Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

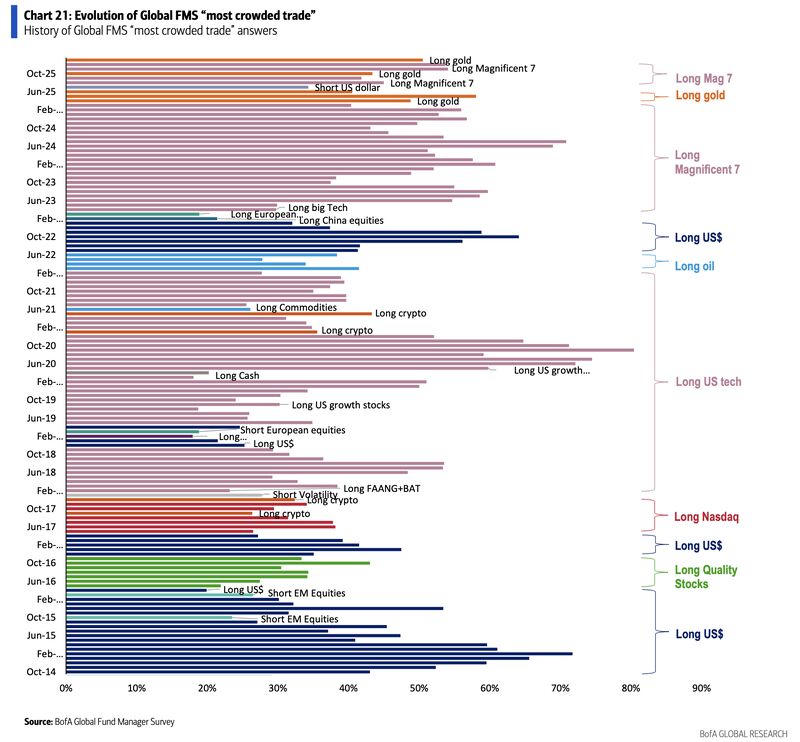

Gold is now the most “crowded trade”, acc to BofA’s monthly Global Fund Manager Survey.

Source: Holger Zschaepitz @Schuldensuehner BofA

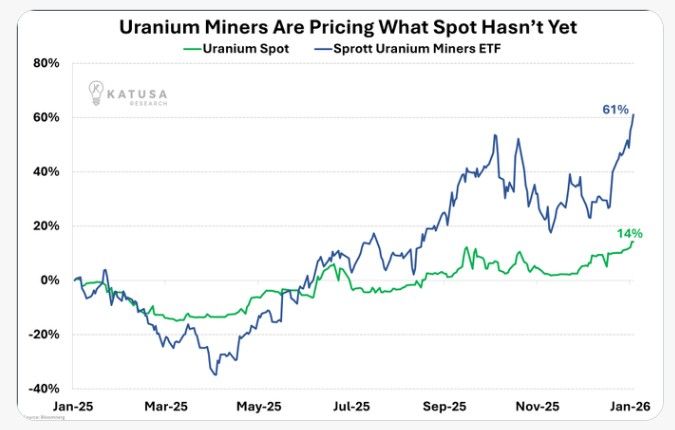

Watch Uranium

Almost 30% of Uranium is uncontracted, resulting in poor spot price performance. Utilities keep waiting for cheaper pounds that aren't coming. And every month they wait, the deficit grows. When they finally buy, spot won't walk higher. It'll gap. Source: Kasuha Research on X

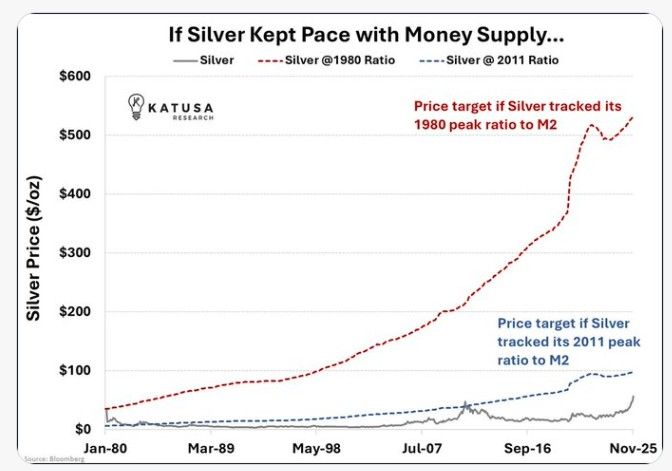

Silver is actually cheap relative to the global currency fiat money supply.

At $90, everyone knows that silver is at nominal all-time highs. But relative to M2, it’s well below a historical peak. This suggests significant upside potential if the market catches up to full monetary expansion. ▪️ If silver matches its 2011 money-supply ratio, you’re looking at about $97 per oz. (we're almost here) ▪️ If silver matches the 1980s ratio, it’s about $531 per ounce. Source: Kasuha Research on X

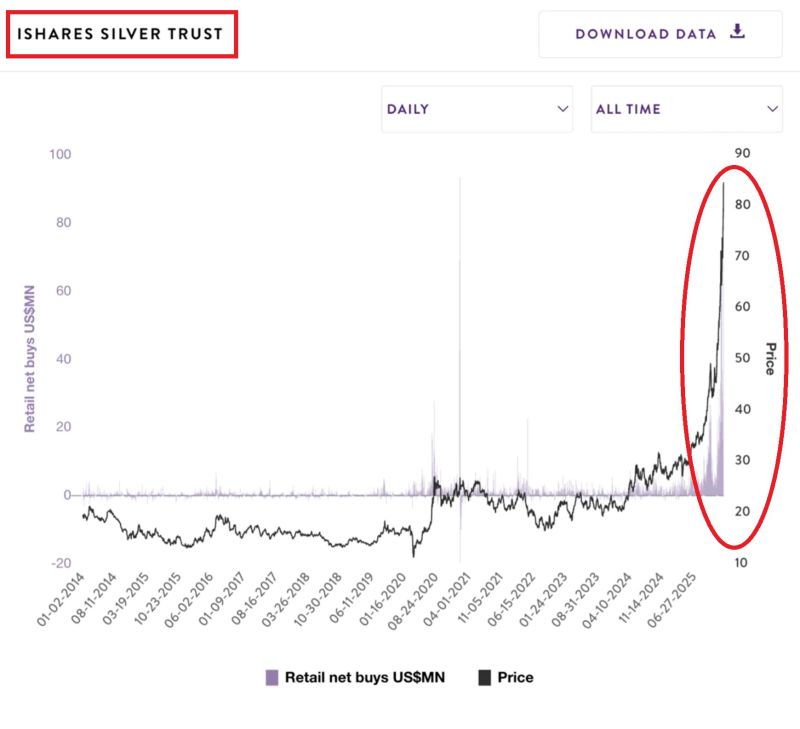

Retail investors have piled into the largest physical-backed silver ETF, $SLV, for 169 days STRAIGHT, the longest streak EVER.

All major silver-linked ETFs have attracted a record +$921.8 million in inflows over the last 30 days. Silver retail buying activity is now 2.1 TIMES higher than the 3-month moving average, and far above the 2021 silver market squeeze. Retail investors are joining the silver rally at a record pace. Source: Global Markets Investor

🚨 Largest Producers in the World 🚨 :

Source: General Knowledge for UPSC @GuideforAll

From Ghost Industry to National Priority

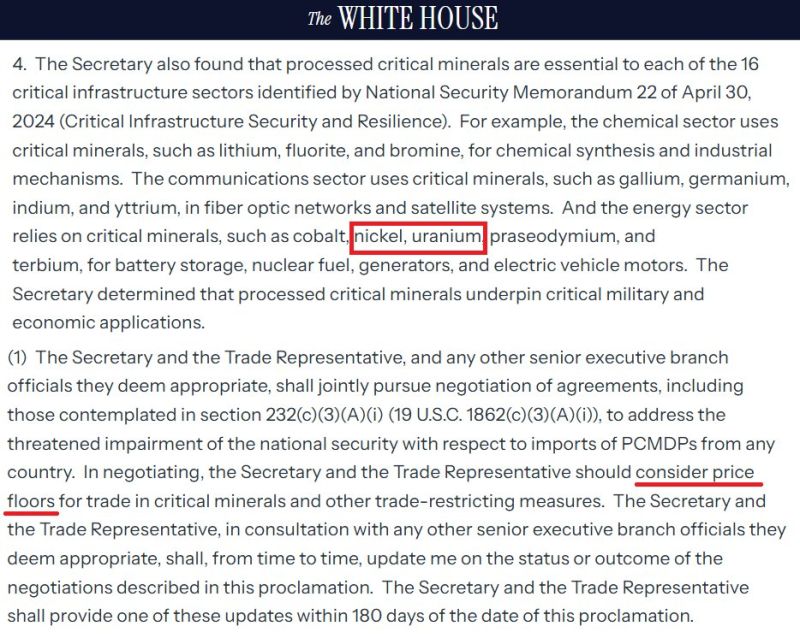

This White House statement on critical minerals explicitly listed uranium as a critical mineral, and it looks like they’re actually considering a price floor guarantee. The US used to be a powerhouse in uranium, but the industry is basically a ghost of its former self now. The government seems to be stepping up and back producers with some real institutional support. Things like strategic stockpiling or a price floor could be a massive game-changer. Between the skyrocketing power demand and energy security needs, support seems to be coming. Source: JH @CRUDEOIL231

This is HISTORIC: The gold-to-silver ratio plunged to 50, the lowest in 14 YEARS.

This means it now takes just 50 ounces of silver to buy 1 ounce of gold, down from ~105 in April 2025. Since then, gold prices have rallied +43% while silver prices have SKYROCKETED an unbelievable +186%. Silver is outperforming gold at the fastest pace in decades. Source: Global Markets Investor Global Markets Investor

The Shanghai premium is screaming stress.

The Shanghai premium is screaming stress. Silver is now trading 9.4% higher in the East than in the West (see chart). Late 2025, you could dismiss this as temporary. That narrative is dead. In the East, silver is already triple digits and the West will soon follow. Source: Bloomberg, Karel Mercx

Investing with intelligence

Our latest research, commentary and market outlooks