Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

THE MINERALS MAP THAT RUNS THE WORLD

Who controls the supply? By Jack Prandelli

Gold and Silver just hit a new all-time high as the US dollar weakened after Powell accused Trump of targeting the Fed.

Now the Fed’s independence is at risk, so investors are dumping dollar and buying metals for safety hedge. The precious metal bull run still shows no signs of stopping in 2026. Source: Bull Theory @BullTheoryio

COPPER: The next global bottleneck? 🔴⚡️

We talk about chips, we talk about data, but we’re forgetting the "Red Metal" that powers it all. S&P Global just released a report that should be a wake-up call for every tech leader and policymaker: The world is facing a 10 million tonne copper deficit by 2040. That isn't just a "shortage"—it’s a systemic risk to the global economy. Why the sudden surge? 📈 We are witnessing a "Perfect Storm" of demand: The AI Revolution: Data centers aren't just about code; they are massive physical infrastructures. Copper demand for AI and robotics is set to more than double by 2040. The Energy Transition: You can't have an EV or a green grid without copper. It is the "Great Enabler" of electrification. Geopolitical Stakes: Access to copper is now a national security issue. If you don't have the metal, you can't build the future. The Supply Reality Check 🛠️ The numbers are sobering: Demand is jumping from 28mn tonnes to 42mn tonnes. Mine production is expected to peak in 2030 and then decline. New mines take years (sometimes decades) to bring online. The "Bottleneck" Warning ⚠️ As Daniel Yergin, Vice-chair of S&P Global, puts it: “At stake is whether copper remains an enabler of progress or becomes a bottleneck to growth and innovation.” With prices already surging from $8,000 to over $13,000 per tonne, the cost of building the future just got a lot more expensive. The big question for the industry: Will we see a massive pivot to copper recycling and new mining tech, or will the "Green Transition" and "AI Boom" stall out due to a lack of raw materials? Source: FT

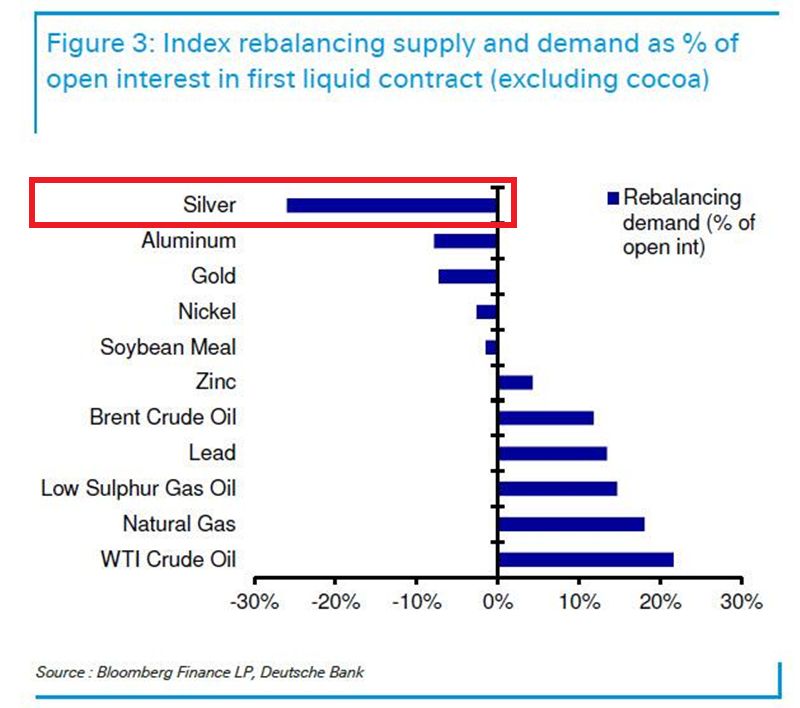

Are silver prices about to CRASH next week?

Next week's commodity index rebalancing could force massive selling of silver futures, pushing prices lower regardless of fundamentals. Silver faces the largest selling pressure among major commodities, with rebalancing demand at -25% of open interest. Index funds will be forced to dump silver futures just to rebalance. Why? Silver's recent surge was driven by speculation, not fundamentals, fueled by ETFs, retail traders, and thin liquidity. Source: DB, Global Markets Investor

