Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

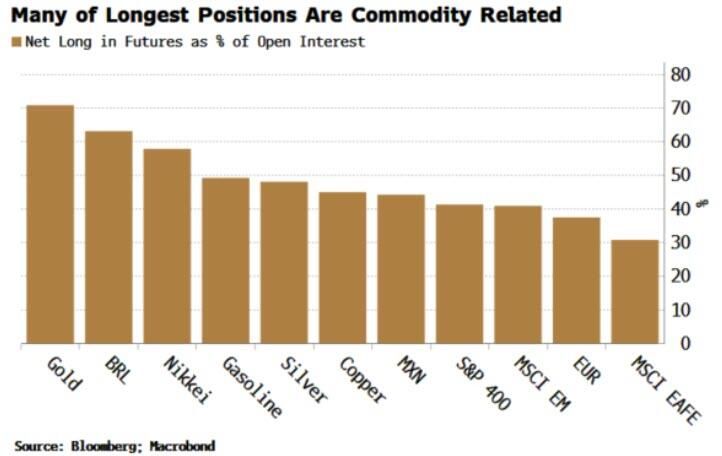

Speculators Are Moving Towards Commodities

Gold, gasoline, silver and copper have the largest net longs, along with emerging currencies related to resources, BRL and MXN. Chart below is in raw percentage terms, that is the net long position as a percentage of open interest. Source: zerohedge, Bloomberg, Macrobond

LME Copper surges to $13,000 for the first time to new record high

Source: www.investing.com

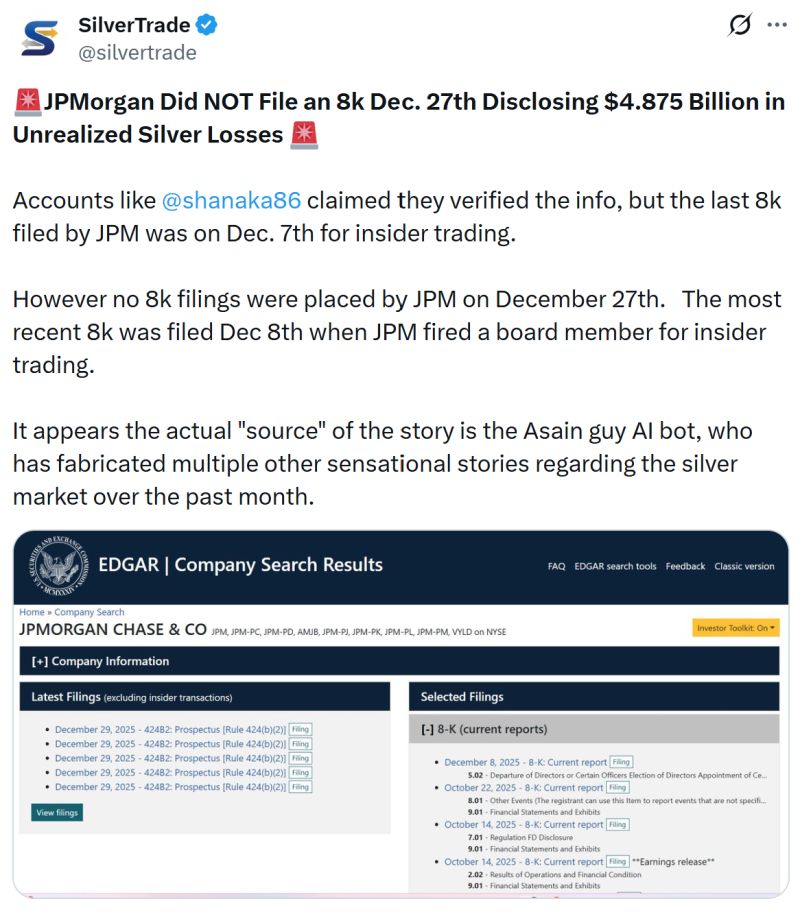

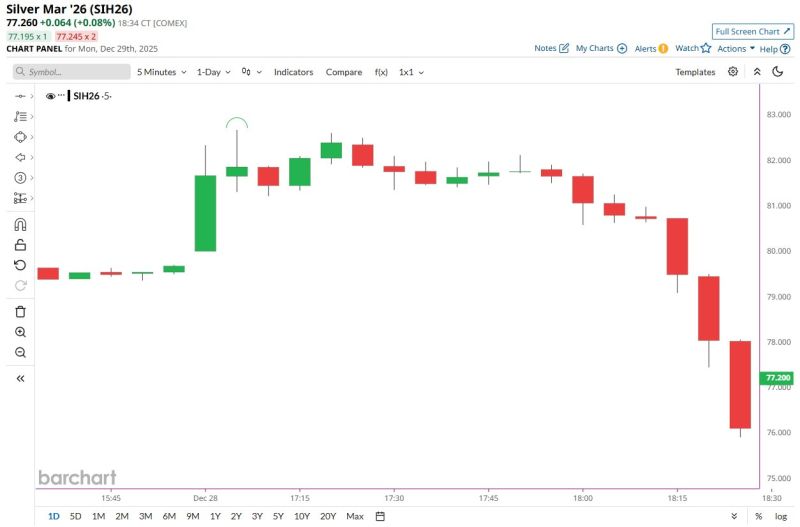

Beware about current rumours circulating on X today about silver squeeze hitting mega banks...

Nothing has been verified yet

David Lee on X came in with his analysis on the price action of silver over the last week. He might have a point:

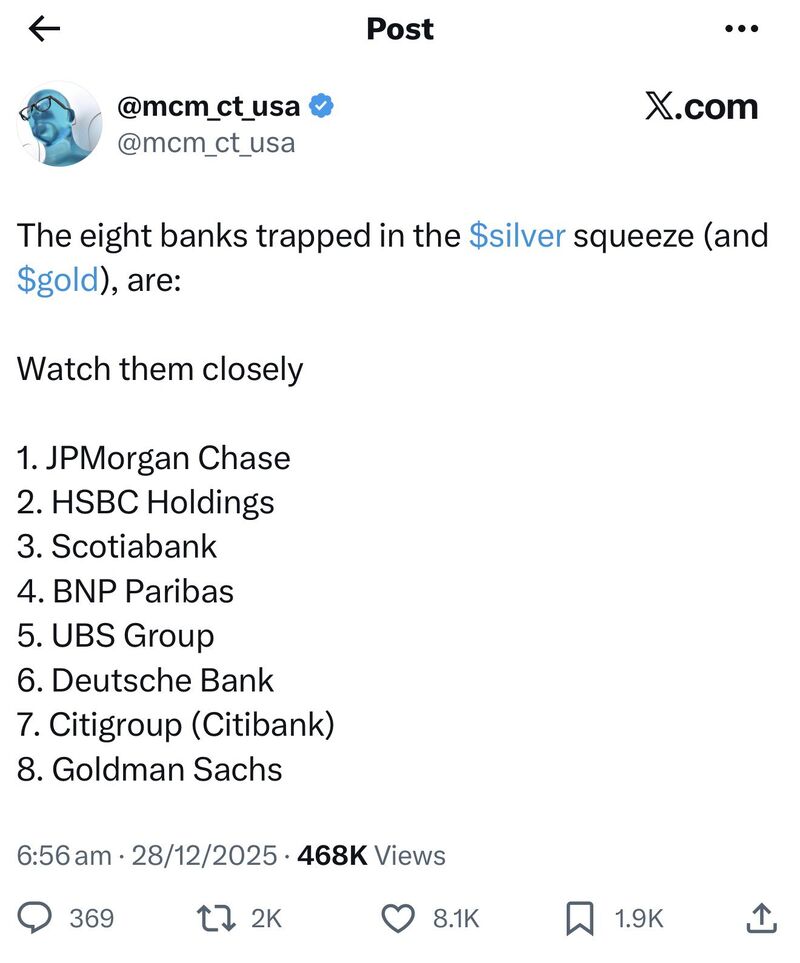

1. Physical silver is not available for December contract delivery 2. Big Banks were buying what physical is still available forcing price up 3. One Big Bank got caught in wrong position and unable to meet margin requirement, its short positions were liquidated forcing price shot up on Friday and Monday Asian trading 4. After the short covering has completed in early Asian trading on Monday morning, price got push down 5. Buyers come back to buy on the dip, cutting the price drop 6. Unless Big Banks can get enough physical to fulfill their delivery commitment, the demand will stay strong 7. With 4 trading days left of December, the next few days will see significant volatility and a chance of more bad news for Big Banks Below is a list by @mcm_ct_usa of Big Banks which might be "trapped in a Silver (and gold) squeeze" ‼️ >>> THIS IS UNVERIFIED INFORMATION. AS MOST OF US, I DO NOT KNOW WHO OWNS WHAT !!! (but it seems that the market has its doubts as big banks are currently getting sold)

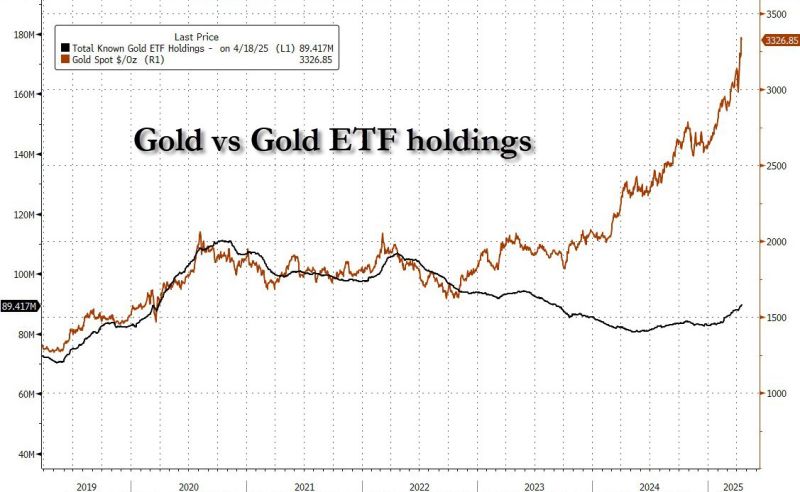

Gold just had its biggest ever ETF inflow at $8.0bn in the past week. There is just a "little" more to go for ETFs to catch up...

Source: zerohedge

The main part of the price smash in silver was approximately 10K contracts in the futures market over just 15 minutes — approximately 50M digital ounces.

Source: Peter Spina ⚒ GoldSeek | SilverSeek @goldseek

$ZSL is the -2x Silver ETF (i.e short Silver ETF with 2x leverage).

The highest volume ever was recorded for this ETF on Friday - by a mile. Are traders betting on a blow off top? Source: Trend Spider

Investing with intelligence

Our latest research, commentary and market outlooks