Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

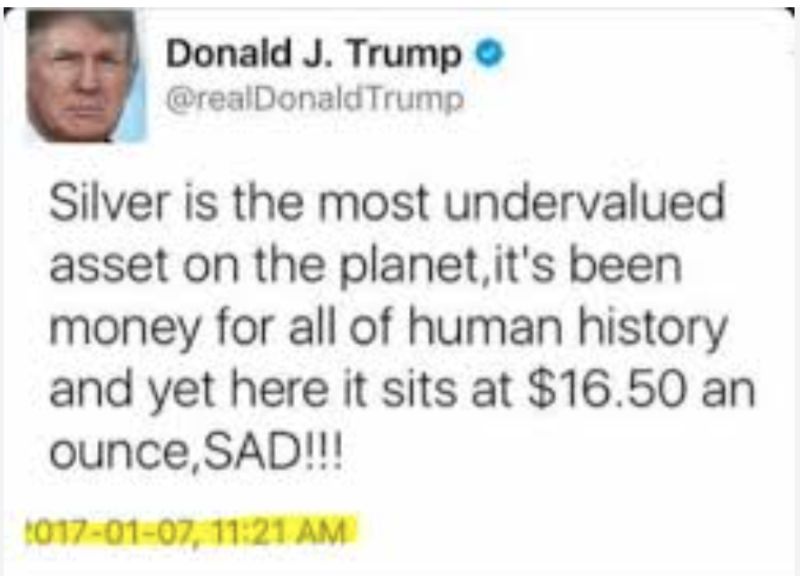

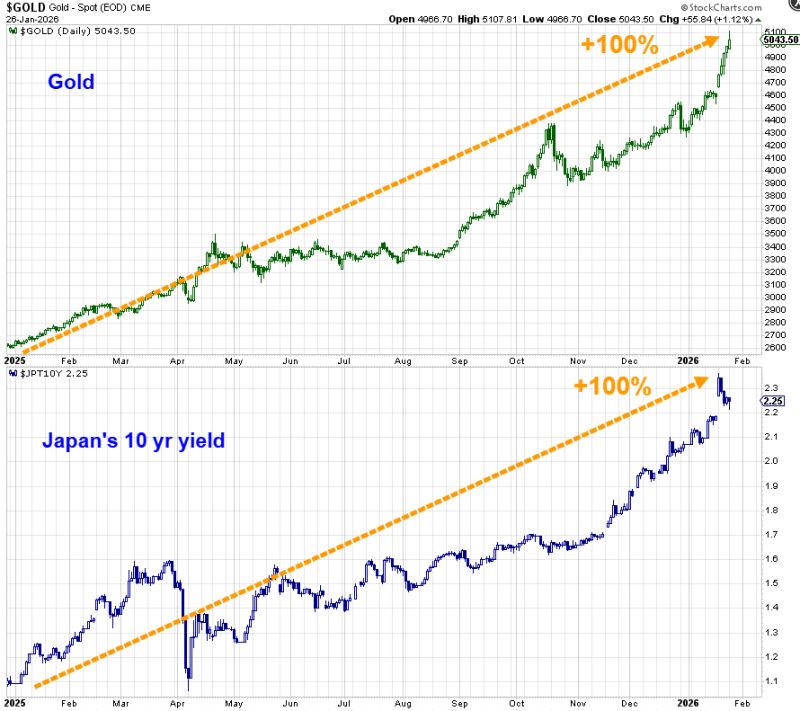

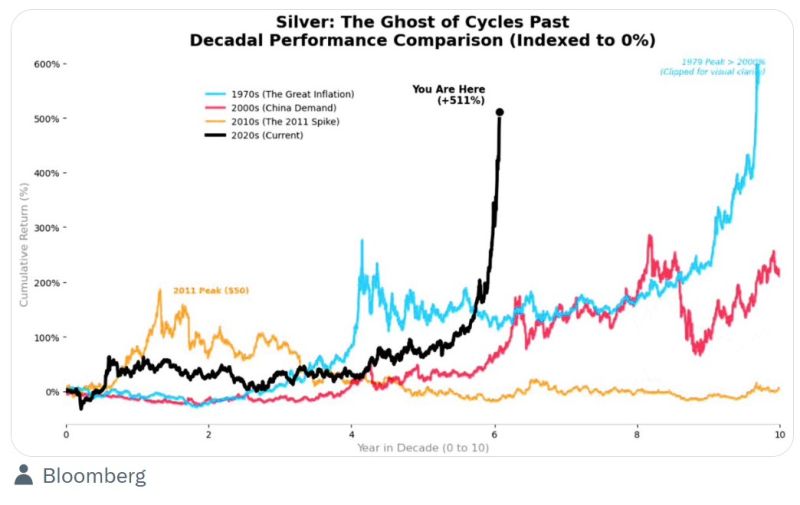

If you want to understand why silver is hitting $100/oz in 2026, stop looking at the news and start looking at the 1-year silver swap minus US interest rates.

In a "sane" market, this line stays above zero. It’s called Contango. 📈 It means: There’s plenty of silver to go around. No one is panicking. You pay a small premium to hold it later because of storage and insurance costs. But right now? We aren’t in Contango. We aren’t even in "normal" Backwardation. We are in EXTREME BACKWARDATION. 📉🔥 When that line drops below zero, the math flips. The market is effectively saying: “We need your silver so badly that we will literally