Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

🔴 Turkey Lira dropped to an all-time low after Istanbul mayor and Erdogan rival arrested.

Imamoglu, the 53-year-old Istanbul mayor, was seen as the next opposition party candidate for the Turkish presidency and was expected to be nominated on Sunday. Charges for the arrest, which Imamoglu and his party reject, include terrorism and organized crime. Source: CNBC, Bloomberg

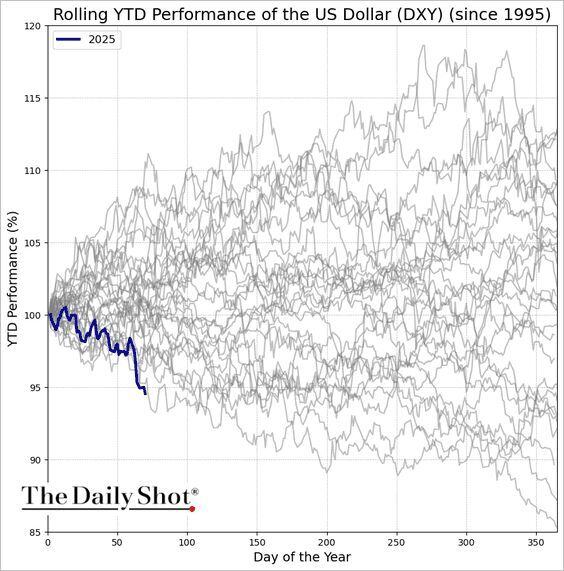

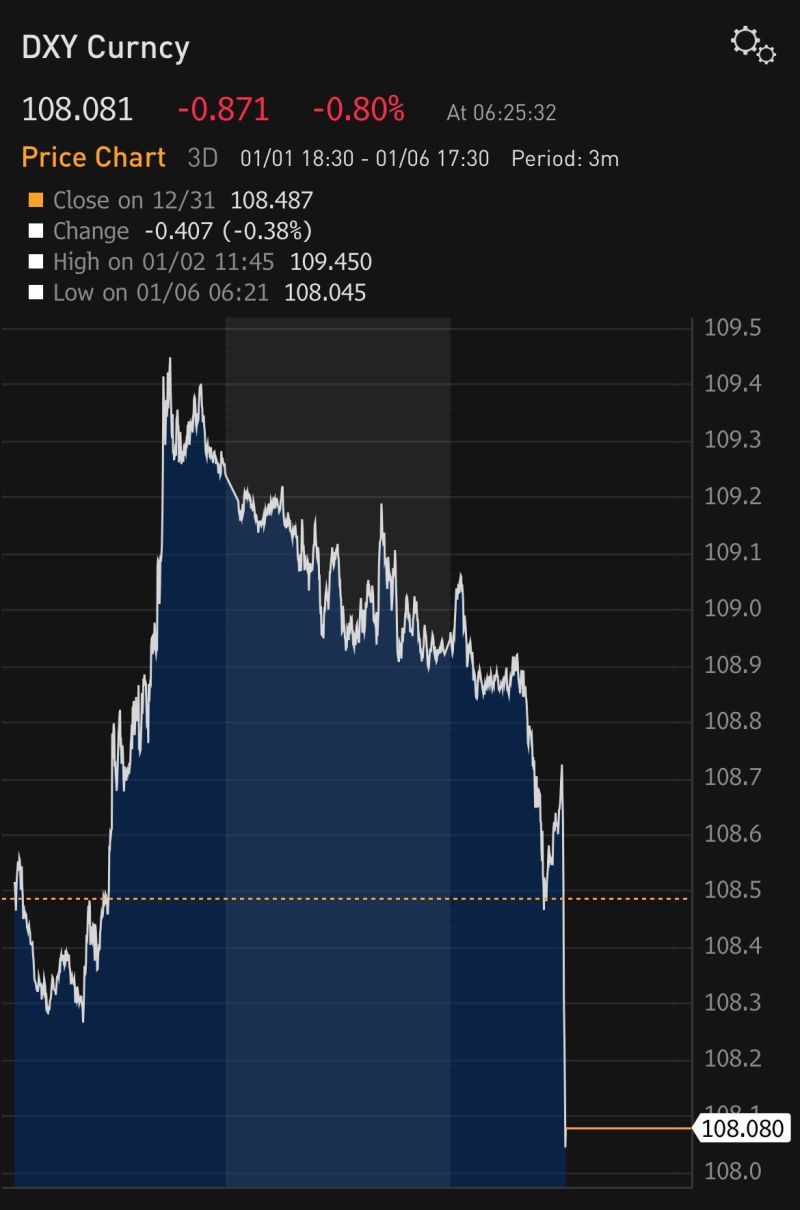

The US dollar is off to its worst start of the year in decades.

