Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

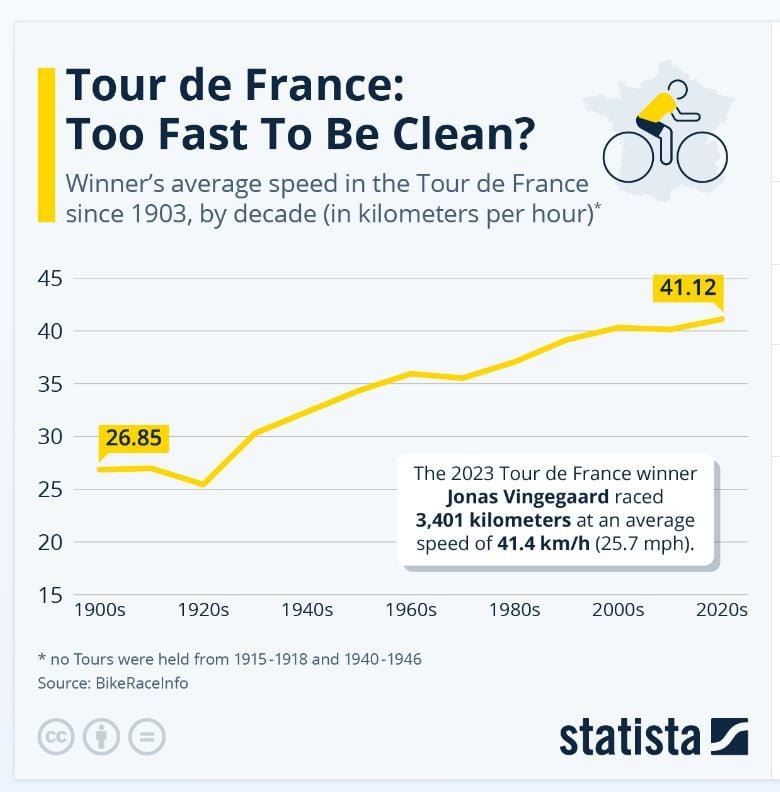

On the way to his second Tour de France victory last year, Denmark's Jonas Vingegaard was facing tough questions regarding his pace before he even arrived in Paris.

How was he going so fast? How was it possible to be over seven minutes ahead of a cyclist of Tadej Pogačar's caliber? Some reporters even explicitly asked: "Are you cheating?". In 2023, Vingegaard completed the grueling 3-week, 3,401 kilometer competition at an average speed of 41.4 km/h (25.574 mph). Given cycling's deservedly bad reputation, it is perhaps understandable that exceptional performances like that still raise suspicions. As Statista's Felix Richter shows in the chart below, the Tour de France has not slowed down since the doping-infested years of the early 2000s. Whether that's due to super-fast carbon bikes, favorable routing or the use of performance-enhancing substances is a question the sport is not yet fully able to answer.

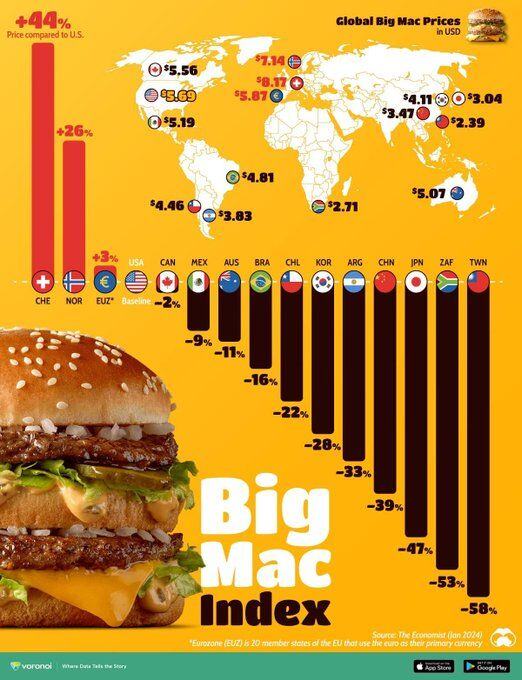

The price of a Big Mac vs. the US in selected countries

Source: Voronoi

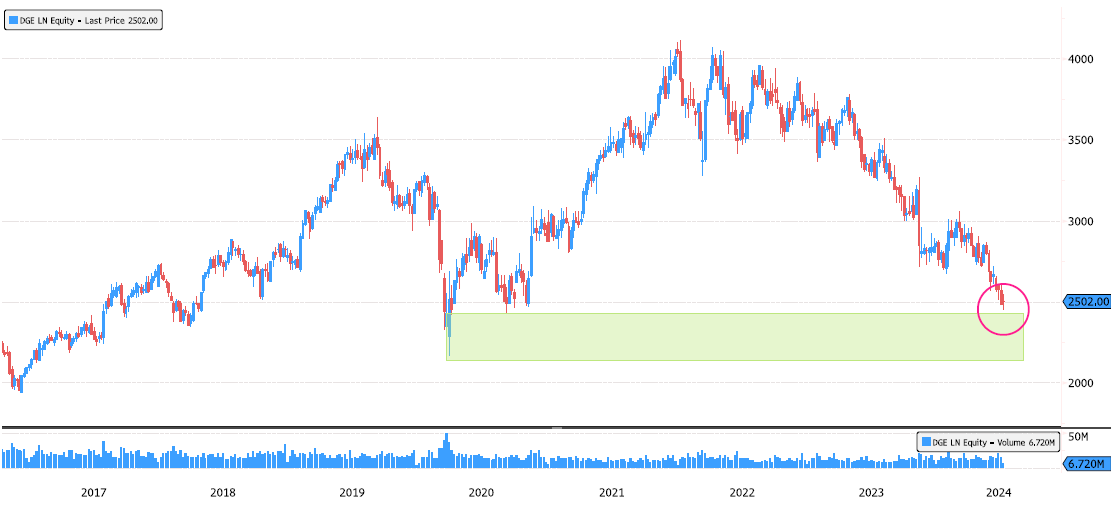

Diageo Reaching Major Support Zone

Diageo (DGE LN) is down 40% since January 2022! The long-term trend remains bullish. The stock is now reaching the 2020 major support zone between 2139-2427. Keep an eye on this level. Source: Bloomberg

Greece has controversially introduced a six-day working week for some businesses in a bid to boost productivity and employment in the southern European country.

The regulation, which came into force on July 1, bucks a global trend of companies exploring a shorter working week. Under the new legislation, which was passed as part of a broader set of labor laws last year, employees of private businesses that provide round-the-clock services will reportedly have the option of working an additional two hours per day or an extra eight-hour shift. The change means a traditional 40-hour workweek could be extended to 48 hours per week for some businesses. Food service and tourism workers are not included in the six-day working week initiative. The pro-business government of Prime Minister Kyriakos Mitsotakis has said the measure is both “worker-friendly” and “deeply growth-orientated.” It is designed to support employees not being sufficiently compensated for overtime work and to help crack down on the problem of undeclared labor. https://lnkd.in/esrbB_4R

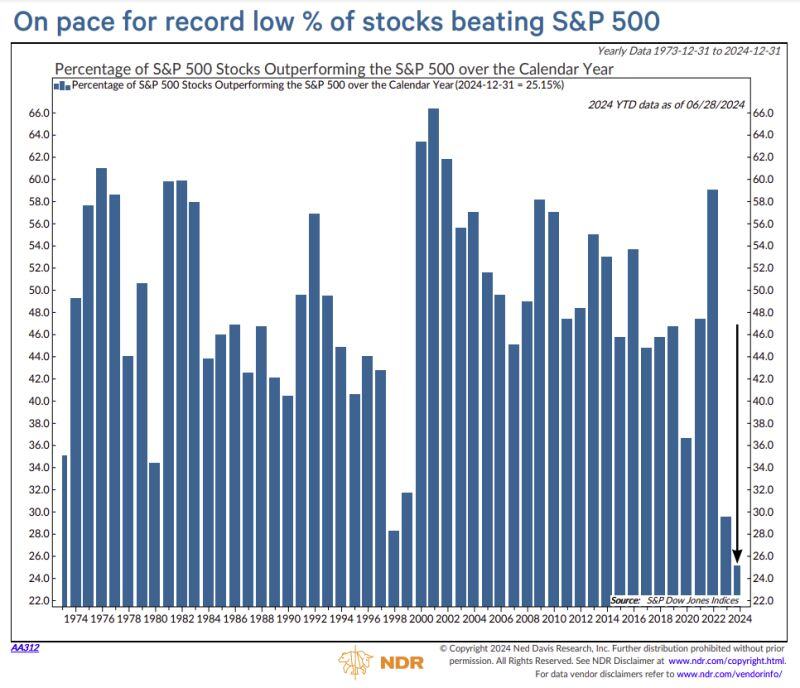

We've never before had so few stocks outperforming the S&P 500.

Source: NDR, Willie Delwiche

Eurozone core inflation unexpectedly sticky: Headline CPI slows to +2.5% in June from 2.6% in May, in line w/forecasts

However, core inflation unchanged at 2.9% – a notch higher than forecasted. Experts had expected it to cool to 2.8%. Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks