Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Gold’s 2025 Surge: Defying the Commodity Downturn

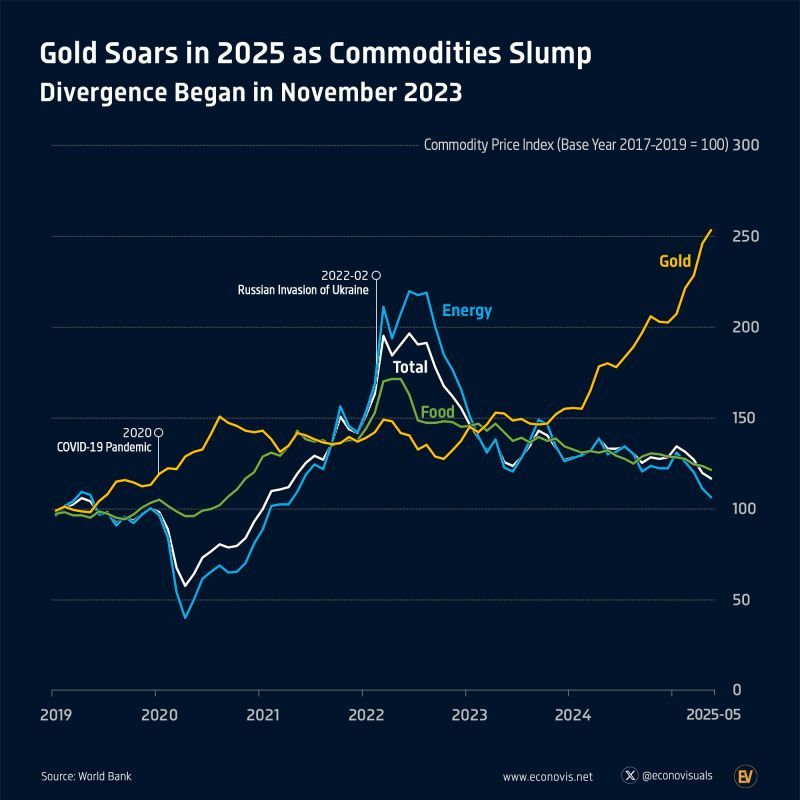

Divergence Began in November 2023 By May 2025, gold prices had surged 25.0% year-to-date, in sharp contrast to the broader commodity market slump. The overall commodity index fell 9.0%, with energy prices down 12.9% and food prices down 5.9%. Gold's value stood 153% above its pre-pandemic level—outpacing the commodity index by 117%, energy by 138%, and food by 109%. Source: Econonovis on X

Here we go...

Silver blasting by more than 5% for its best day in more than 1 year 📈📈 Source: Barchart

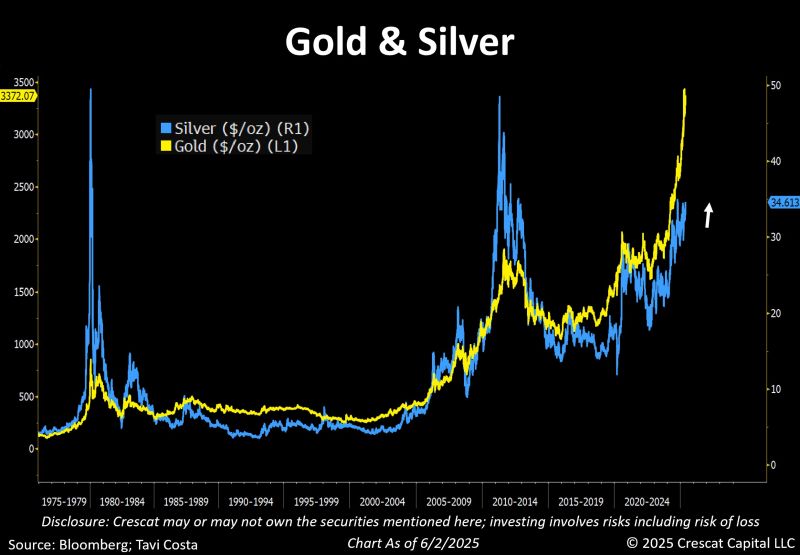

Is it time for silver to shine?

If history is any guide: Gold makes the first move — then silver takes over. With the gold-to-silver ratio near 100, is yesterday's sharp move on Silver (up +5%) just the beginning? Source. Bloomberg, Crescat Capital

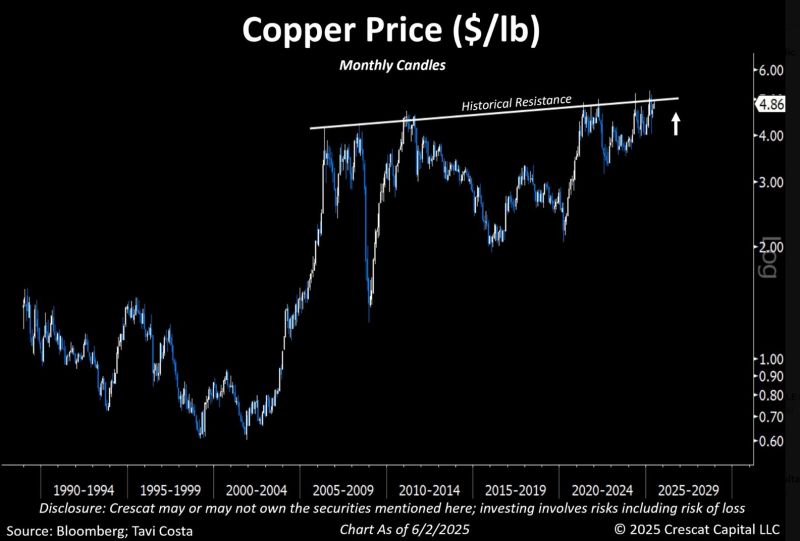

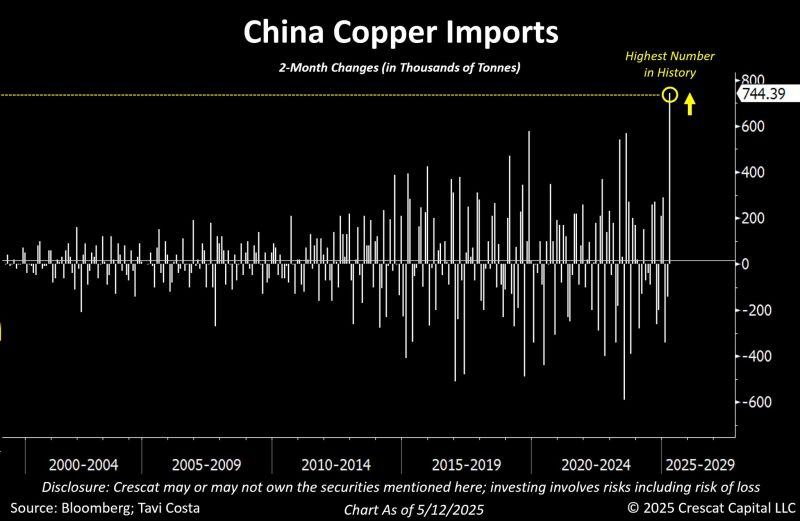

Copper is approaching a pivotal inflection point, in my view.00,000 More Sellers Than Buyers—the Most on Record. (Clone)

As highlighted by Otavio (Tavi) Costa, just as $2,000/oz was a defining level for gold, the $5/lb threshold carries similar significance for copper. "Once this level is decisively breached again, copper could enter a phase of price discovery much like what we saw with gold" he added. Let's keep in mind that Copper is central to nearly every major infrastructure initiative of the coming decade — ranging from data centers and onshoring to grid modernization, the resurgence of manufacturing, residential development, and more. Source. Bloomberg, Crescat Capital, Tavi Costa

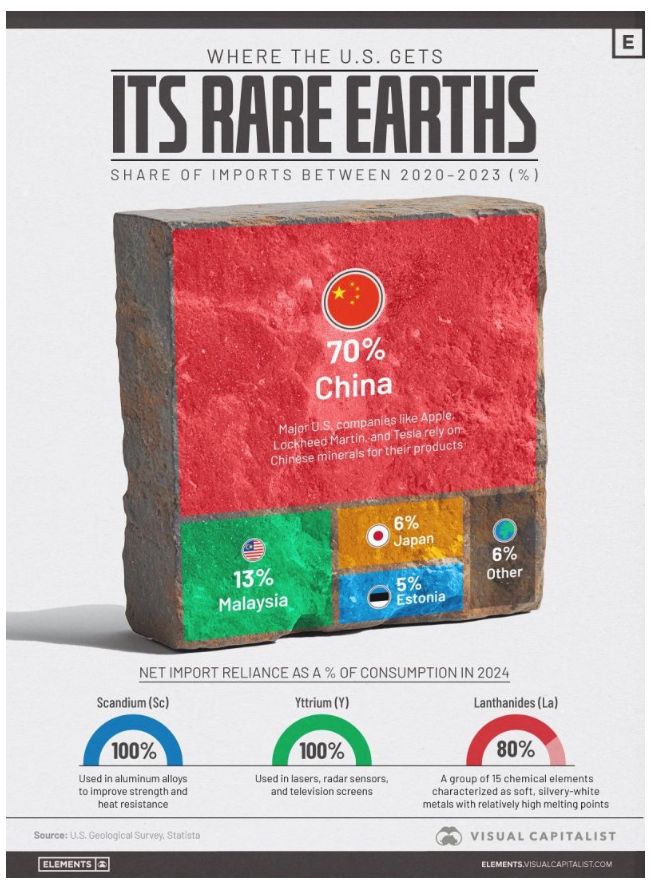

China's dominance in the global supply of rare earth elements (REEs) is a significant factor influencing various industries, from smartphones and electric vehicles to guided missiles and satellites.

Between 2020 and 2023, China supplied 70% of U.S. rare earth imports, establishing itself as the primary source. Following closely are Malaysia, Japan, and Estonia in the top four suppliers. Despite their name, rare earths are not scarce in the Earth's crust; the challenge lies in extracting them in concentrated amounts economically and sustainably. China plays a pivotal role in this scenario, producing approximately 90% of the world's refined rare earths. Its extensive capacity for separation and purification gives it a substantial influence over global supply chains. For instance, yttrium, crucial in radar systems, lasers, and television screens, saw 93% of its U.S. imports originating from China between 2020 and 2023. Other vital rare earths like Samarium, Gadolinium, Terbium, Dysprosium, Lutetium, and Scandium face similar supply concentration challenges. These elements are integral to military applications, electric motors, and cutting-edge electronics, with companies such as Lockheed Martin, Tesla, and Apple relying on them for their core products. Source: Elements

China has just reported its largest two-month copper imports in history.

The world remains firmly entrenched in a deglobalization trend. Even if we got a (temporary) US-China trade deal over the week-end, this foes not change the The push to secure strategic metals is just one manifestation of this broader shift unfolding in the markets. Source: Tavi Costa, Bloomberg

The Gold/Silver Price Ratio is now trading at 102x, the highest level in history since the U.S.

Dollar came off the Gold Standard (excluding the Covid scare) Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks