Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

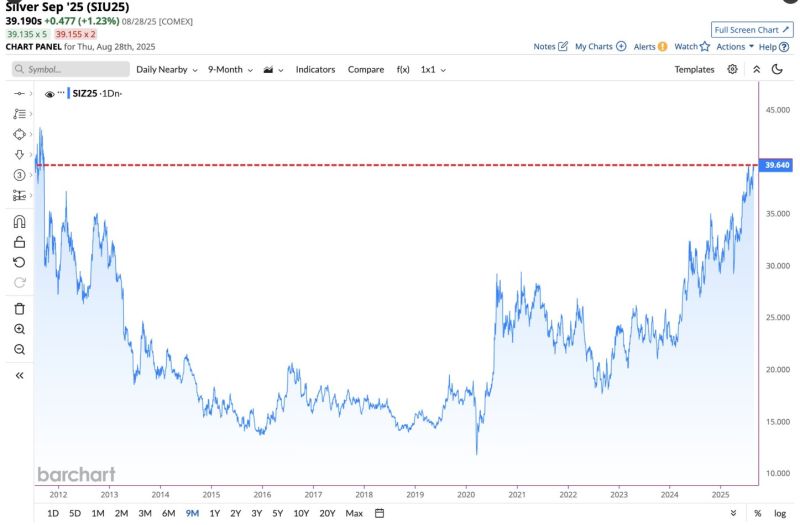

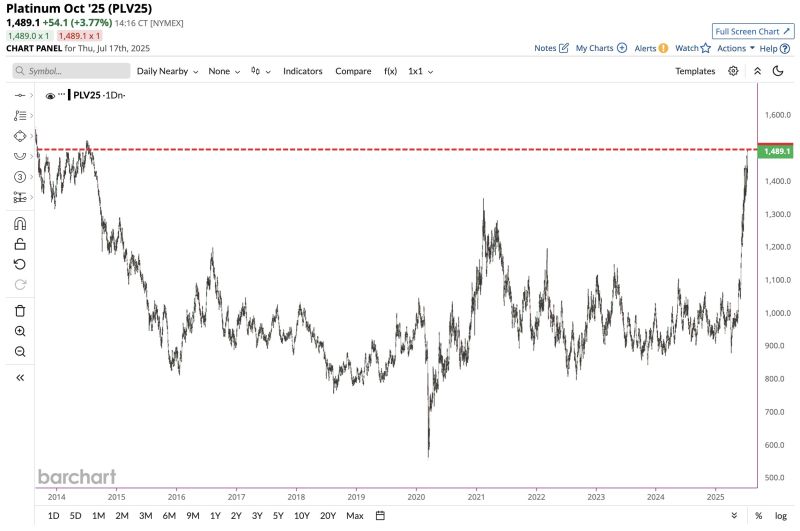

In case you missed it... silver hits highest closing price in almost 14 years 📈📈

Source: Barchart

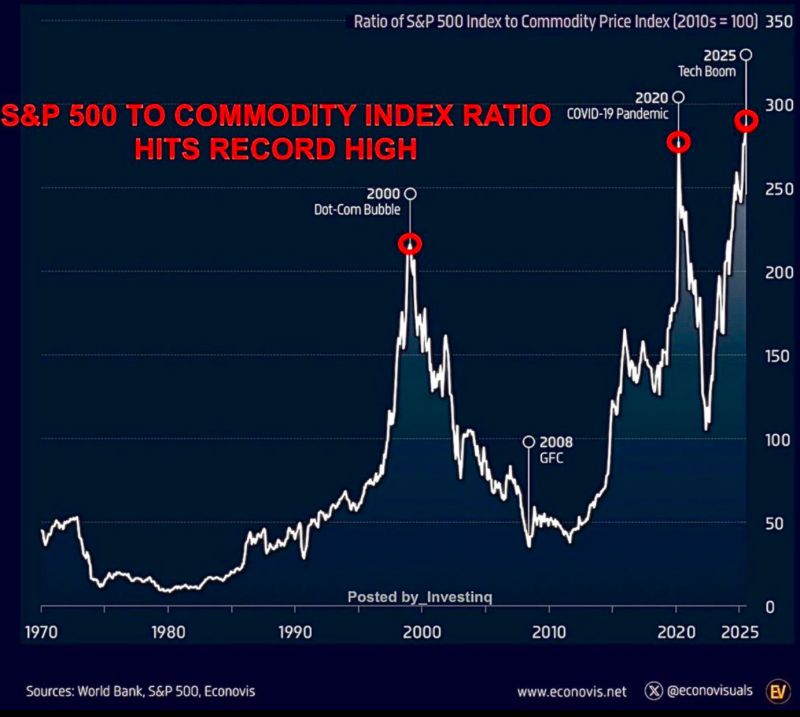

A new all-time-high for sp500 to commodities ratio

Source: Worldbank, Econovis

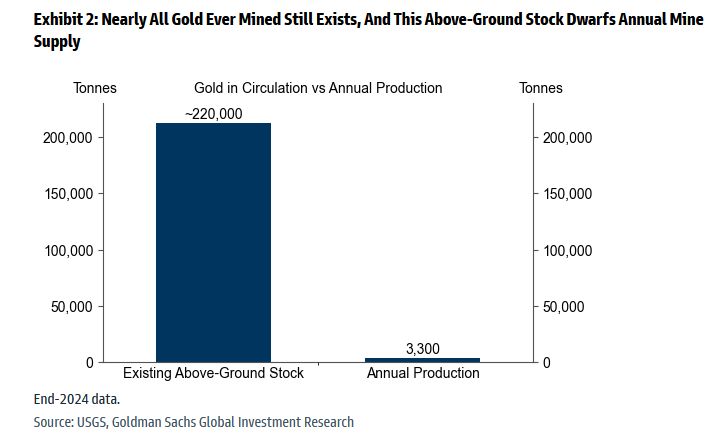