Source: The Daily Shot

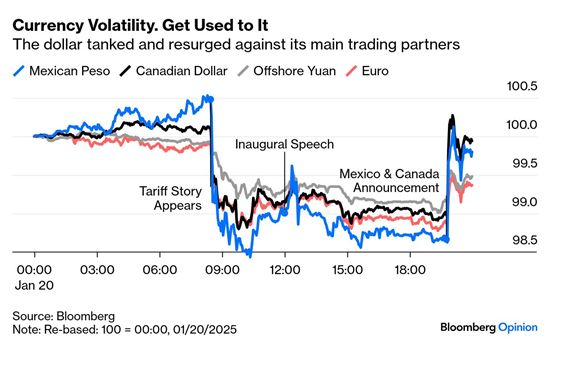

BREAKING: The dollar dropped and stocks surge after the Washington Post reported that Donald Trump’s aides are exploring tariffs that would apply to every country, but only cover critical imports

See the kink to our 10 surprises 2025 (surprise #1: Trump 2.1 "(...) What if concerns over the inflationary effects of tariffs prompt him to pivot, adopting a more conciliatory approach with trading partners—a shift from Trump 2.0 to Trump 2.1): https://lnkd.in/eKXRsc58 Source: MenthorQ, Bloomberg

BREAKING: The Canadian dollar is flying after reports that Prime Minister Trudeau is to announce resignation as early as Monday

Source: Reuters, Bloomberg

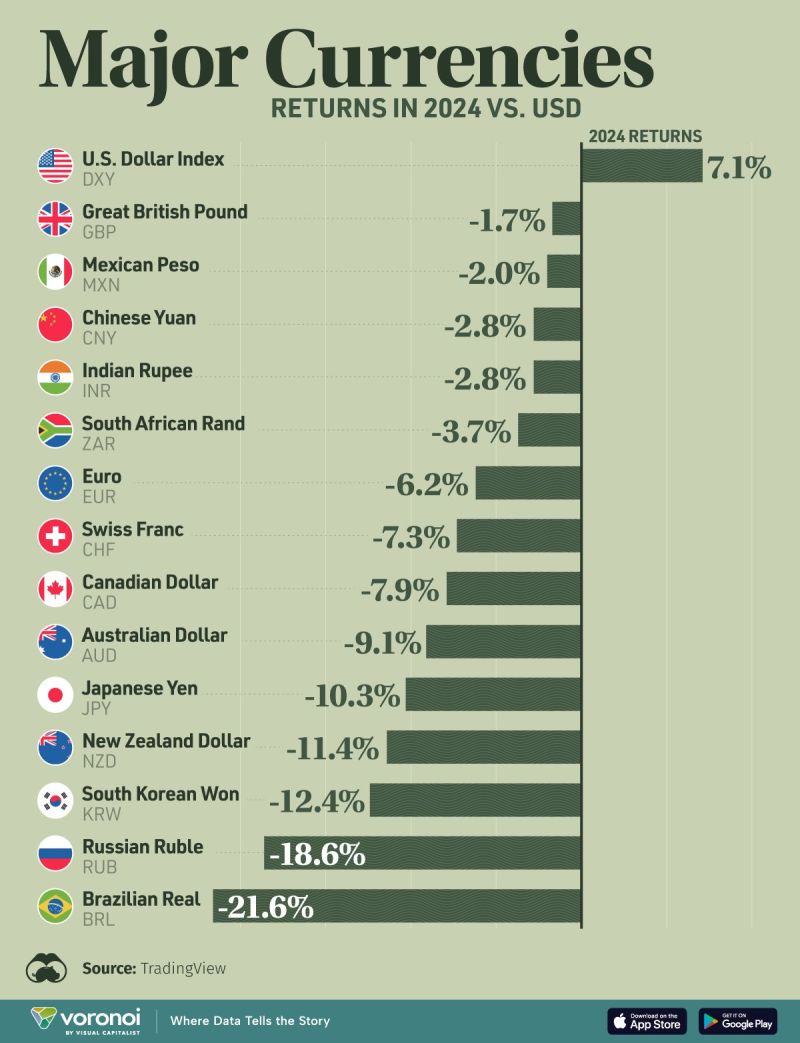

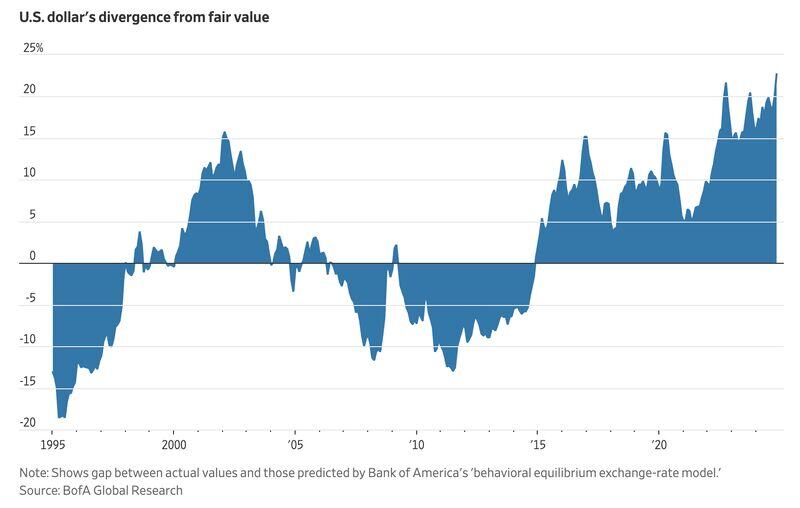

USDollar is now the most overvalued in history according to Bank of America.

Bank of America uses a "behavioral equilibrium exchange model (BEER)", an economic concept used to estimate the equilibrium exchange rate of a currency based on fundamental macroeconomic factors and behavioral relationships. BEER models derive the equilibrium exchange rate from observable economic fundamentals such as Terms of trade, Productivity differentials, Net foreign assets, Interest rate differentials and Trade balances Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks