Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

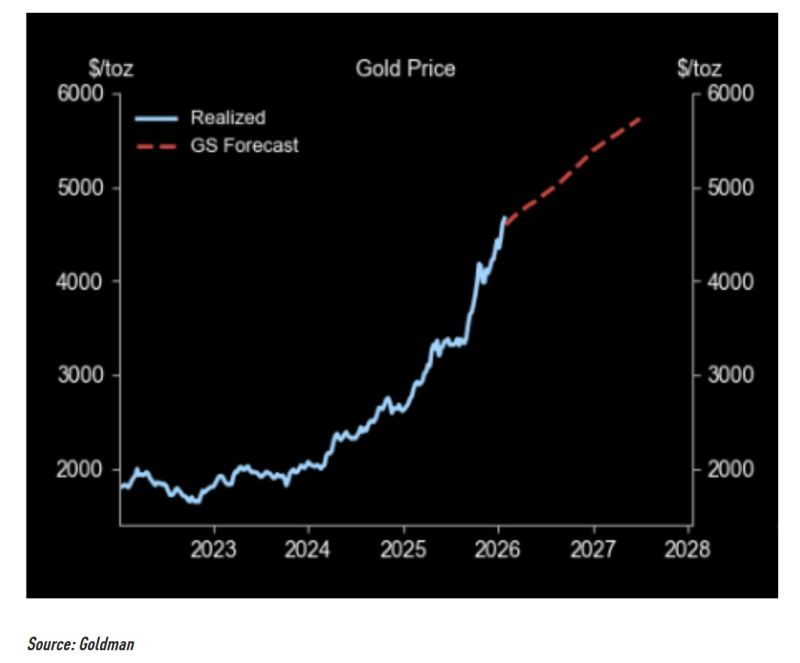

And there you have it Gold is officially trading above $5,000.

Source : Mohamed El-Erian

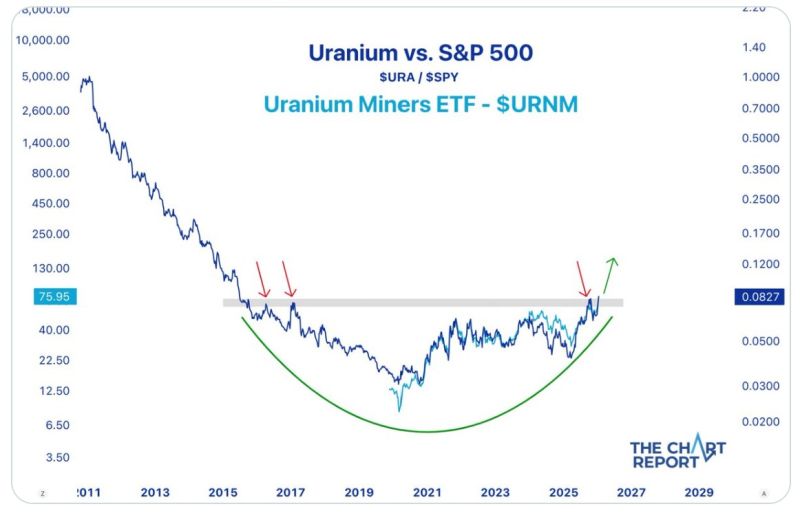

Uranium miners closed at new all-time highs last week. Is the relative trend just getting started

$URA $URNM $SPY Source: Donovan Jackson @TheDonInvesting on X The chart report

Goldman is raising Gold price target to $5,400

"We raise our Dec2026 gold price forecast to $5,400/toz (vs. $4,900 prior) because the key upside risk we have flagged--private sector diversification into gold--has started to realize. We assume private sector diversification buyers, whose purchases hedge global policy risks and have driven the upside surprise to our price forecast, don't liquidate their gold holdings in 2026, effectively lifting the starting point of our price forecast." Source: TME

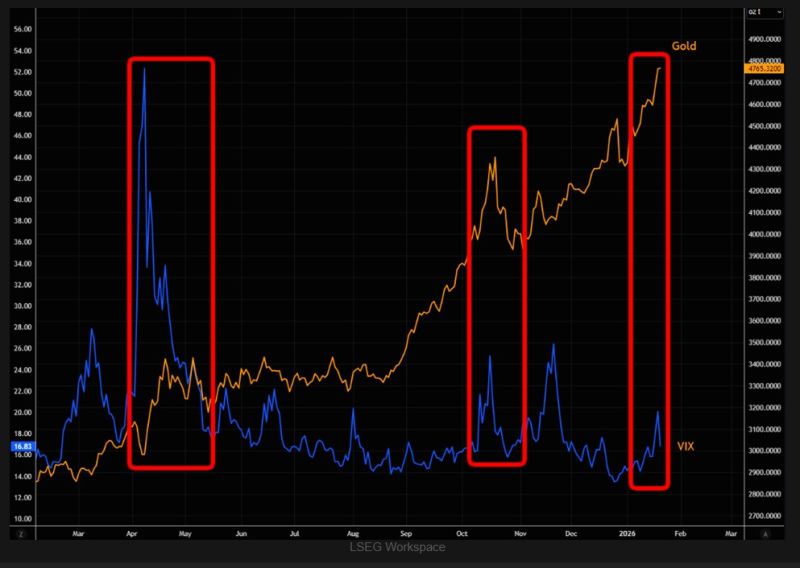

Is Gold Still the Go-To Fear Hedge

Better hashtag#hedge alternatives? hashtag#Gold as the global fear hedge looks expensive relative to the VIX. Volatility remains somewhat elevated despite the recent pullback tied to the Greenland/Trump headlines, but chasing gold here as protection looks late. Source: TME

Countries With the Most Natural Resources:

1.🇷🇺Russia $75.0 Trillion 2.🇺🇸United States $45.0 Trillion 3.🇸🇦Saudi Arabia $34.4 Trillion 4.🇨🇦Canada $33.2 Trillion 5.🇮🇷 Iran $27.3 Trillion 6.🇨🇳China $23.0 Trillion 7. 🇧🇷Brazil $21.8 Trillion 8.🇦🇺Australia $19.9 Trillion Source: Jack Prandelli

Investing with intelligence

Our latest research, commentary and market outlooks