Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

🚨 NEW YORK BEGGING FOR SILVER. LONDON CAN’T DELIVER.

Source: @MakeGoldGreat on X

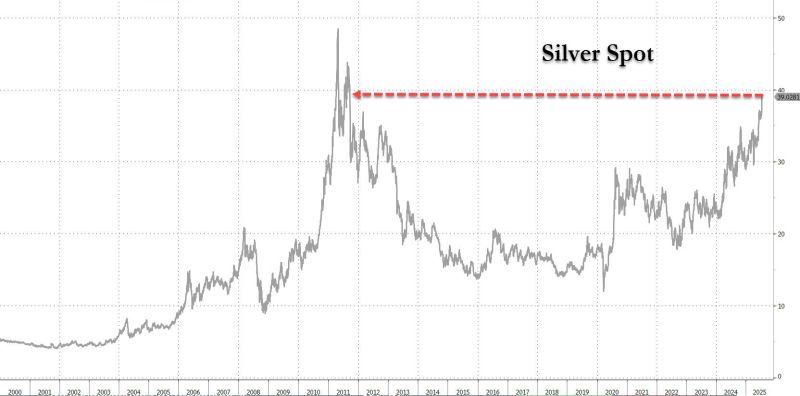

Silver surges above $39 for the first time since the first US downgrade in Aug 2011

Source: zerohedge

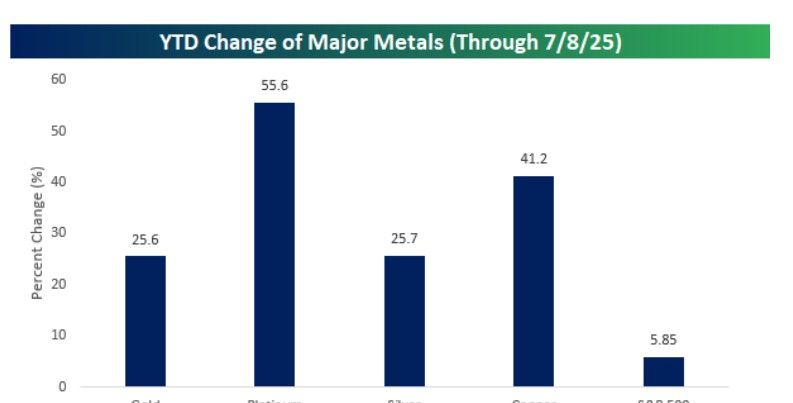

The charts below show the YTD change in the main metals and the sp500 through July 8th of each year since 1990.

While gold is up less than any of the other four metals this year, through yesterday's close, the only other year with a larger YTD gain was in 2016. The only other year it was up over 20% was in 2006 (22.3%). Platinum's 55.6% gain is easily a record through this point in the year. In fact, it's double the prior record of 27.8% that was reached in 2006 and 2008. The only other year that platinum gained more than 20% YTD through 7/8 was in 2000 (23.6%) and 2016 (23.4%). Silver and copper have both experienced 20%+ YTD gains through 7/8 more than gold and platinum. Silver had a larger YTD gain last year and has now had six 20%+ YTD gains since 1990. Copper's 41.2% gain this year ranks as the best since 2009 (53.1%) and is the seventh time that the commodity has rallied more than 20% YTD. While all four commodities have experienced other YTD gains of 25%+, this year is the first time all four have rallied 25%+ YTD through 7/8 in the same year. The only time they ever all simultaneously rallied 20%+ YTD was in 2006, and the only other year when all four were even up 10% YTD at this point in the year was in 2008. Other years since 1990 have seen big runs in the metals, but none of them have been quite like the 25%+ across the board gains in 2025. Source: Bespoke

BREAKING: Coffee

Coffee falls to its lowest price since November Enjoy your ☕☕☕ Source: Barchart

In case you missed it... Copper is up +29% year-to-date.

Better than gold.

So far, this has been the year of precious metals🔥

Performance year-to-date: Platinum +42% Gold +27% Silver +22% Bitcoin +9% The S&P 500 +3% Since the beginning of 2024: Bitcoin +149% Gold +63% Silver +52% Platinum +33% S&P 500 +26% Source: Global Markets Investor

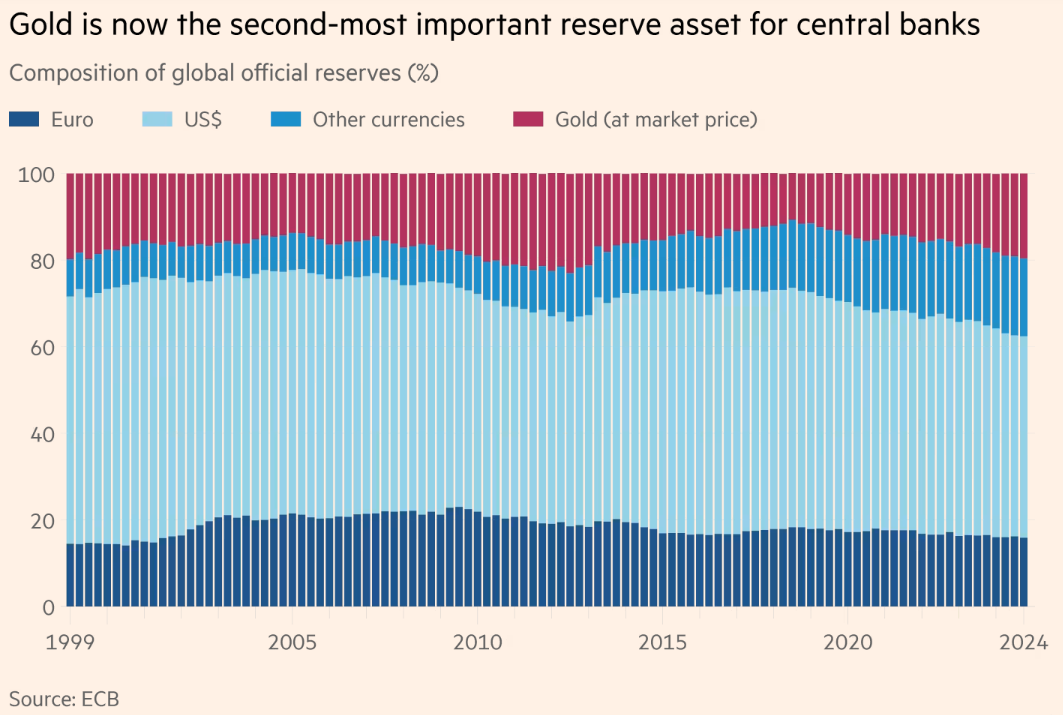

Gold is now the second-most important reserve asset for central banks

Source: ECB, MKS-PAMP, FT

Investing with intelligence

Our latest research, commentary and market outlooks