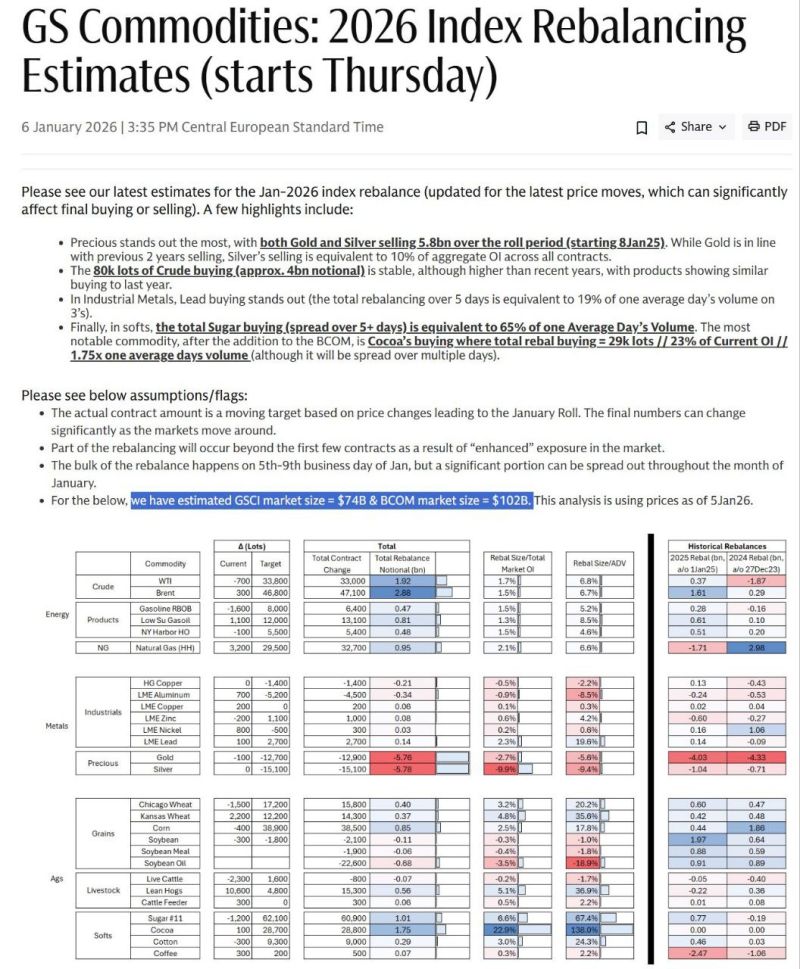

As highlighted by Lia the Trader @Liathetrader on X BEWARE $SILVER holders ‼️

The 2026 commodity index rebalancing (BCOM & GSCI) kicks off this week, forcing big adjustments in holdings. Precious metals stand out with massive estimated outflows—over $6.8B in gold and $6.8B in silver selling pressure. Silver's weight in BCOM drops sharply from ~9.6% to ~1.45%, triggering passive funds to dump futures. This could create short-term downward pressure on silver prices starting Thursday (Jan 8-14 roll period). Silver is trading around $78/oz today after huge 2025 gains (~150%), making it a prime rebalancing target. Expect volatility—analysts warn of potential dips, but fundamentals (industrial demand, deficits) remain bullish long-term.

All of the World’s Silver Reserves by Country, in One Visualisation:

• Peru alone holds roughly 22% of the World’s known Silver reserves. • Mexico dominates global Silver production, but its reserve base is much smaller than several peers. Source: Silver Gold News @SilverGold_News

Uranium, $URA extends it’s rally, gaining +5% The bull market is broadening

Source: Hedgeye

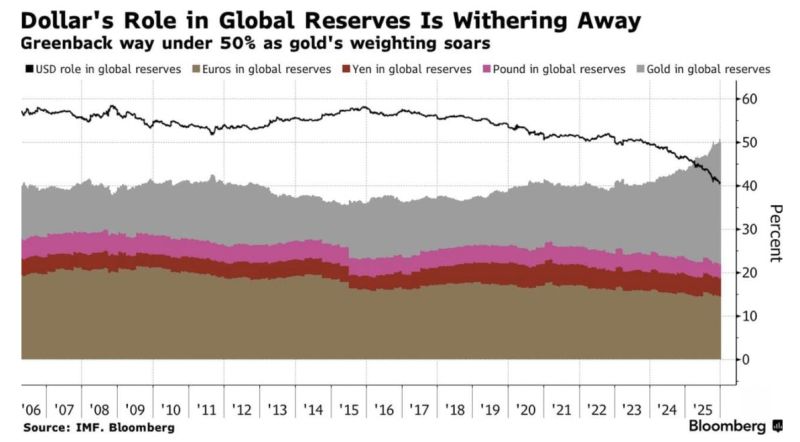

Gold has overtaken the U.S. Dollar as the largest Global Reserve Asset 🚨🚨🚨

(of course performance helped) Source: Barchart, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks