Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

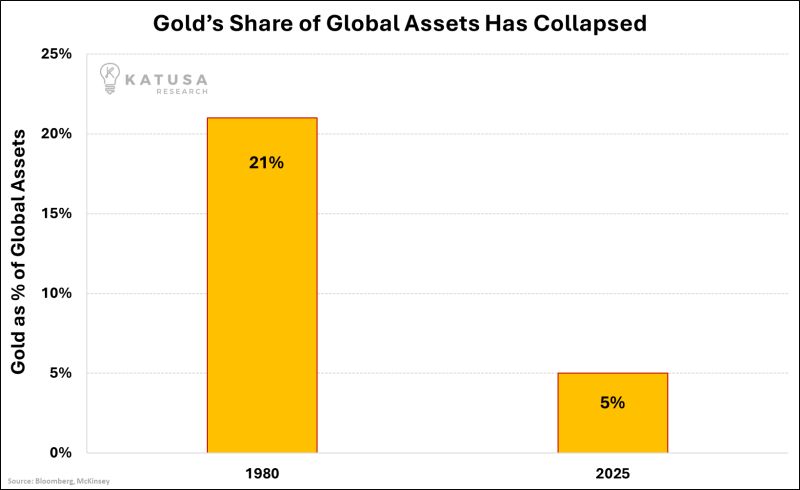

Gold was 21% of global assets in 1980. Today it's 5%

The financial universe got 4X bigger. Stocks, bonds, derivatives, crypto Sometimes the denominator is the story Source: Katsua Research

Gold hits most overbought level on the monthly chart in 45 years.

But beware, an asset can stay overbought during a long period of times in a bull run. And the market isn't speculating; it's rationally repricing the metal for a new era of fiscal dominance, negative real yields, and de-dollarization. Source: Barchart

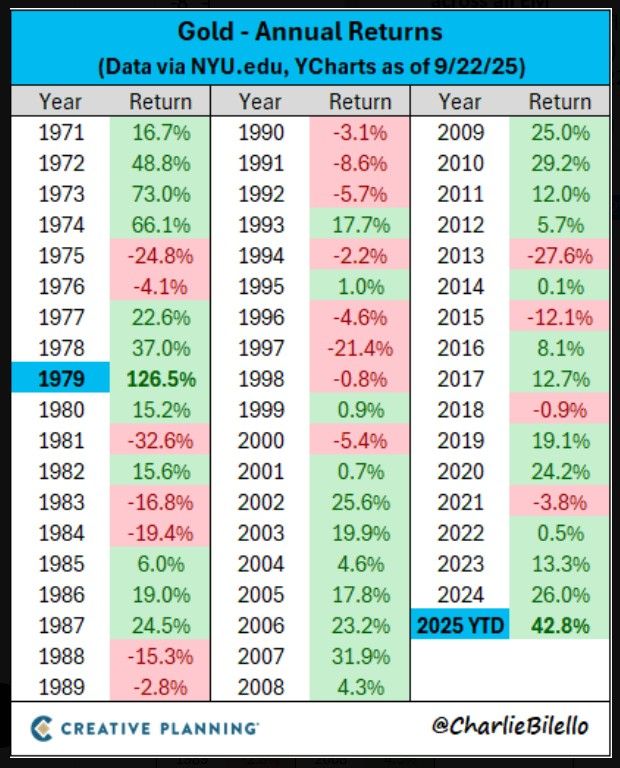

Gold is on pace for its best year since 1979, up over 42% in 2025.

Source: Charlie Bilello

The gold price is rising again.

It fell back briefly after last week's Fed, as markets digested a more complicated meeting than they had hoped for. But now we're back off to the races and gold is resuming its rise. As rightly put by Robin Brooks, "the world is running out of safe havens. Gold is the winner..." Source: Robin Brooks

Is Silver a pure AI play?

Note how Silver has been moving in sync with Global X Artificial Intelligence ETF $AIQ... Source: The Market Ear

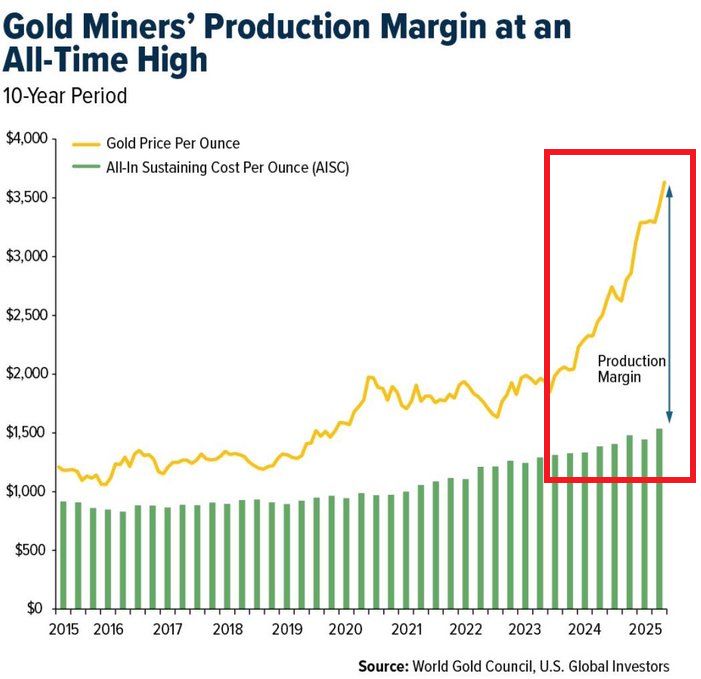

Gold miners are making record profits:

Production margins are at an all-time high as gold prices surge while costs rise much slower. Miners are now earning more per ounce than ever in the past 10 years. Meanwhile, gold miners ETF, $GDX, has skyrocketed 103% year-to-date. Source: Global Markets Investor

Investing with intelligence

Our latest research, commentary and market outlooks