Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

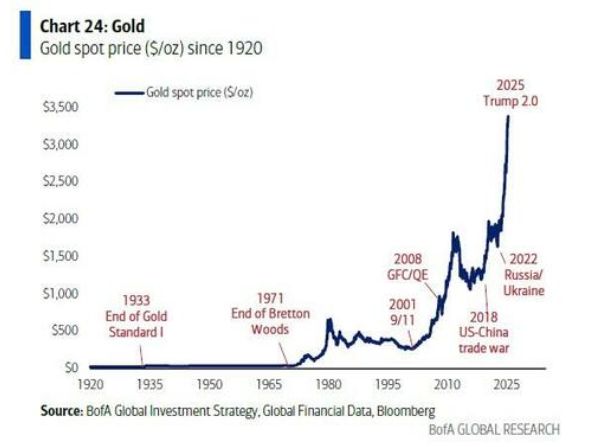

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Oil drops on signs conflict may space Iranian crude production

Oil fell as the conflict in the Middle East has so far avoided disrupting crude production and the Wall Street Journal reported that Iran privately expressed willingness to deescalate hostilities with Israel. West Texas Intermediate tumbled as much as 4.9%, after spiking higher at the open, after the newspaper said Tehran would be open to returning to the negotiating table as long as the US doesn’t join the attack. The development quelled fears that a protracted conflict would engulf a region that produces around a third of the world’s crude. Source: Bloomberg

Oil jumped as much as 14%

- biggest daily gain in more than 5 years - as Israel launched a series of airstrikes in Iran, and escalated the long-simmering conflict between the two nations into a full-on war. ➡️ The strikes targeted sites linked to Iran’s nuclear enrichment program, as well as top scientists Fereydoun Abbasi-Davani and Mohammad Mehdi Tehranchi, both of whom were killed, Iranian media reported. ➡️The commander-in-chief of Iran’s Islamic Revolutionary Guard Corps, Hossein Salami, was also killed in a strike. ➡️Netanyahu says attacks would ‘roll back’ Iran threat ➡️Tehran vows retaliation against Israel and US ➡️Washington distances itself from ‘unilateral’ attack. Trump said he will to convene National Security Council meeting. ➡️Oil prices jumped more than 10% as traders anticipated tighter supply. ➡️Gold is up 1.5% at $3,450. S&P 500 futures are down -1.5%. Bitcoin is down 3% at $104k

A major breakout for palladium

Source: Graddhy - Commodities TA+Cycles

China, U.S. officials reach agreement for allowing rare-earth, tech trade.

The negotiators will now seek approval on the framework from the U.S. and Chinese presidents, before implementing it. The U.S. and China have reached an agreement on trade, representatives from both sides said after a second day of high-level talks in London, with the deal now awaiting a nod from the leaders of the two countries. “We have reached a framework to implement the Geneva consensus and the call between the two presidents,” U.S. Commerce Secretary Howard Lutnick told reporters. That echoed comments to reporters from Li Chenggang, China’s international trade representative and a vice minister at China’s Commerce Ministry. U.S. President Donald Trump and Chinese President Xi Jinping spoke by phone late last week, stabilizing what had become a fraught relationship with both countries accusing each other of violating the Geneva trade agreement. At a meeting in Switzerland in mid-May, the world’s two largest economies had agreed to a 90-day suspension of tariffs added in April, and a rollback of certain other measures. Lutnick said he and U.S. Trade Representative Jamieson Greer will head back to Washington, D.C., to “make sure President Trump approves” the deal outline. If Xi also agrees, then “we will implement the framework,” Lutnick said. Chinese restrictions on rare-earth exports to the U.S. are a “fundamental part” of the latest agreement and the U.S. expects the issue “will be resolved in this framework implementation,” Lutnick said. He indicated U.S. restrictions on sales of advanced tech to China in recent weeks would be rolled back as Beijing approves rare-earth exports. While Chinese state media had been quick to announce Xi’s call with Trump last week, Beijing’s official mouthpieces were conspicuously silent more than one hour after Lutnick’s comments, except for a lower-profile mention citing Vice Commerce Minister Li as saying that the talks helped build bilateral trust. On Tuesday local time in London, U.S. Treasury Secretary Scott Bessent told reporters he was headed back to the U.S. in order to testify before Congress. Chinese Vice Premier He Lifeng, the lead negotiator on trade talks with the U.S., and Chinese Minister of Commerce Wang Wentao also participated in this week’s discussions. China’s CSI 300 index was trading slightly higher, while U.S. stock futures were down as investors awaited details on the trade framework. First take >>> The fact that the two sides will now brief their leaders could be a sign that some disagreements or unresolved details still require internal discussion. The framework agreement signals a commitment to de-escalate and continue the dialogue process, but whether it will lead to concrete agreements or substantive breakthroughs continues to be uncertain. Source: Bloomberg, CNBC

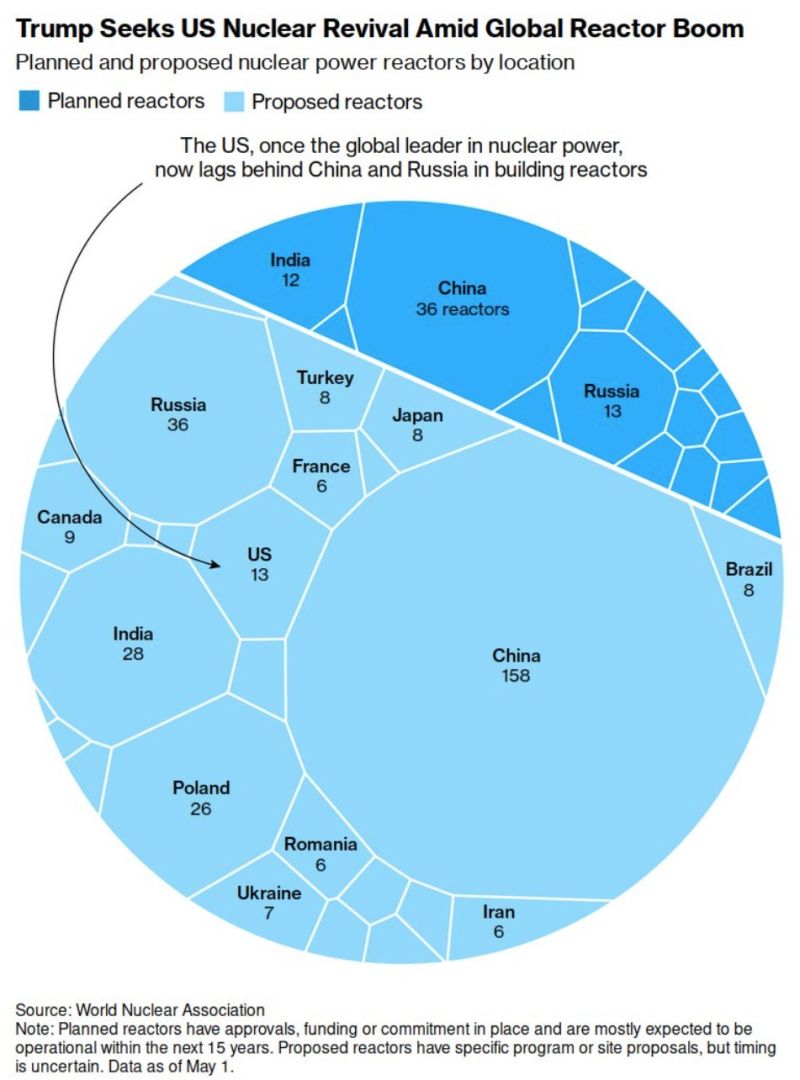

Bullish for the nuclear power sector and uranium producers

Source: Markets & Mayhem

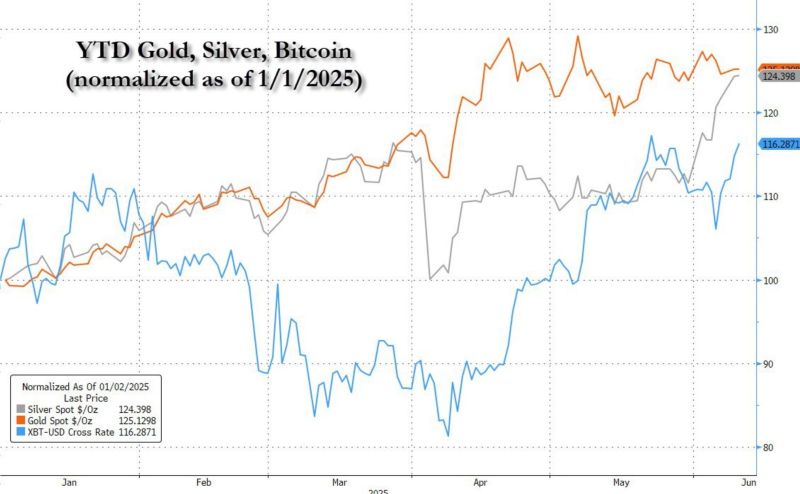

Silver about to surpass gold as best performing asset YTD

Source: zerohedge

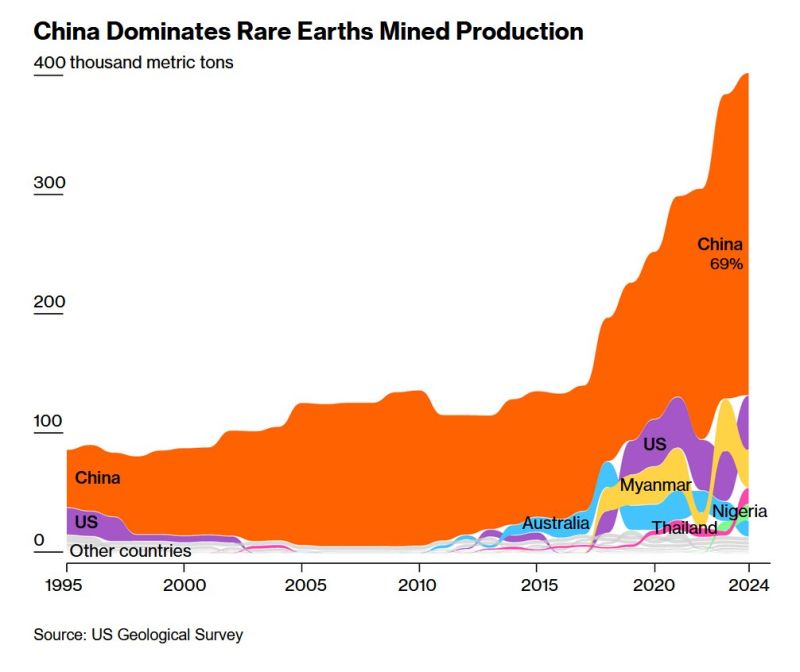

China dominates global rare earths production:

China now produces nearly 400,000 metric tons of rare earths a year. This is a massive 69% of the global output, per the US Geological Survey. The US is seeking to restore flows of critical minerals in today's trade talks. Source: Global Markets Investor

Investing with intelligence

Our latest research, commentary and market outlooks