Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

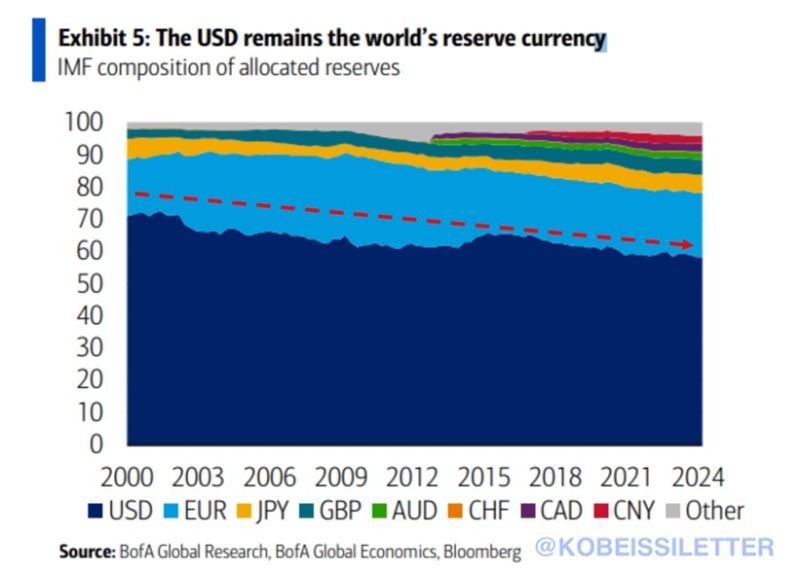

The US Dollar's reserve currency status remains in a downtrend:

The US Dollar share of the world's central banks reserves fell slightly to 58.4% in Q4 2023 from 59.2% in Q3 2023, according to the IMF. By comparison, the US Dollar accounted to 71% of reserves globally in 2000. However, it is worth noting that the US Dollar remains the most dominant currency and it's not even close. For example. the Chinese Yuan's share in Q4 2024 was just 2.3% and the Euro's share is ~20%. Is the US Dollar's reserve currency status safe? Source: The Kobeissi Letter, BofA

BREAKING 🚨: Argentina

Argentina's Peso has plummeted to an an all-time low against the U.S. Dollar on the Black Market (which is where Argentinians go to convert to USD) Source: FT, Barchart

China now settles half of its crossborder trade in renminbi, up from zero in 2010

• Rise in RMB use highlights sanctions-proofing strategy of Beijing and its allies, such as Russia • China's promotion of CIPS, its homegrown alternative to Swift, may support rise in RMB use Source: Agathe Demarais

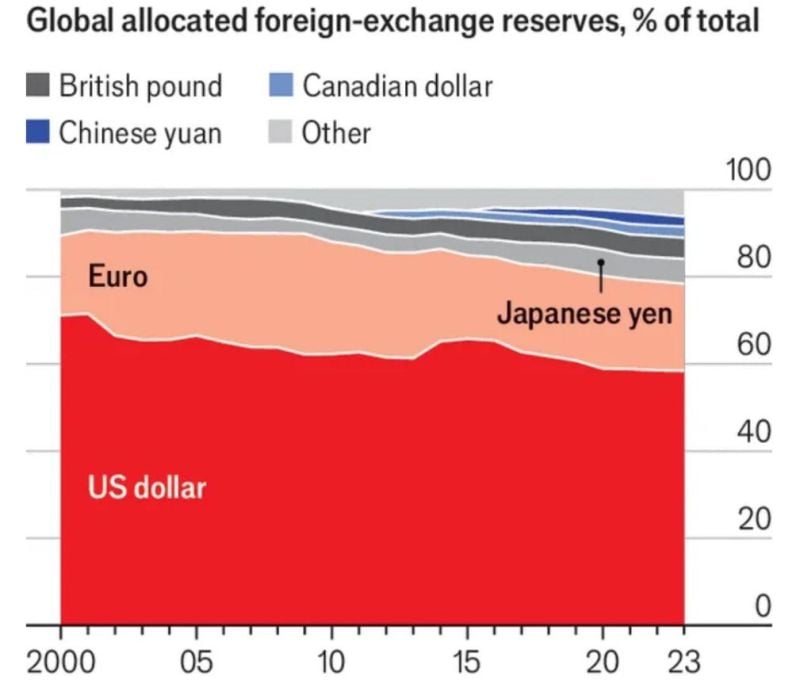

Global foreign exchange reserves.

The US dollar still dominates but share has been eroding sligthly Source: Michel A.Arouet

JUST IN 🚨: Treasury Secretary Janet Yellen says the Bank of Japan BoJ should consult with her before intervening to support Japanese Yen

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks