Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

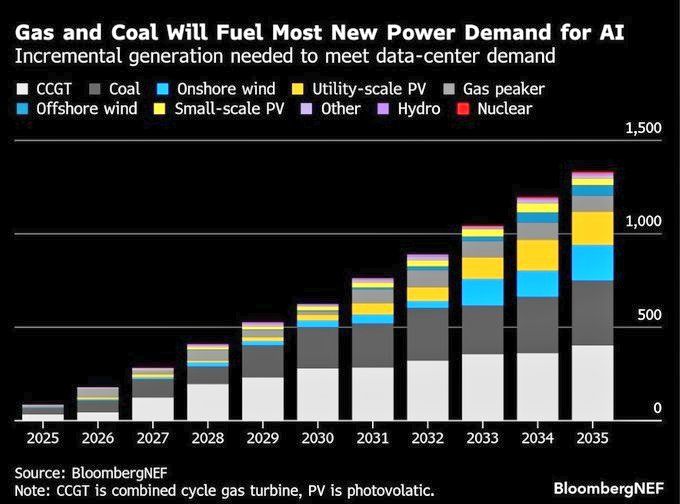

And the winner of the power demand is .... Coal !

Source: Bloomberg, @AzizSapphire

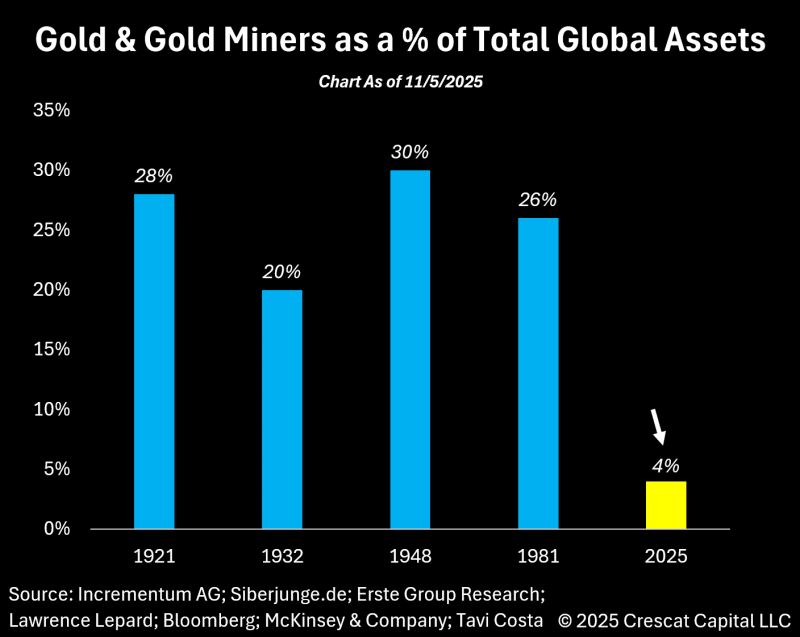

Gold and gold miners together represent about 5% of total global assets.

That is approximately 7–5 times below the highs reached in prior cycles. Source: Tavi Costa, Bloomberg

The US has added copper, silver, and uranium to its official list of critical minerals

This expanded the Trump administration’s definition of resources considered essential to the nation’s economy and security According to a Bloomberg report, citing a US government website, the revised US Geological Survey list now includes 60 minerals in total — 10 more than before — with new additions such as metallurgical coal, potash, rhenium, silicon, and lead. The list also encompasses 15 rare earth elements and replaces the previous version published in 2022. https://lnkd.in/eFTMDJ29 Source: Firstpost

In case you missed it... Soybeans jump to highest price since July 2024 📈📈

Source: Barchart

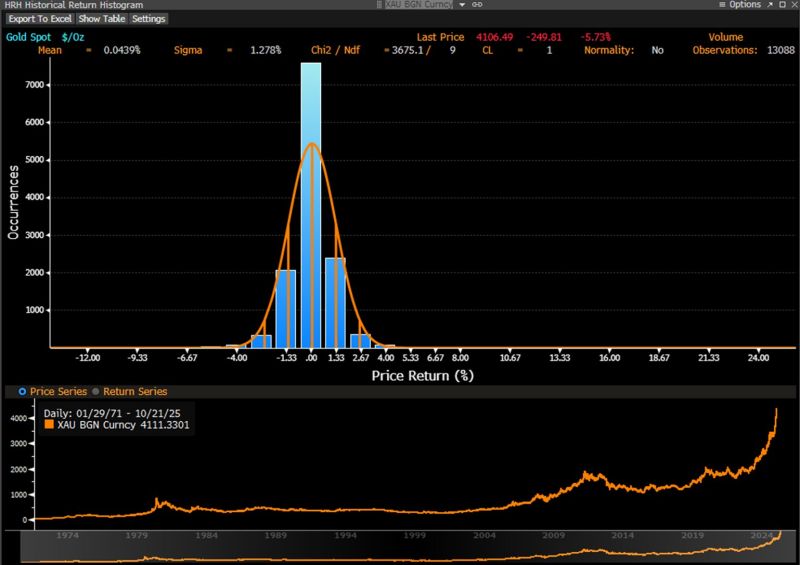

Gold is giving us a lesson in statistics. Yesterday's −5.7% move is a rare 4.46-sigma move.

