Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

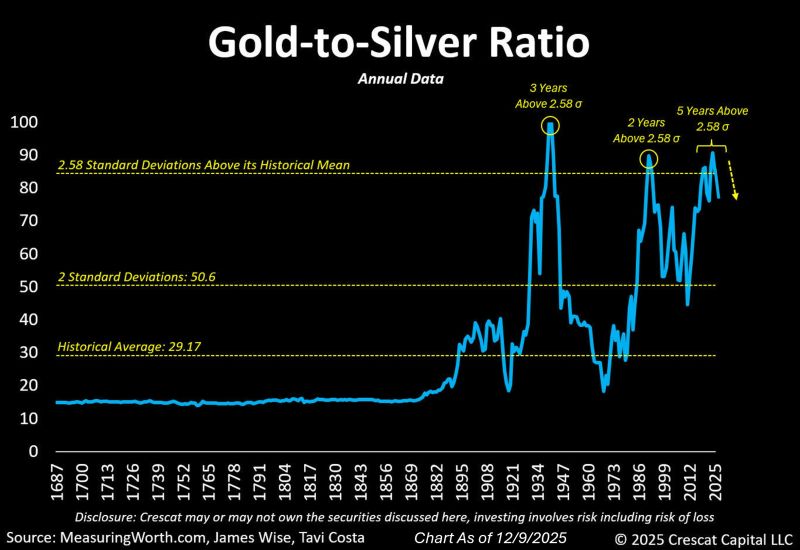

The gold-to-silver ratio is starting to move abruptly, as it often does after reaching extremely elevated levels.

Source: Tavi Costa

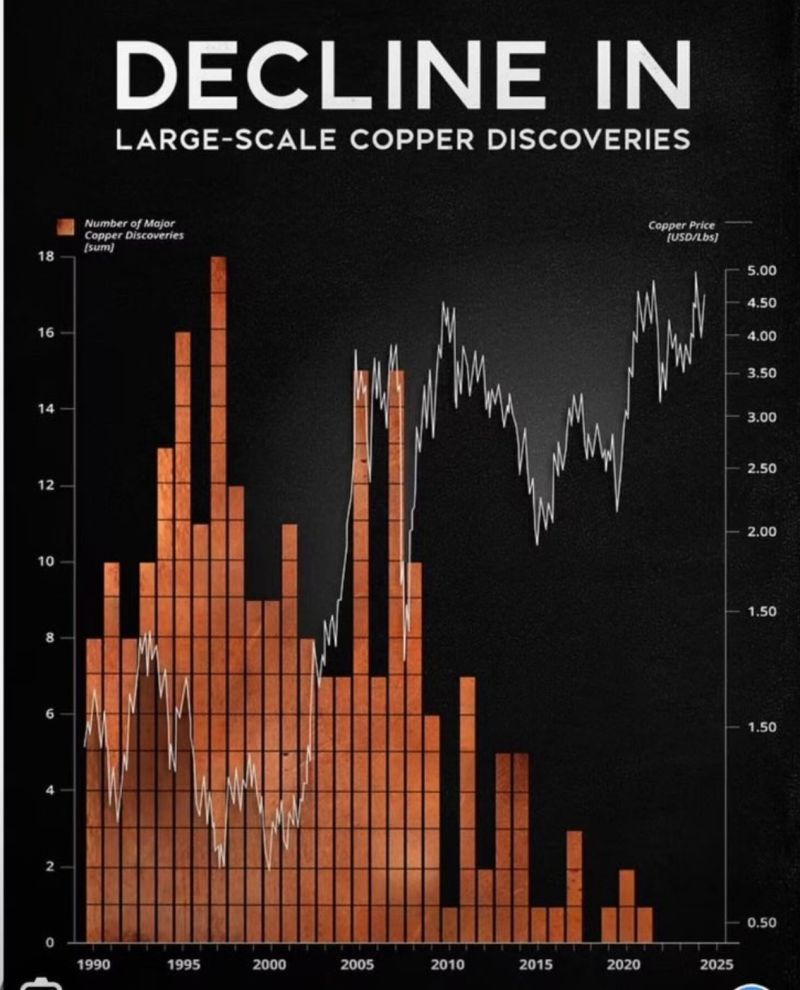

You can’t electrify the world without copper and the world is running out of it.

- Large-scale copper discoveries are down 90% over the last two decades - Copper deficits are projected to widen through 2030 - Copper demand is surging: driven by electrification, data centers, and AI - It takes 20+ years from discovery to first production How far can this copper bull market run? Source: Lukas Ekwueme @ekwufinance

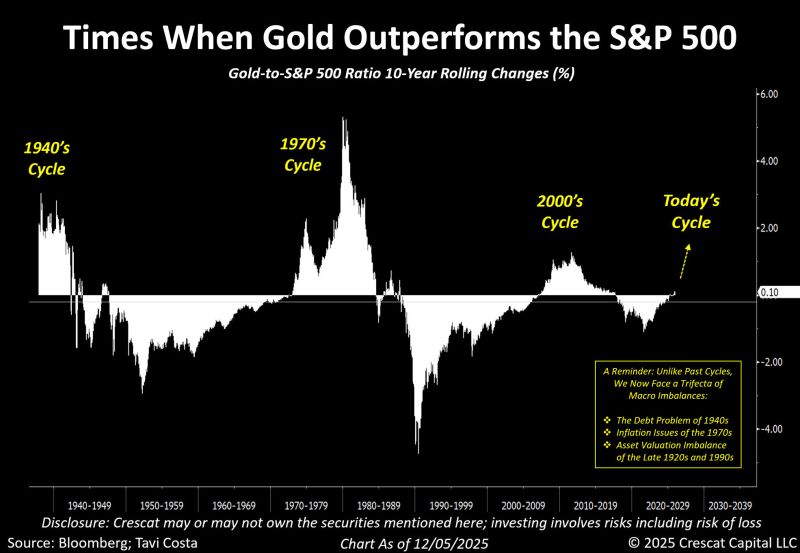

Gold relative to S&P 500: are we just at the start of the cycle?

A fascinating chart by Otavio (Tavi) Costa Gold relative performance dynamic follows very long-term cycles, and we’re likely only in the early stages of this one. As Tavi points out, we now face a trifecta of macro imbalances: ▪️The Debt Problem of the 1940s ▪️Inflation Issues of the 1970s ▪️Asset Valuation Imbalance of the Late 1920s and 1990s Source: Bloomberg, Crescat Capital

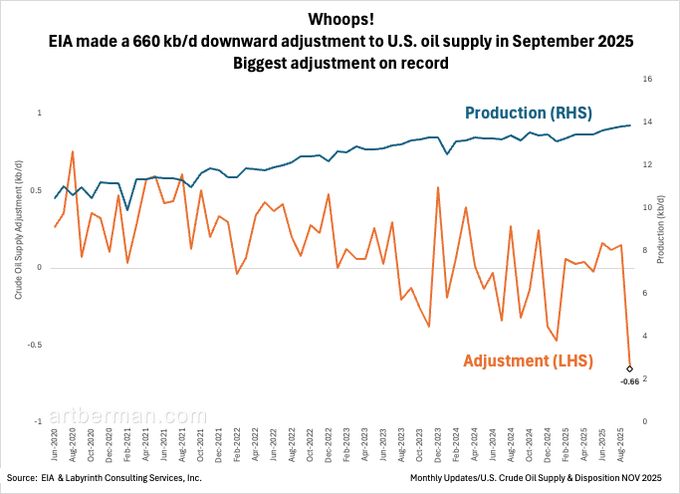

The IEA’s “historic oil glut” narrative is collapsing in real time.

US production, the foundation of their entire forecast, has now been quietly revised downward. And not by a small amount. This is the largest US supply revision in the IEA’s entire history. 660,000 kbpd just for the month of September The reason: - US shale, the only global source of meaningful growth for 15 years, is peaking. - Tier 1 acreage is drilled out - Gas-to-oil ratios are exploding - Water cuts are rising across every major basin - Decline rates are accelerating as sweet spots exhaust Shale’s boom phase gave the world a decade of easy barrels, masking the fact that the rest of the world wasn’t investing. Its bust phase will do the opposite... leave a supply hole the world cannot fill in the short term.

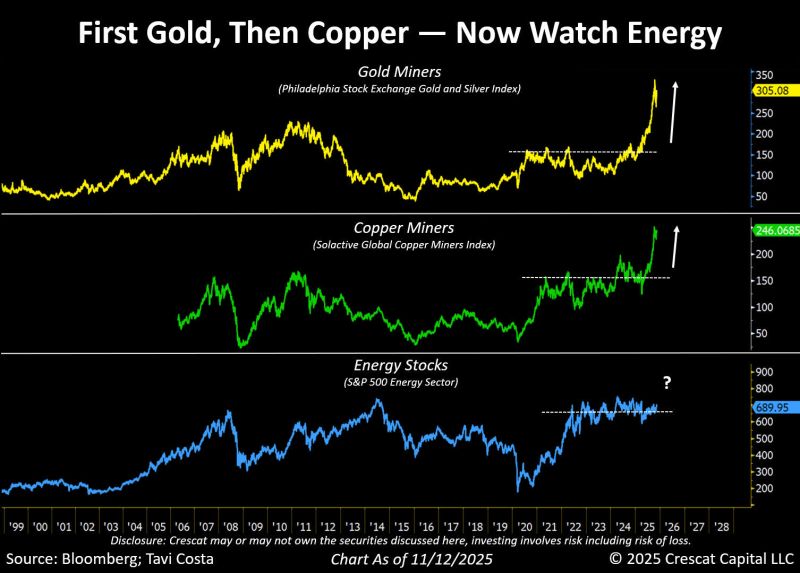

Otavio (Tavi) Costa just made a case for energy stocks, which have been quietly inching higher.

Here's his view: ▪️Positioning remains deeply bearish. ▪️U.S. oil and gas rigs are contracting meaningfully. ▪️Oil is trading near one of the cheapest levels in history relative to the money supply. ▪️Energy’s weight in the S&P 500 is hovering near record lows. He sees energy equities as one of the most fundamentally attractive corners of the market right now. Your thoughts? Source: Tavi Costa, Crescat Capital, Bloomberg

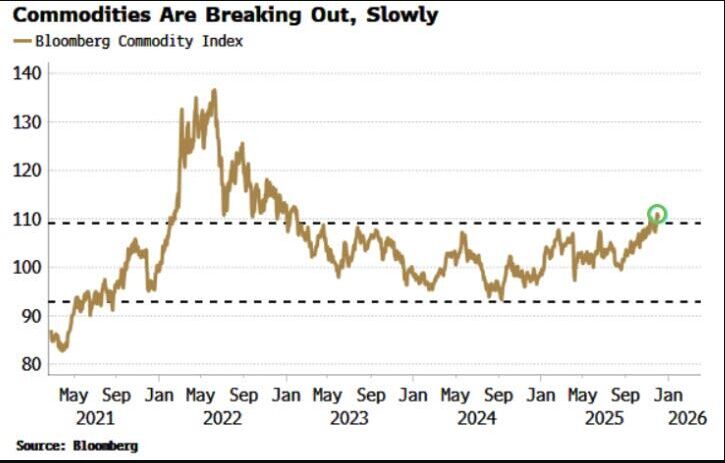

The Bloomberg Commodity Index is breaking out from a three-year range.

Source: Connor Bates @ConnorJBates_ Bloomberg

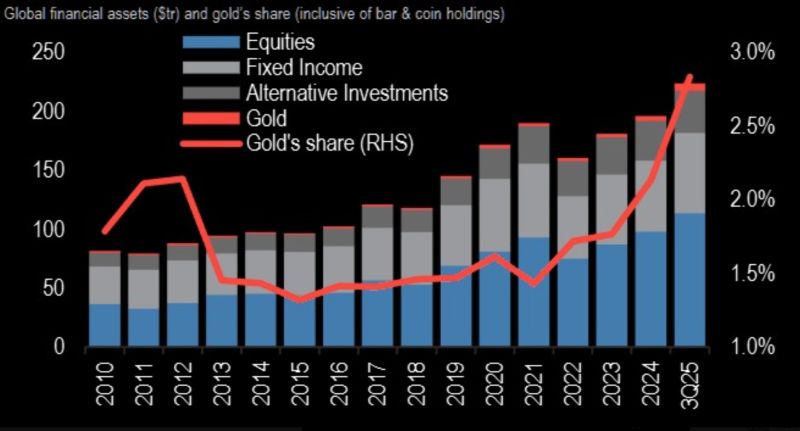

Gold is only 2.8% of investor AUM... imagine 4–5%.

Source: The Market Ear

Gold is on pace for its best year since 1979, up over 60% in 2025.

Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks