Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

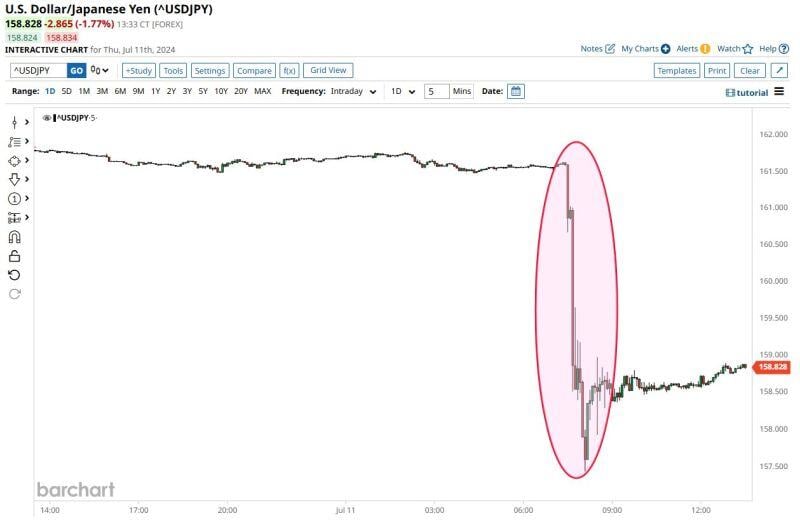

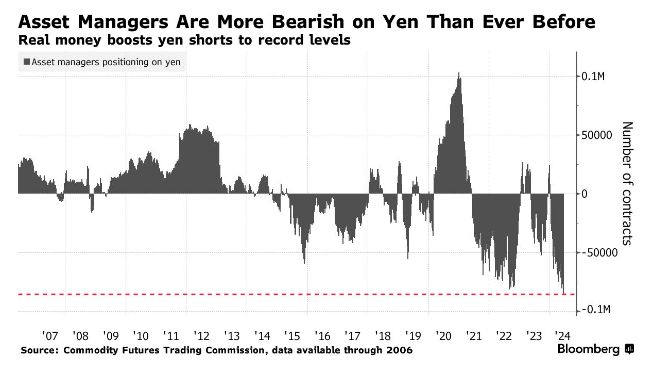

The Japanese Yen is up against the US dollar to its strongest level since mid-June.

The USD-JPY currency pair is down over 3% since Thursday after hitting a 38-year high following another round of intervention by Japan’s Ministry of Finance. Japanese authorities reportedly spent $22 billion on Thursday and Friday to prop up the yen, according to Bloomberg. This comes after Japan spent a record $62 billion to support the currency between April 26th and May 29th. Over the last 12 months, the Yen has declined by ~12% and has been the worst-performing currency of G10. Source: The Kobeissi Letter

Is the Bank of Japan intervening again trying to prevent the Yen from falling further against the U.S. Dollar?

barchart

How India's rupee went from most to least volatile currency in Asia

Source: Bloomberg

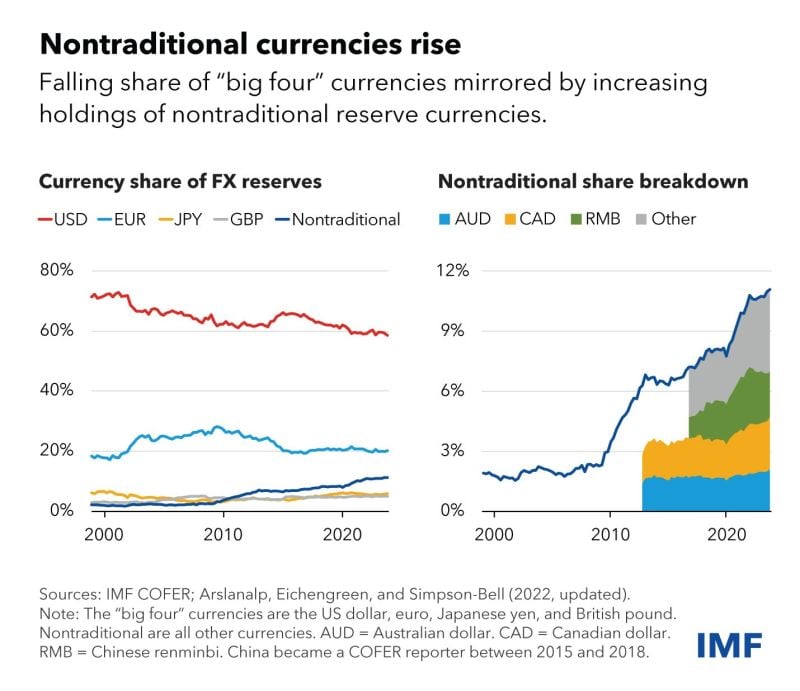

The US dollar’s share of foreign reserves remains dominant, though it has continued to slowly erode

This has been accompanied by a rise for others such as the Australian dollar, Canadian dollar, Chinese renminbi, and Korean won. Source: IMF

Investing with intelligence

Our latest research, commentary and market outlooks