In a “normal” world, that’s once every 240,000 trading days. In reality −4.67% to −6.00% occurred 34 times since 1971, i.e. in 13,088 trading days (0.26% = 1 in 385 days). Even bigger drawdowns happened 21 times since 1971. Message: Gold is NOT low-vol. FOMO caused the latest leg up. Now, profit taking and weak hands got shaken out. Means? Statistically speaking, chances are that calmer days are ahead. Source: Alexander Stahel 🌻@BurggrabenH on X

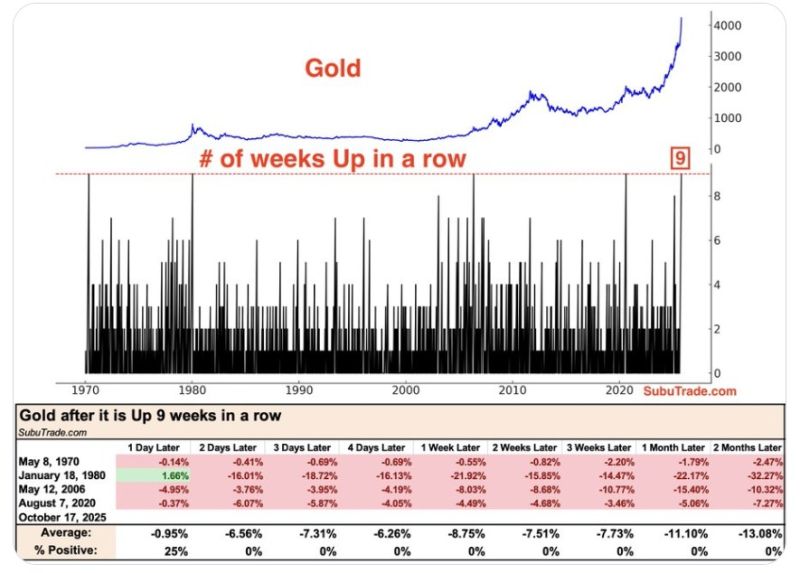

Gold is Up 9 weeks in a row.

Gold has never gone up 10 weeks in a row before. Source: Subu Trade on X

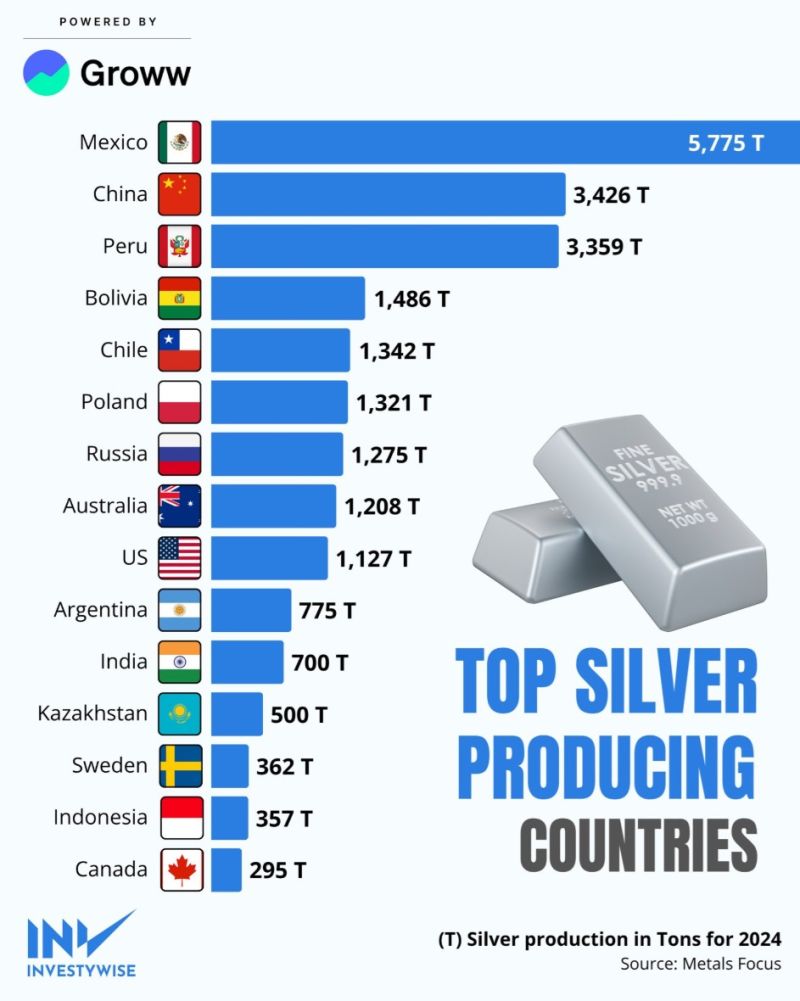

Mexico tops the list as the largest Silver Mine producer in 2024, followed by China and Peru.

Source: InvestyWise @Investywise

Investing with intelligence

Our latest research, commentary and market outlooks