PAY YOU to sell it to us today and buy it back later.” What does this tell us? The Vaults are Bleeding: LBMA and COMEX inventories are hitting decade lows. Industrial Desperation: AI chip manufacturers and EV giants aren't waiting for "better prices"—they are buying everything that isn't bolted down. The Great Decoupling: The "paper price" on a screen is becoming a fantasy. The price of a real bar in your hand is the only thing that matters. When lease rates for silver stay higher than cash interest rates, you aren't looking at a "bubble." You’re looking at a physical shortage. The shorts are being squeezed. The vaults are being drained. Does it mean the silver rally 🚀 has further to go??? Source: Karel Mercx @KarelMercx Bloomberg

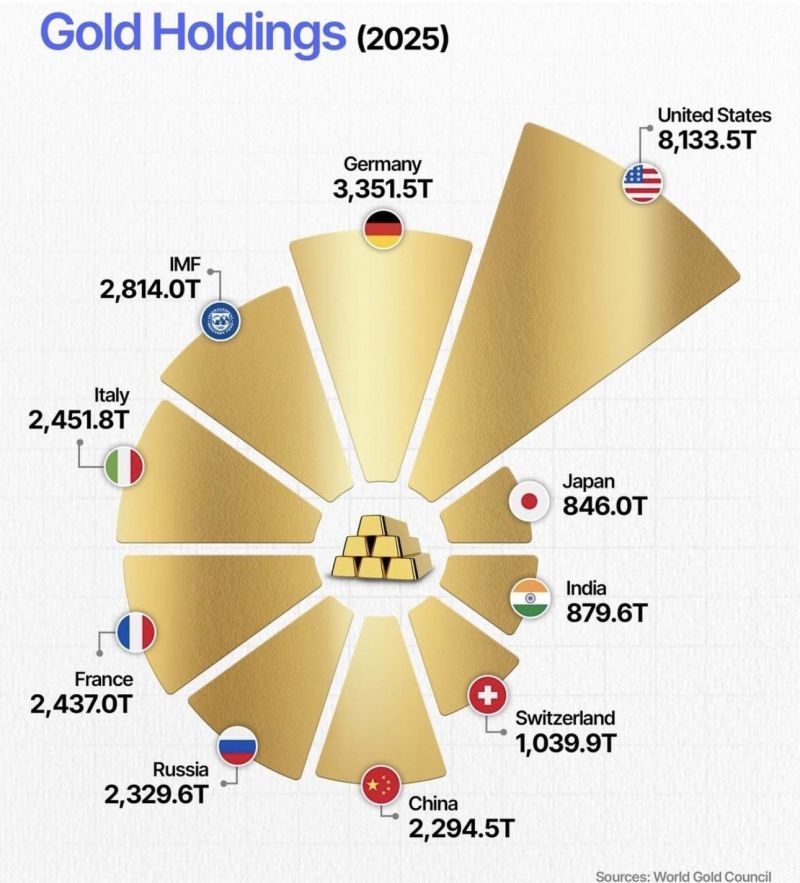

Who really holds the world’s gold?

• 🇺🇸 United States still dominates with 8,100+ tonnes • 🇩🇪 Germany remains Europe’s anchor • 🇮🇹 🇫🇷 🇷🇺 all sit around 2,300–2,450 tonnes • 🇨🇳 China keeps climbing, quietly • 🇨🇭 Switzerland punches far above its size • 🇯🇵 🇮🇳 hold far less than their economic weight

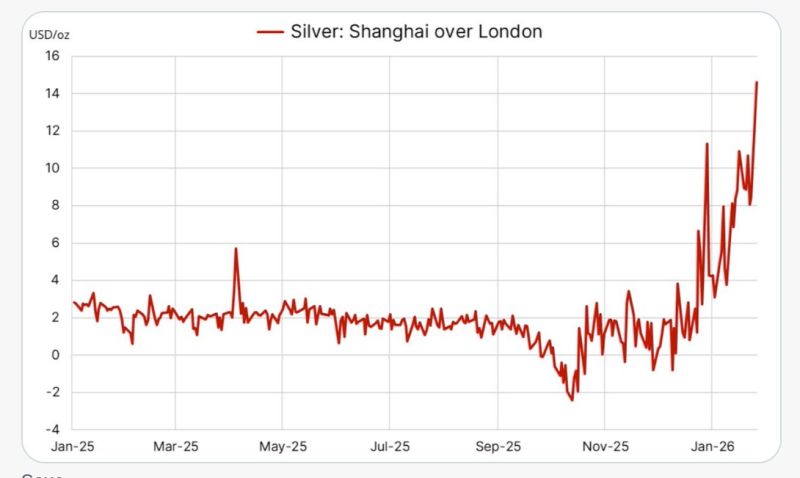

The spread between silver prices in Shanghai vs London is skyrocketing...

Source: Markets & Mayhem

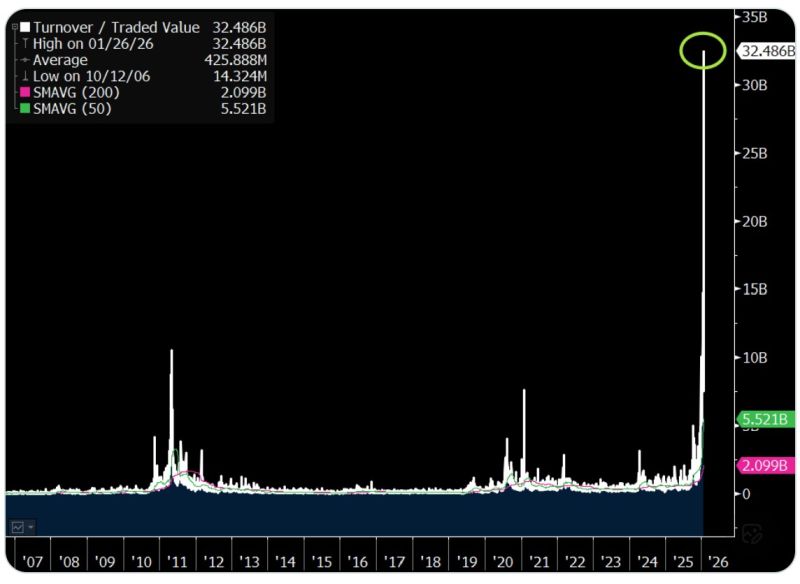

The volume in the silver ETF $SLV is $32b..

That's 15x its average and by far the most volume of any security on the planet. For context, $SPY is $24b, $NVDA and $TSLA $16b... Source: Bloomberg, Eric Balchunas

Silver is currently beating the performance of the NASDAQ 100 over the last decade

Source: Stocks World

This is the most insane run in silver ever during such a short span of time.

Source: Markets & Mayhem

Investing with intelligence

Our latest research, commentary and market outlooks