Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

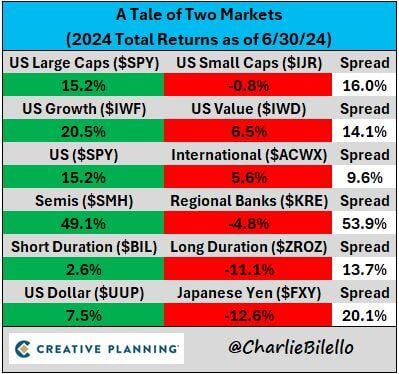

The first half of the year was a Tale of 2 Markets...

-Best of times: US large cap growth stocks, short duration bonds, US Dollar -Worst of times: Small caps, value, international, long duration bonds, Japanese Yen Source: Charlie Bilello

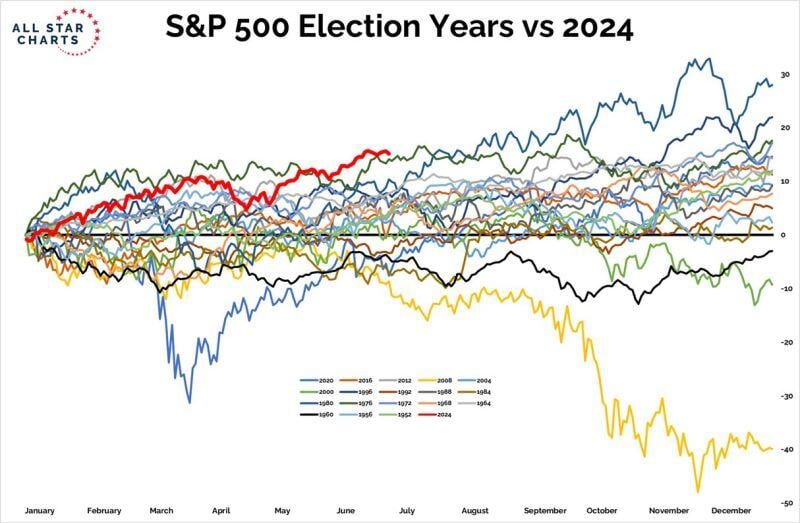

2024 has been the best H1 start out of all election years going back to 1952

Source: Grant Hawkridge

The Japanese Yen is at its lowest level since 1986 against the US Dollar, losing 53% of its value from the 2011 peak.

Markets know that japan has a binding constraint: the fiscal one. They thus need to intervene to keeps yield low which means that they can NOT intervene to strengthen the yen. And so the Yen keeps falling... $JPYUSD Source: Charlie Bilello, Robin Brooks

APPLE IS EXPECTING BIG IPHONE 16 SALES, BASED ON CHIP ORDERS.

STOCK CLOSED UP NEARLY 3% Apple $AAPL has reportedly increased its chip order with TSMC $TSM, With the increased order in place, Apple is supposedly preparing to sell between 90M and 100M units of the iPhone 16 - Apple Insider

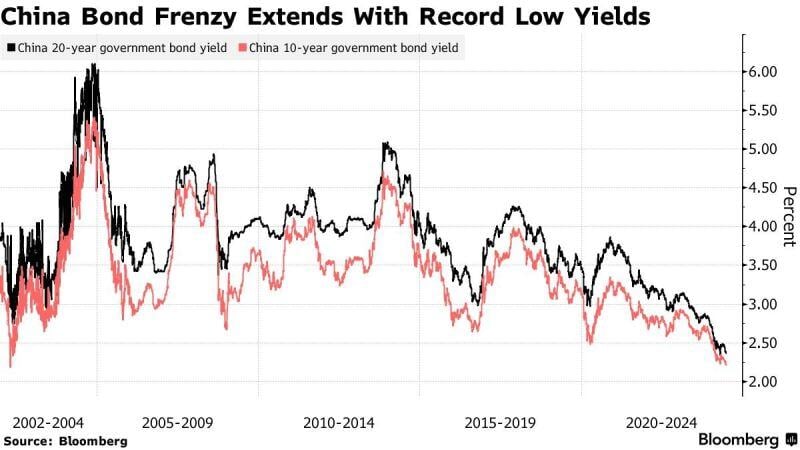

China 10-year yield declines to historic low as rally extends

The yield on China’s benchmark bonds fell to a record low as investors continued to snap up the notes amid pessimism about the domestic economy. The onshore 10-year government yield declined two basis points to 2.18%, set to close at the lowest since Bloomberg began tracking the data in 2002. Yields on the 20- and 50- year bonds have been trading at their historic lows for months. Source: Bloomberg

Bridgewater Associates is launching a fund that uses machine learning as the primary basis of its decision-making.

The vehicle will debut with almost $2 billion of capital from more than a half-dozen clients and begin trading Monday, according to people familiar with the matter, who asked not to be identified discussing the strategy. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks