Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

I’m not a gold buyer, it costs 4% to own it,”

Dimon said Tuesday at Fortune’s Most Powerful Women conference in Washington, referring to storage costs for billionaires who have to store several hundreds gold bars worth billions, and clearly not referring to 99% of actual gold buyers who own a little gold at home and which costs them 0% to own it. That said, Dimon admitted that gold “could easily go to $5,000, $10,000 in environments like this. This is one of the few times in my life it’s semi-rational to have some in your portfolio.” Source: zerohedge, metals mine

$GLD Gold Trust ETFD just broke out of a 5-year cup & handle vs $SPY S&P 500 index ETF.

COVID highs are now in sight. Source: Trend Spider

Silver to hit $100 by the end of 2026 says BNP Paribas and Solomon Global

Source: Barchart

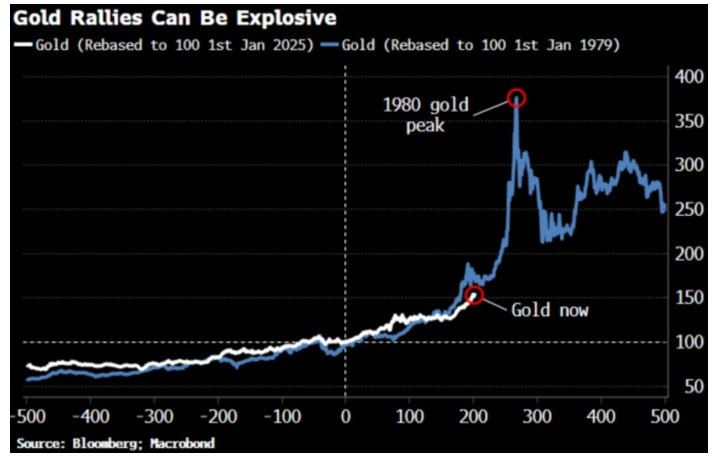

Will gold rally be as explosive as the one in the 80s ???

Source: Macrobond, Bloomberg, Incrementum AG

Silver was brutally slammed by $3.75/oz, or 7%, in the early hours of the morning.

Is someone (a bank?) trying to force prices below the critical $50 level ??? Source: Jesse Columbo

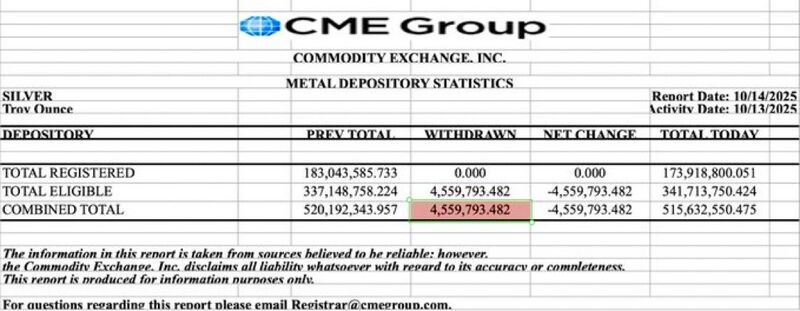

Silver continues leaving COMEX, another 4.56 million ounces withdrawn in a single day.

That means traders are actually taking physical delivery instead of just trading paper contracts. It’s happening because the London silver price is higher than New York’s, so traders are pulling real metal from U.S. vaults to sell it where it’s worth more. Each withdrawal tightens supply further and shows how physical demand is outpacing what’s left on paper. Source: StockMarket.news

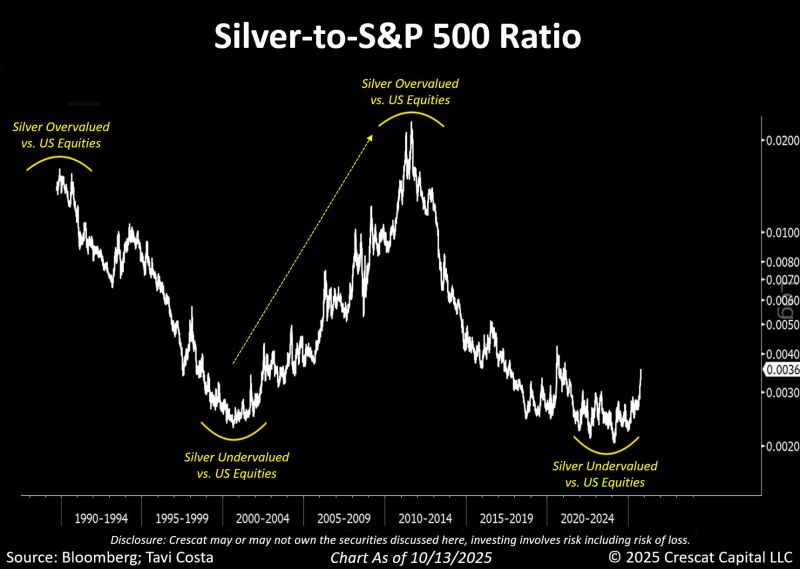

Are we still in the early stages of a major cycle where silver outperforms U.S. equities????

This chart by Otavio (Tavi) Costa highlights just how early we might be in a broader trend of capital rotating into hard assets. Source: Crescat, Tavi Costa, Bloomberg

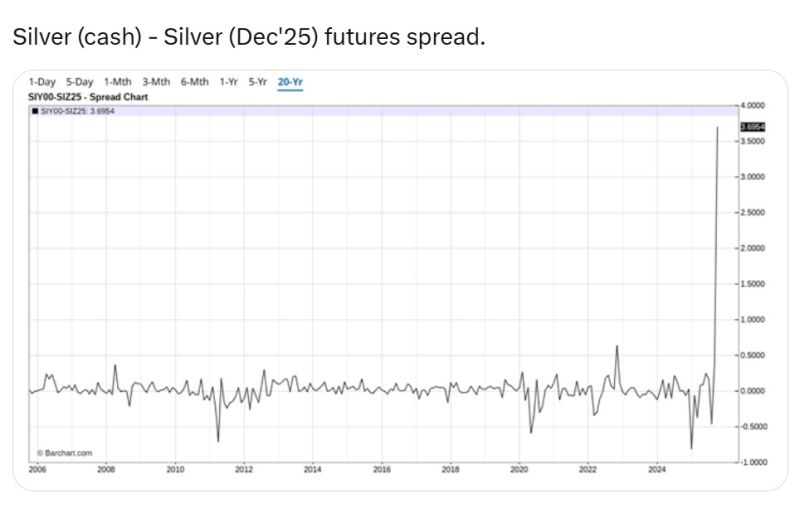

Silver short squeeze in one chart:

Silver (cash) - Silver (Dec'25) futures spread. Huge Backwardation as PAPER SCRAMBLES TO FIND METAL ! The spot/future basis on Silver is going crazy because the London market has little metal available for delivery ‼️ The lease rate for 1 month, 3M and 1Y is adjusted by USD interest rates so in normal circumstances it is near 0.2%, reflecting only the normal storage and insurance costs of silver. It is now an inverted market, with London spot way above futures. Overnight lease is 100% annualized, 2 weeks 25%, 1 months 11%, 3 months 8% and 1y 4.1%, which is very abnormal ‼️ Spot in London trades above NY futures, liquidity is vanishing, and shorts are paying eye-watering borrow to survive the roll. ➡️ As such, overnight borrowing costs have spiked to triple-digit annualized in the tightest moments. 😨 So what is going on? As Hinza Cerny explained on X: Traders are literally booking transatlantic cargo slots. Estimated 15–30 million oz are being lined up to fly/sail from New York to London to capture the premium. Physical arbitrage in real time. Sure, there might be plenty of Silver on COMEX (roughly 526 moz sitting there according to estimates). But this is on paper - until they’re moved, cleared, insured, and accepted. Logistics, brands, and time matter. The context: SUPPLY >>>> LBMA London vault silver is 24,581 tonnes (~790 moz) as of end-September 2025 — materially below the 2020–2021 highs. The “float” that actually trades is a fraction of total stocks. DEMAND shock on the other side >>> India’s imports nearly doubled in September despite record prices. It’s so tight in India that major silver ETF platforms paused new lump-sum inflows to protect investors from extreme premiums. · Price action: silver has ripped to all-time/high-water marks in this move, riding the hard-asset bid. This is what a real squeeze looks like: – Spot > futures (London premium) – Borrow explodes – Cargo doors open – Paper scrambles to find metal “Will scrap save the day?” Not overnight. Recycling lags price and takes time to hit the market. Logistics are slow; psychology is fast. Watch these signals: – London–NY spread (does it compress?) – LBMA vault data (monthly drift) – COMEX registered outflows to London (weekly tells) – ETP inventory changes (are bars moving?) ·Beware ! Volatility will be savage. Spreads can snap back if metal arrives… or they can widen if it doesn’t. Remember 1980? Different era, same lesson: attempts to control price fail when physical reality refuses to cooperate. This time, industry demand + sovereign fear + retail conviction = a tougher opponent Source: zerohedge, Honza Černý @honzacern1

Investing with intelligence

Our latest research, commentary and market outlooks