Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

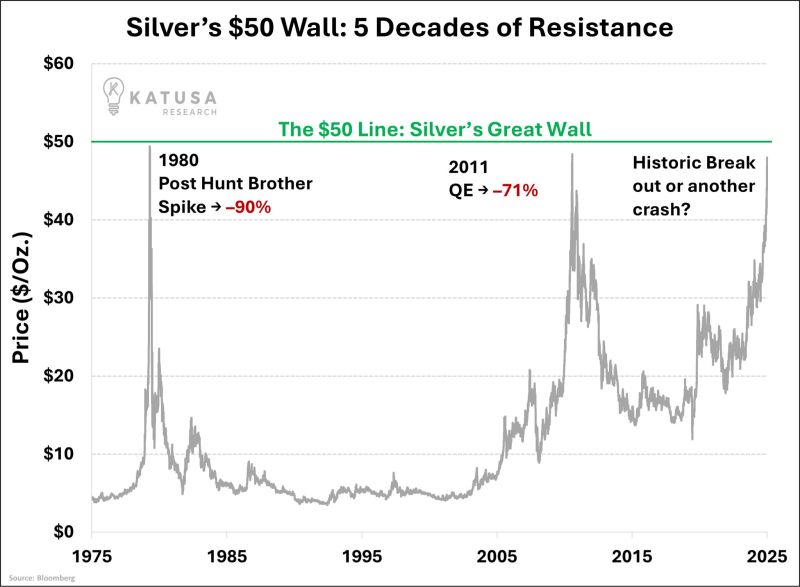

Silver is putting in an absolutely huge shooting star candle. We need a confirmation, but this one is very big so watch out!

The $50 resistance remains a big one. Source: The Market Ear

As pointed out by Wall St Mav, Rare earth metals are NOT rare. Plenty of sources around the world.

95% of the refineries and smelters that process raw ore are in China. Even if rare earths are mined in USA, it all needs to be shipped to China. Issue is that trying to build a smelter in the USA or Europe seems impossible these days. The environment litigation would take years. Hence the scarcity issue. Source: CNBC, Wall St Mav

Gold is now above $4,000/oz, and who would’ve thought silver would remain this cheap relative to gold?

Source: Tavi Costa, Macro Trends

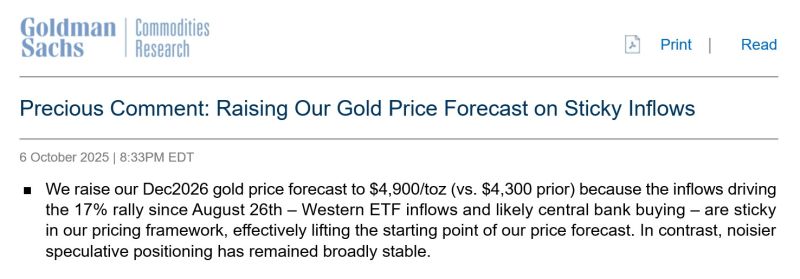

Goldman is raising their gold price Dec2026 forecast to $4,900 (prior $4,300)

Source: Goldman Sachs

Silver’s approaching the level that destroyed it twice

1980 → down 90% 2011 → down 71% Will it be the breakout of a lifetime or another déjà vu? Source: Katusa Research

gold just had its best monthly performance since August 2011...

Source: zerohedge

It's official.

Silver just reached its highest quarterly close in history. Source: Otavio (Tavi) Costa @TaviCosta, Bloomberg

A beautiful quarterly candles chart of silver

Source: Tavi Costa, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks