Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

LARGEST LIFE INSURANCE PROVIDER IN US, NEW YORK LIFE, WITH $900b AUM, SUGGESTS PRECIOUS METALS ALLOCATIONS UP TO 20%

Source: @calvinfroedge

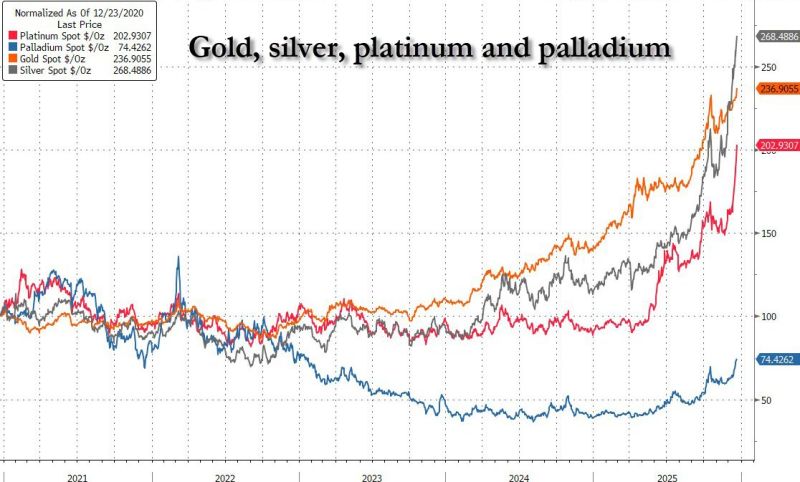

Silver now outperforming Gold by the largest margin in almost 5 years and closing in on the greatest outperformance in more than a decade 🚨🚨

Source: Barchart

BREAKING: Gold trades above $4,500 for the first time in history.

Source: Trend Spider

JUST IN 🚨: Gold hits $4,400 for the first time in history 📈📈

Source: Barchart

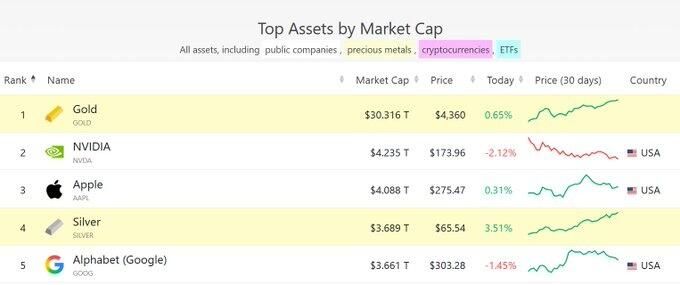

Silver's surge yesterday moved it above Google as the 4th largest asset by market cap...

Source: zerohedge

Investing with intelligence

Our latest research, commentary and market outlooks