Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

THE BIG MONEY IS QUIETLY POSITIONING FOR A GOLD EXPLOSION.

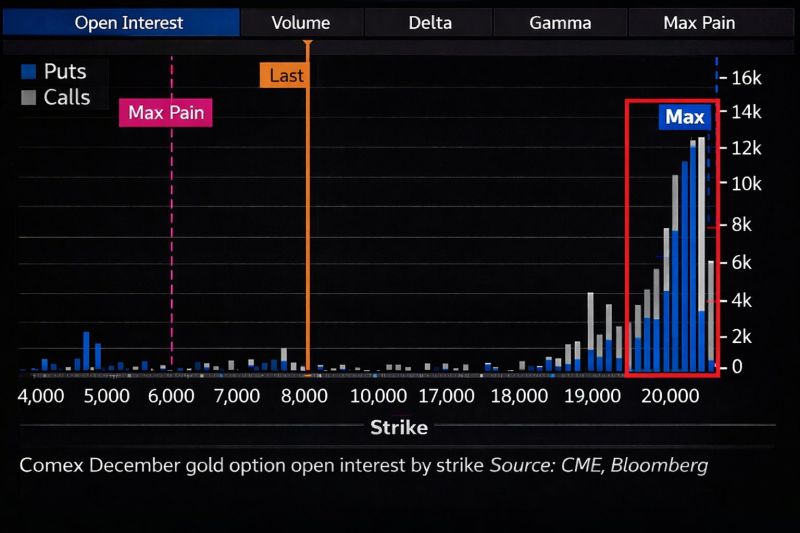

While retail investors are panic-selling the dip, the "smart money" is doing something absolutely radical. I’m looking at the COMEX data, and the numbers are staggering. The Strategy: Insiders are loading up on gold options with strike prices between $15,000 and $20,000 for December 2026. The Context: Current Gold Price: ~$4,961 The Target: A 3x to 4x increase in value. Here is the part most people missed: This buying spree didn't happen during the hype. It started right after gold hit $5,600 and "dumped" hard. When the price dipped below $5,000, retail investors ran for the exits. They saw a correction; the insiders saw a generational entry point. Right now, they are sitting on over 11,000 contracts. Why does this matter? Because you don’t place a bet that gold will triple out of "optimism." You do it because you see a fundamental shift in the global financial system that others are ignoring. Source: Alex Mason @AlexMasonCrypto

TME: "Gold bounced cleanly off the 50-day and the longer-term trend line.

We’re now trading at the highest levels since that bounce, hovering around the 50% retracement of the large down candle. So far, this has been a textbook rebound as positioning resets. gold likely needs more time to consolidate. $5,200 stands out as major resistance, while $4,800 marks key support". Source: TME

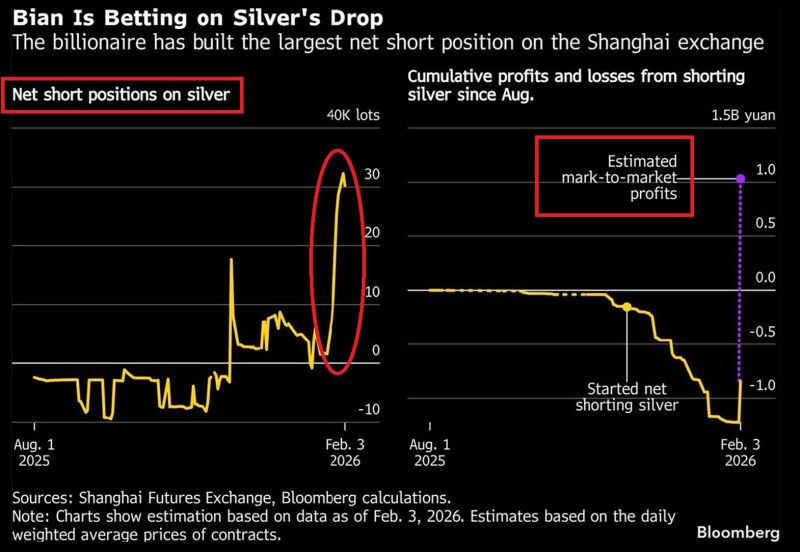

A billionaire Chinese trader has built the largest net SHORT position in silver on the Shanghai Futures Exchange, holding ~450 tons, or 30,000 contracts.

His short position is now worth ~$300 million in paper gains after silver prices collapsed. Including losses from earlier positions (he has been forced to liquidate some positions), he stands to make a net profit of ~1 billion yuan, or $144 million. Previously, he made nearly $3 BILLION from bullish gold bets on the Shanghai exchange since early 2022. A billionaire ramped up his Global Markets Investor @GlobalMktObserv

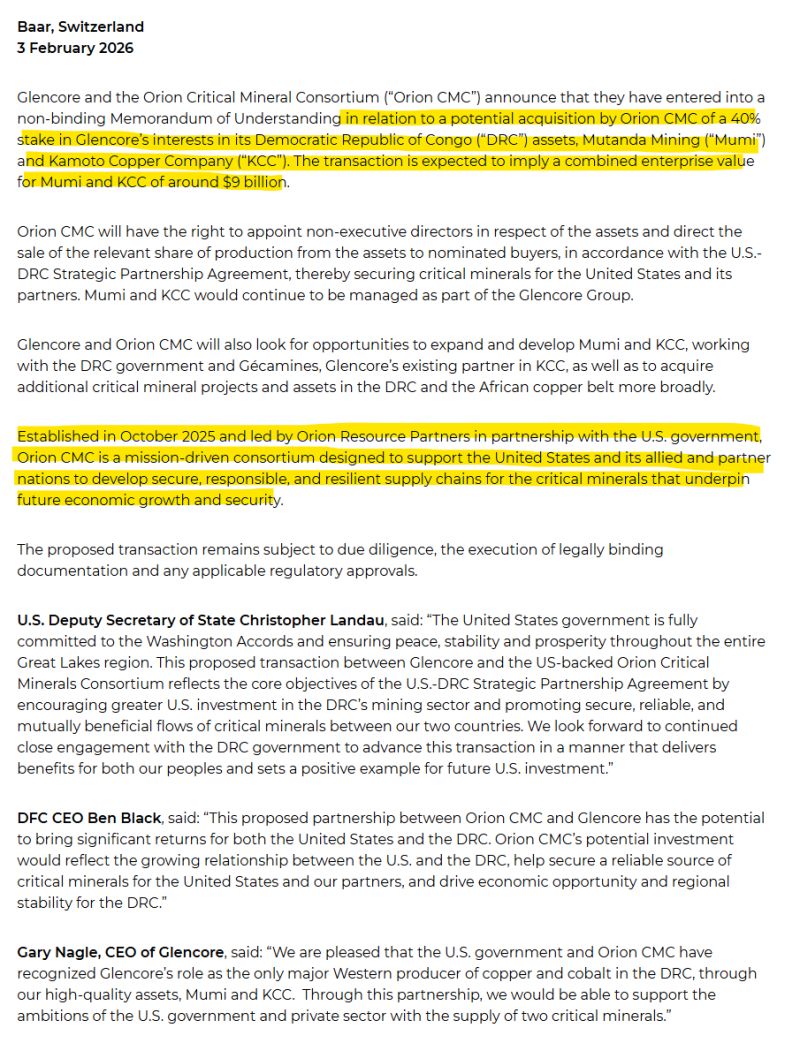

Glencore agrees to sell 40% stake on its two African copper and cobalt businesses to a US government-backed group

Washington continues to seek more control over critical minerals. The deal values the 100% of the mines at $9 billion, including debt. $GLEN Source: Javier Blas @JavierBlas

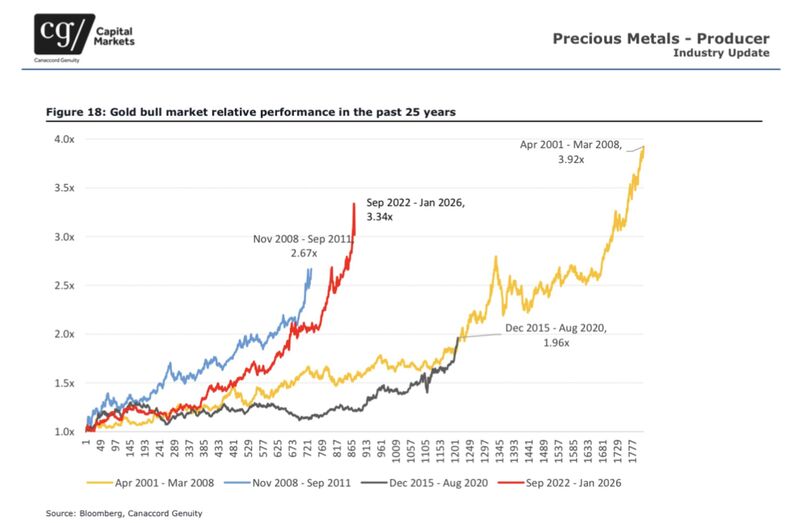

Current gold bull market in historical perspective

Source: Willem Middelkoop @wmiddelkoop Canaccord Genuity Bloomberg

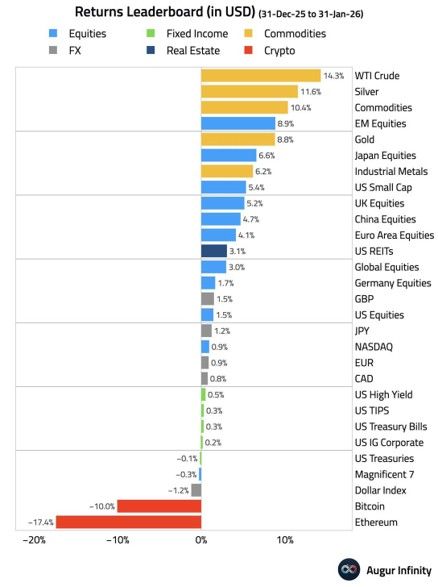

January 2026 best and worst performers 👇

🟢 Commodities is the best performing asset class YTD: WTI Crude is up +14.3%, Silver +11.65% and Gold +8,8% 🟢Global equity markets gained +3.0%. EM equities lead (+8.9%) ahead of Japan (+6.6%), UK (+5.2%), China (+4.7%) and Euro area (+4.1%). As it was the case in 2025, US equities underperform (+1.5%) as Mag 7 are negative YTD 🟢Credit posted modest gains while US Treasuries are slightly down 🔴 Dollar index is down -1.2% 🔴 Bitcoin and Ethereum are the worst performers, down double-digit Source: Augur Infinity

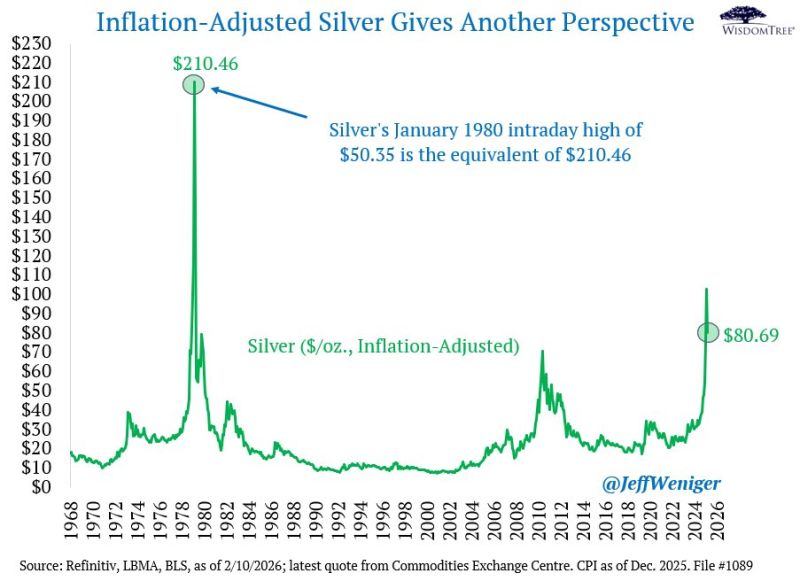

Silver just "crashed" 31% in a single day. 📉

But if you’re looking at the price on your screen, you’re missing the real story. On January 30, while paper silver was hitting $78, physical silver in Shanghai was trading at $120. That is a 54% premium. 🤯 The Great Divorce In a legitimate market crash, physical assets usually trade at a discount. Buyers disappear. Panic sets in. But what we just witnessed wasn't a bubble bursting. It was Paper and Physical divorcing in real-time. 💔 The system is breaking because the arbitrage required to close that gap relies on metal that simply doesn't exist in the vaults. The Math of a Meltdown Look at the COMEX leverage right now: - Registered Inventory: 108.7 million ounces. - Open Interest: 1.586 BILLION ounces. - The Leverage Ratio: 14:1. The Reality: If just 7% of contract holders stand for physical delivery, the vaults are empty. Game over. 🛑 The Bottom Line We are watching a game of musical chairs where 14 people are fighting for one seat. The "price" is becoming irrelevant when you can't actually source the metal at that cost. Is March 2026 the ultimate stress test for the global financial system? ⏳ Source: Shanaka Anslem Perera ⚡@shanaka86 on X

Investing with intelligence

Our latest research, commentary and market outlooks