Gold is unlike other commodities – it is not consumed; it is stored.

Nearly all gold ever mined – about 220,000 tonnes – still exists, and this above-ground stock dwarfs annual mine supply. - From Goldman's primer on gold Source: zerohedge

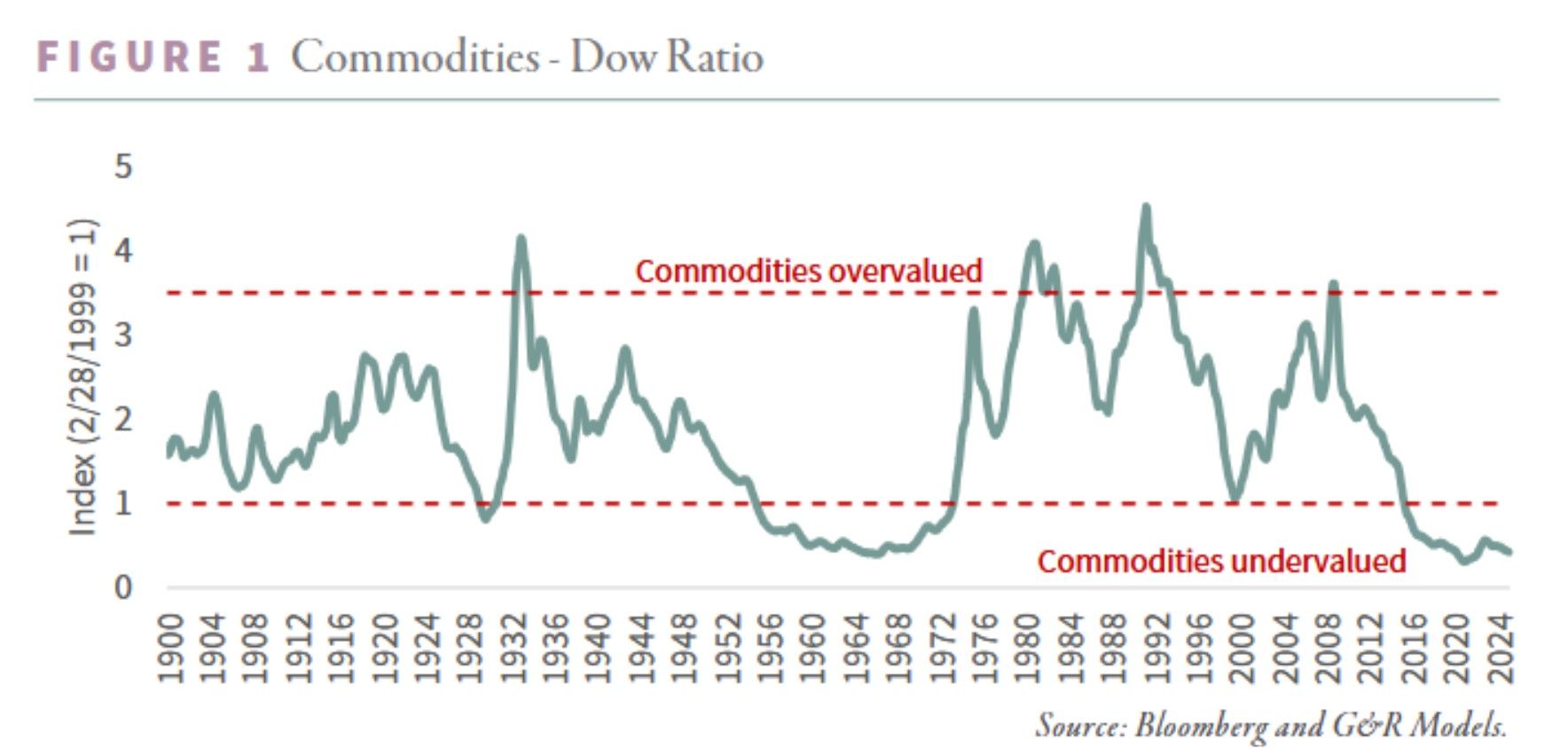

Not much improvement for the commodities-to-dow ratio

Dow Jones hit new all-time high while oil stays in a down trend. Source: Bloomberg, Finding Value Finance on X

