Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

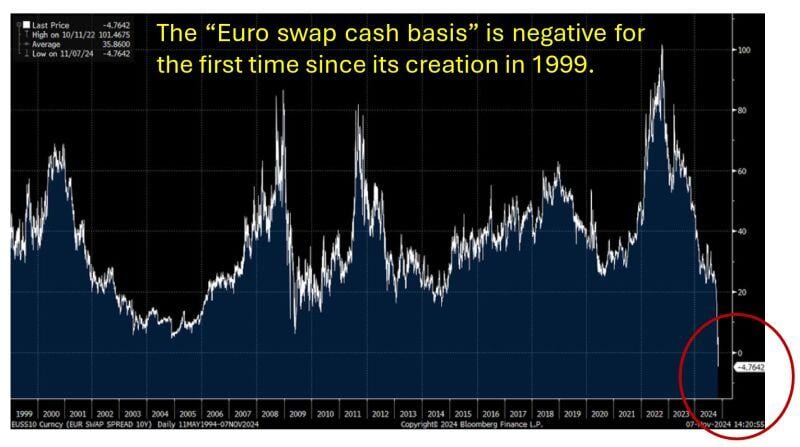

🚨 The “Euro swap cash basis” is negative for the first time since its creation in 1999.🚨

👉 It reflects the difference in cost between borrowing money in euros and the cost of swapping it to another currency, like U.S. dollars. 👉When it’s negative, it means borrowing in euros and swapping it to dollars is unusually expensive or difficult. 👉The fact that it’s negative for the first time since 1999 suggests that dollar demand is at an all time high🥤 Source: BowTiedMara @BowTiedMara

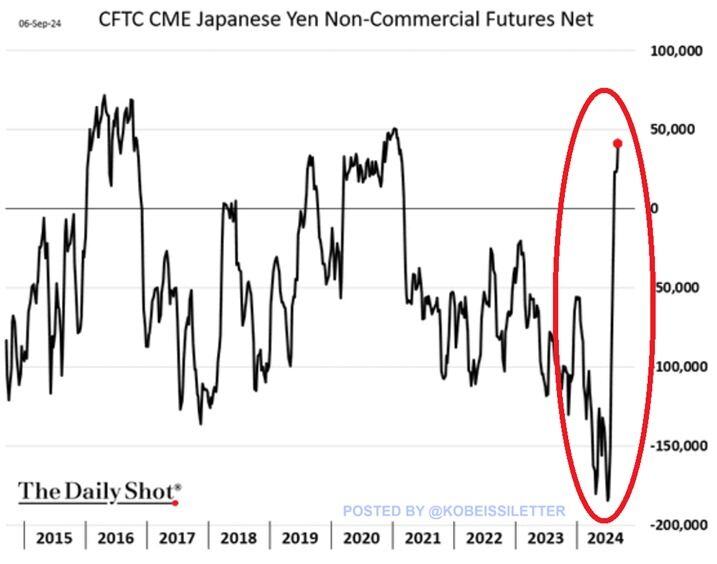

Net long positions on the Japanese yen hit ~45,000 last week, the highest level in 3.5 years.

By comparison, in early August, speculative positions reached net short ~180,000 contracts, the most in at least 20 years. The las time such a sharp reversal from short to long occurred was during the 2008 Financial Crisis. This comes after the Japanese Yen has strengthened against the US dollar by 12% since July as the carry trade has scaled back. The $USDJPY pair is flat year-to-date and is trading at its lowest level since the first week of January. Japanese Yen volatility is still here. Source: The Kobeissi Letter

Morgan Stanley's CIO Michael Wilson says "yen carry trade risk lingers for US stocks"

Source: Bloomberg

Hedge funds have finally turned net bullish on the Japanese Yen

Source: Bloomberg, David Ingles

The Yen Carry trade unwind is far from over, with total net Yen shorts being barely covered...

Source: Global_Macro @Marcomadness2

This is the most important chart in the world today: the Japanese Yen vs the USD. Why is it so important?

1. For 30 years Japan has 0% interest on their currency. 2. As a result for 30 years investor borrowed YEN at no cost and invested it globally. They invested in T-Bills abroad and a basket of risk assets including the Nasdaq. 3. For the first time in many year the BOJ increased interest rates this week by 0.25%. This was almost unprecedented. 4. As a result of the increased interest rates and the signal to the market, investors are now concerned that the money they borrowed for free is no longer free and therefore they are unwinding their trades and sending the funds back to Japan. 5. The estimated quantum of this trade is over $4 trln!! The only question that remains is how aggressive they will be. But for now WE MUST KEEP OUR EYES ON THIS CHART! If it keeps strengthening risk assets are going to get sold even more. If it weakens again then risk assets might rally (all else being equal). Source: Ran Neuner on X, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks