Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

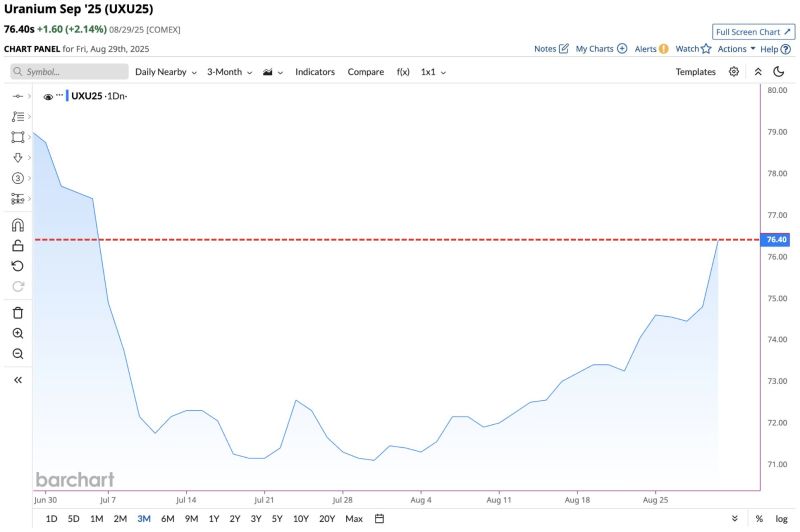

J-C Parets on Lithium:

"Lithium is the bridge commodity - connecting cyclical reflation with structural demand. EVs, battery storage, datacenters, renewable energy - these aren't optional trends. They're structural. Lithium demand doesn't go away because the economy slows for a quarter. When capital rotates back into lithium, it tells us that the forward-looking, technology-driven demand story is aligning with the cyclical reflation story that gold and copper already flagged". Source: J-C Parets

In case you missed it...

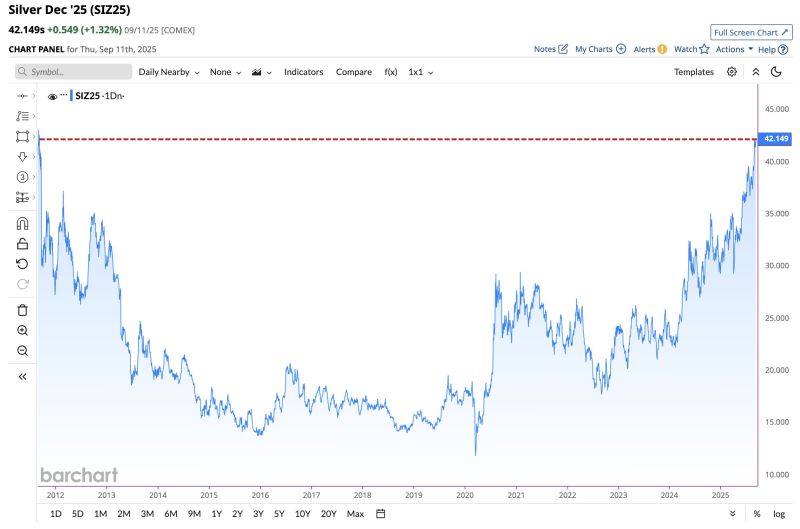

Silver hits highest closing price in 14 years. Source: Barchart

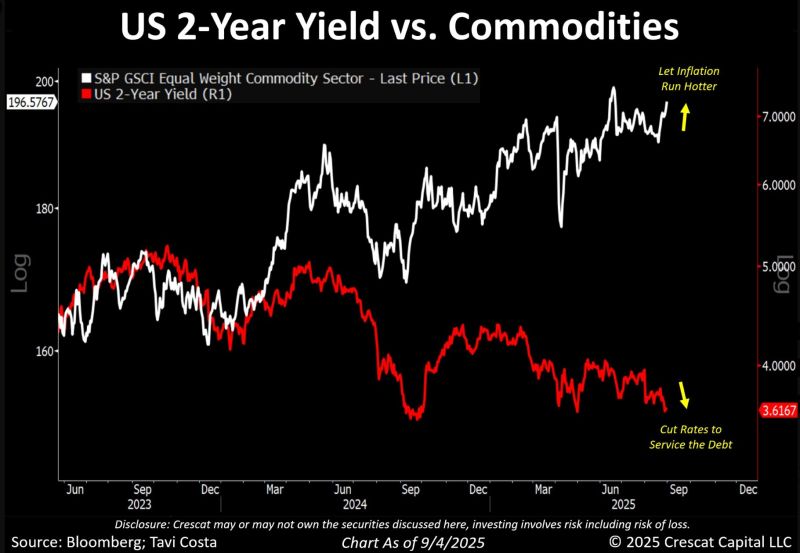

As highlighted by Otavio Costa, this is the environment we are in:

US 2-year yields approach multi year lows as commodities approach all time highs. The Fed is likely to cut rates to service debt. And the price to pay inflation expected to run hotter. Source: Tavi Costa, Bloomberg

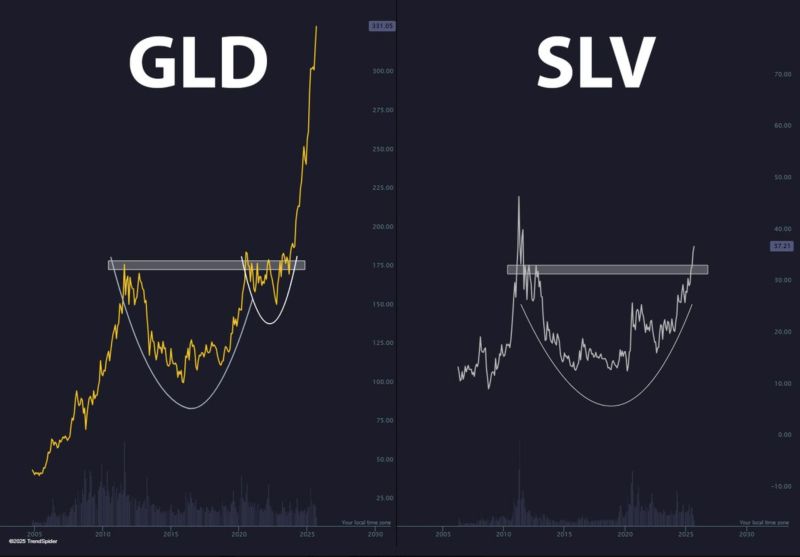

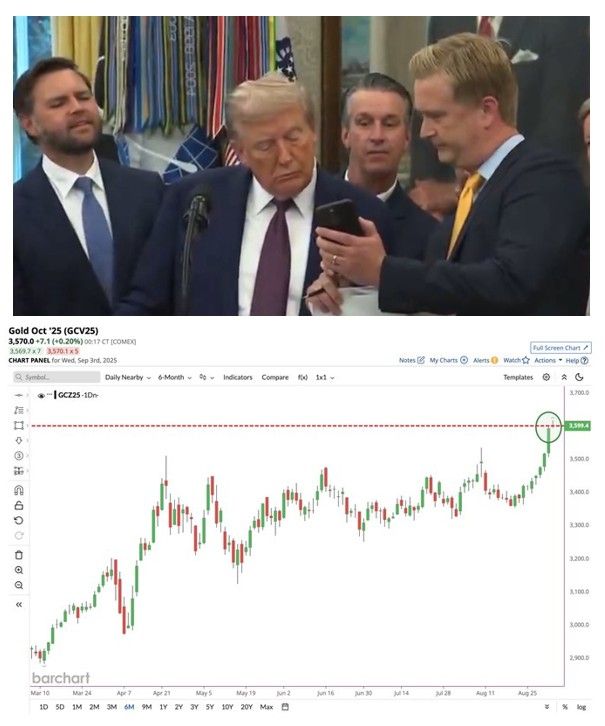

Gold just hit all-time highs, 100 times the $35 it was in 1971 when Nixon closed the gold window

"The metal itself hasn’t changed; it’s still atomic number 79, the same as thousands of years ago. What changed is the dollar. Once it was tied to gold, now it floats, weakened by inflation and endless deficits. That’s why it takes over 100x more dollars to buy the same ounce". Source: StockMarket.News @_Investinq on X

Investing with intelligence

Our latest research, commentary and market outlooks