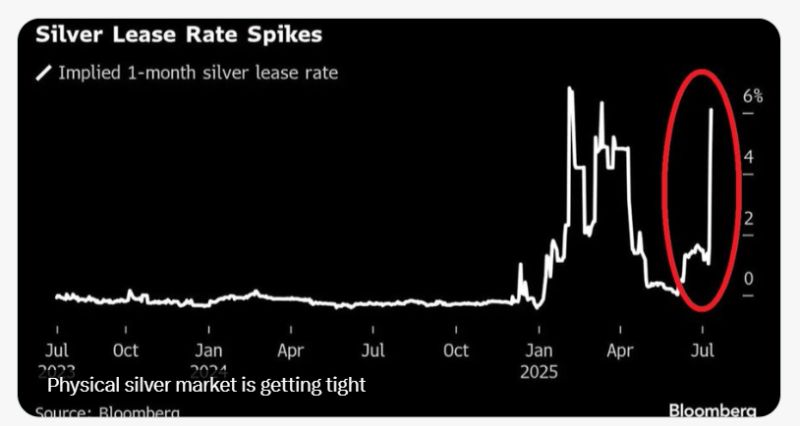

‼️Physical silver market is getting TIGHT

1-month silver lease rates, the cost to borrow silver short-term, spiked above 6%. It’s normally close to 0% because physical silver is usually abundant and easy to borrow. Source: Bloomberg, Global Markets Investor

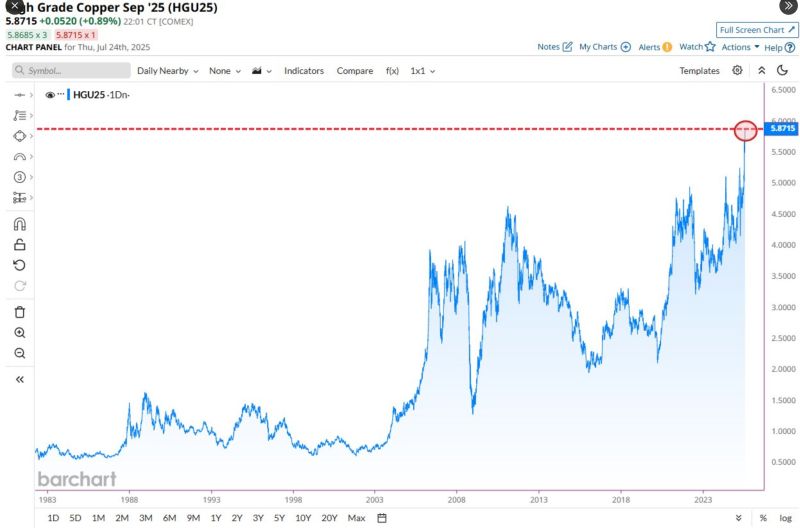

Copper soars to highest closing price in history 📈📈

Source: Barchart

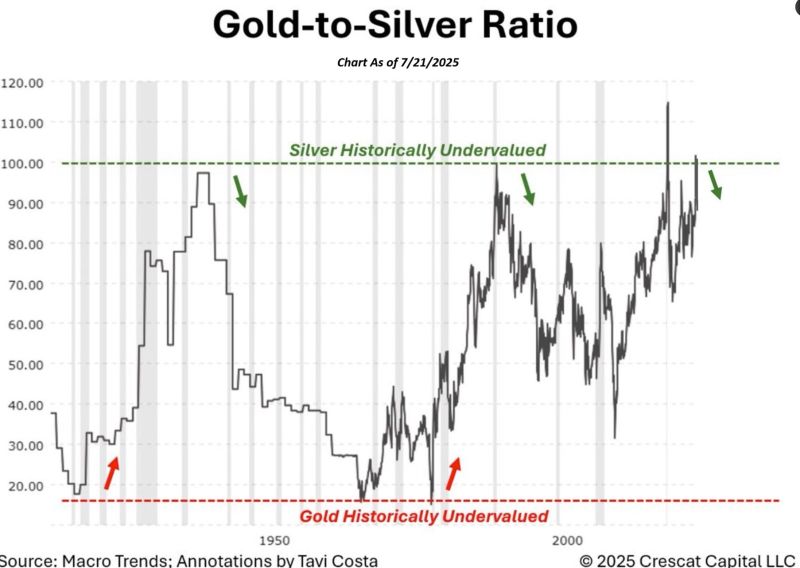

It's remarkable to see silver approaching $40/oz, yet still historically undervalued relative to gold.

Source: Tavi Costa

Investing with intelligence

Our latest research, commentary and market outlooks