Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

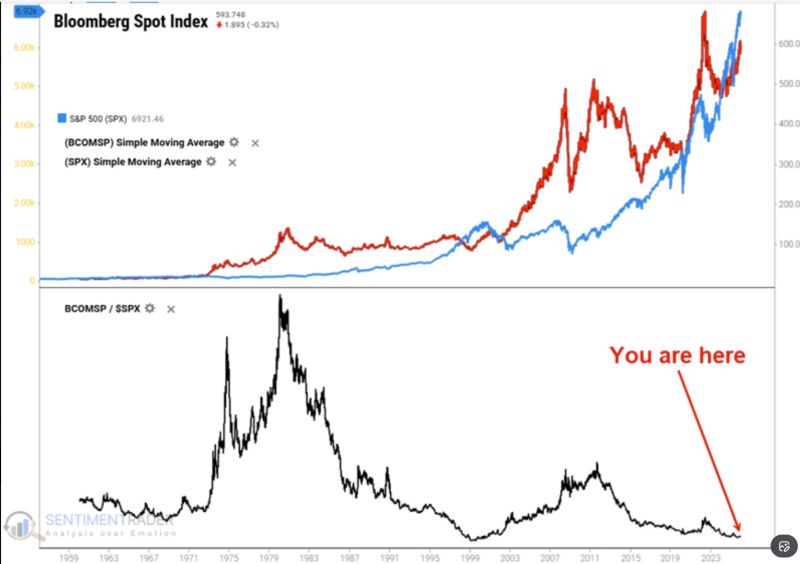

Stocks keep making new highs, but commodities are telling a very different story.

The relative performance of commodities versus the S&P 500 is sitting near levels that have only shown up a few times in history. Those gaps didn’t last forever Source: SentimenTrader

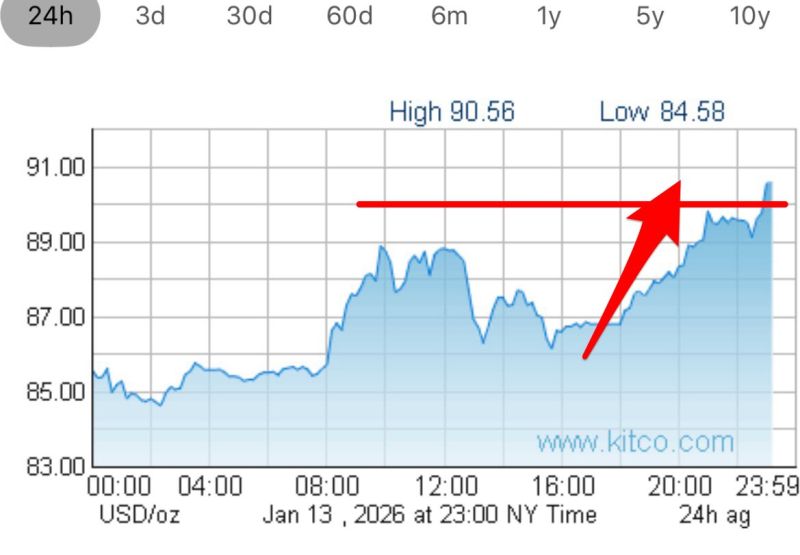

According to technical models, hashtag#silver $SLV should’ve stopped about 47 trendlines ago...

Source: Trend Spider

Silver storms through the $90 level. This is unprecedented! Both exciting & concerning at the same time.

Source: Silver Gold News

The Gold/Silver pair down to 52x - the lowest since Dec 2012

Since: zerohedge

The next 24 hours could be extremely volatile! supreme court tariff ruling is expected today at 10:00 am et

Markets price a 71% chance that courts rule Trump’s tariffs illegal, raising the prospect of $600B+ in refunds and significant market uncertainty. A non-consensus view argues the opposite outcome is more likely: keeping the tariffs may be less disruptive than reversing them. U.S. businesses have already adapted by restructuring supply chains, repricing goods, and adjusting investment plans, so a sudden rollback could punish those who adjusted and reward those who didn’t. Early fears of runaway inflation, collapsing earnings, and stalled growth have not materialized. Striking down the tariffs would also create legal and fiscal uncertainty around refunds and replacement measures, increasing volatility. Once embedded, tariffs function as a fiscal revenue tool, not just trade policy. Bottom line: The court may prioritize the least disruptive outcome—maintaining or modifying tariffs rather than eliminating them outright. Source: Cassian @ConvexDispatch, @BobEUnlimited

