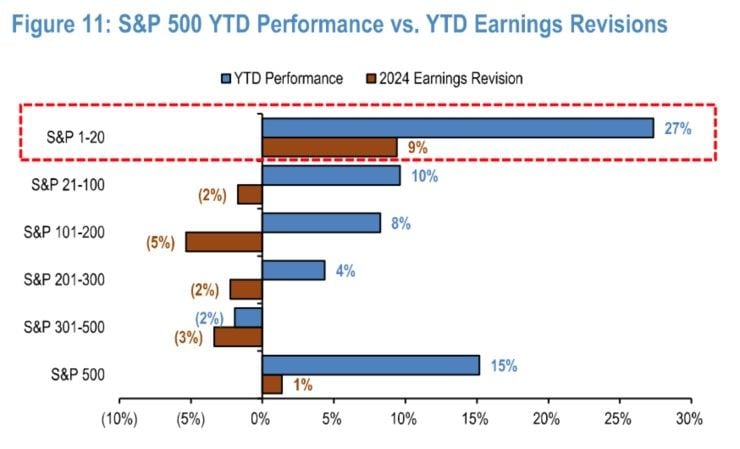

S&P EPS positive revisions have been a tailwind for the market.

However, note that EPS revisions outside of the top 20 have been NEGATIVE YTD and during the last 12 months. Source: JP Morgan

The 13 largest luxury companies by market cap.

Four fun facts: → $LVMH's market cap is more than double the size of the bottom ten companies combined. → $RMS is by far the largest single-brand company on the list, at 3.3x the size of $RACE. → Despite owning 10+ brands including iconic maisons such as Gucci, Saint Laurent, Brioni, and Bottega Veneta, $KER's revenue is "only" ~€20B, compared to Hermès' >€13B. → Tiffany & Co. was acquired by LVMH during the pandemic at a $16B valuation, which would place them at #8 on this list. Source: Quartr

US Poll: Majority believe Biden's cognitive health doesn't qualify him for presidency

A new CBS News/You Gov poll reveals that 72% of Americans doubt Biden's "mental and cognitive health" meets the standards required for the presidency. Of those surveyed, 46% of Democratic voters believe Biden should consider withdrawing from the race due to health concerns. The poll also asked respondents about former President Donald Trump's fitness for office, with 50% expressing confidence in his mental and cognitive abilities, while 49% disagreed. Source: https://www.albawaba.com/

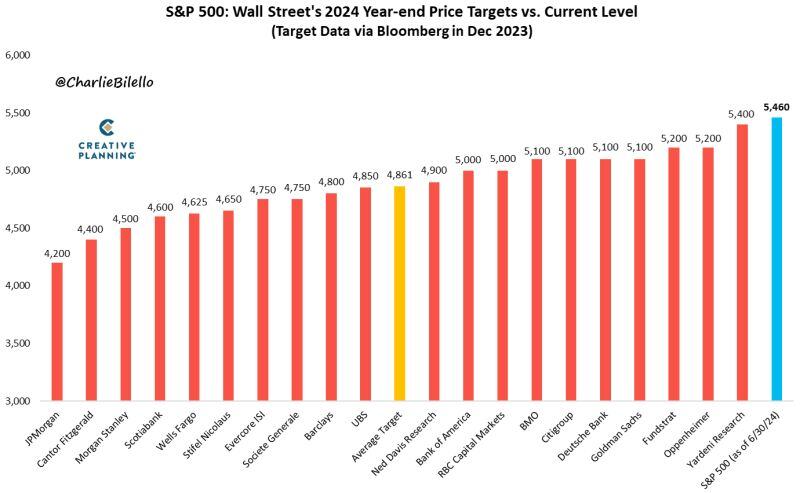

At 5,460, the S&P 500 ended the first half above every 2024 year-end price target from Wall Street strategists

We're 12% higher than average target price of 4,861. $SPX Source: Charlie Bilello

The Le Pen vote

Parliament elections 1st Round- over time: 1988: 9% 1993: 12% 1997: 15% 2002: 11% 2007: 4% 2012: 13% 2017: 13% 2022: 18% 2024: 34% National populism is only getting stronger. Source: Matt Goodwin

Investing with intelligence

Our latest research, commentary and market outlooks