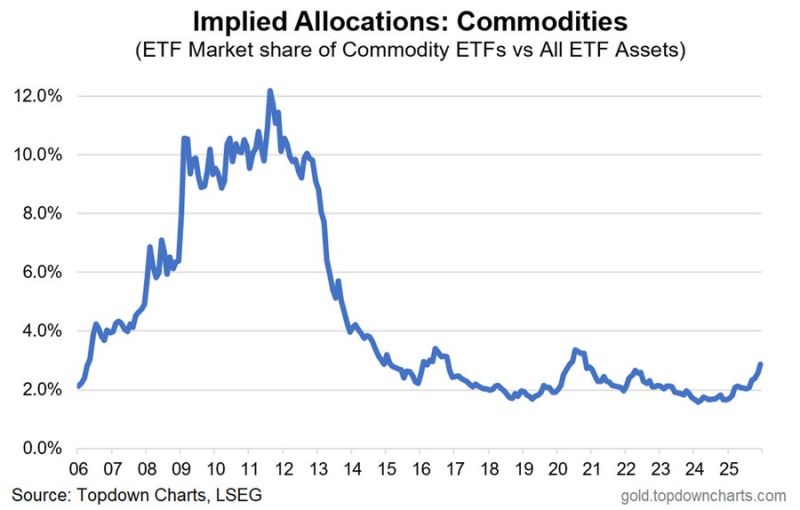

The commodity supercycle is back

The Sovereignty Trap: By offshoring industry to China for higher margins, the West traded its independence for cheap labor; China now controls the minerals essential for Defense, EVs, and tech. Resource vs. Currency: The ability to print money is irrelevant if China refuses to sell the raw materials required for survival and industry. The Great Rebuild: To regain independence, Western nations are aggressively reshoring industry, stockpiling minerals, and rebuilding infrastructure. The Irony of Tech: Building the "New Economy" (Silicon Valley, AI, Green Tech) is impossible without massive amounts of "Old Economy" materials like copper, lithium, and steel. Source: Topdown charts, LSEG, Lukas Ekwueme @ekwufinance

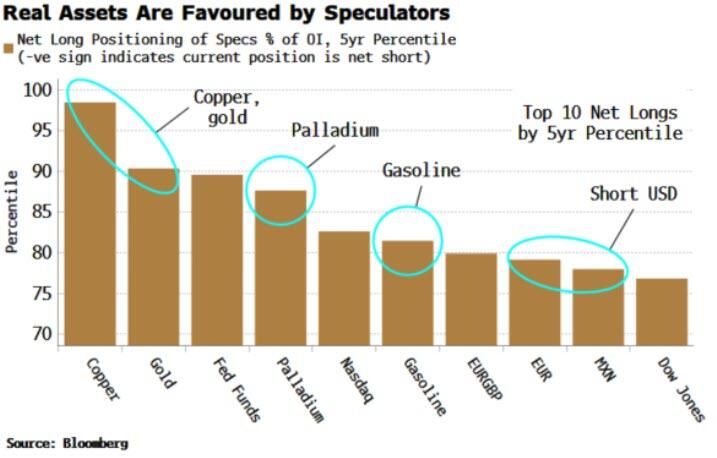

Speculators Are Positioning For A Fiscally Dominant World

In 2026, the global financial landscape is shifting from central bank independence to Fiscal Dominance, where political spending needs now dictate interest rate policy. To hedge against this, "smart money" is fleeing the US Dollar and Treasury bonds fearing structural inflation and pivoting into hard assets like gold and copper. This trend is confirmed by current Commitment of Traders (COT) data, showing record institutional positioning in precious metals as a final shield against currency debasement. Source: zerohedge, Simon White, Bloomberg macro strategist

The Divergence of Commodities and Consumer Inflation (2017–2026)

Source: Lawrence McDonald, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks