Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

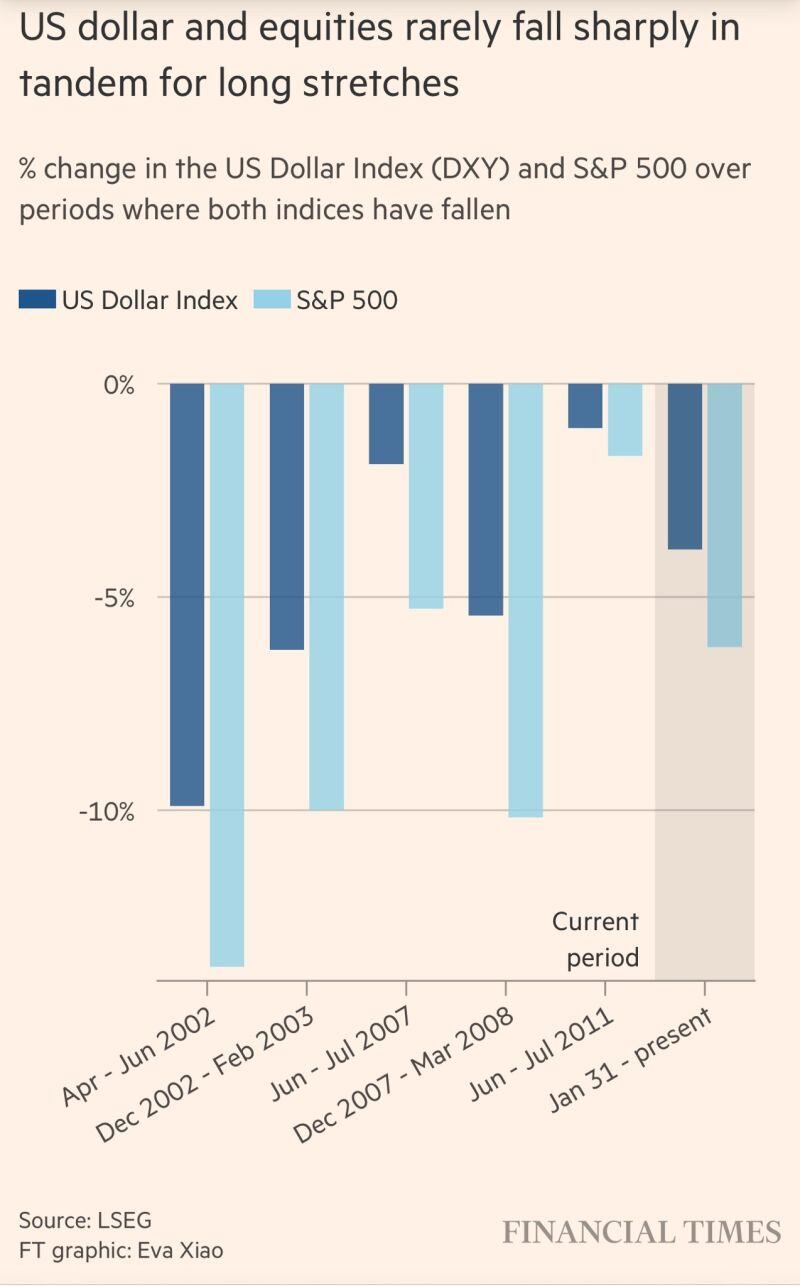

From the behavior of a Developed Market to that of an Emerging Market in just one week?

Witnessing such a rare disconnect between the USD index (dark line) and US Treasury yields (blue line) is truly intriguing. Source: Andreas Steno Larsen

Markets are dumping the dollar in Asia as the Dollar Index $DXY plunges below 100

Euro = 1.13 Yen = 143 Swissie = 0.8194 Source: zerohedge

Here's another retaliation from china...

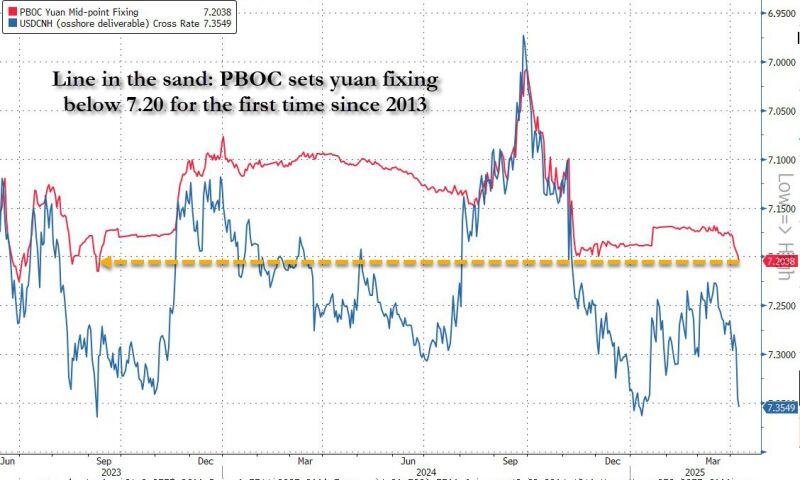

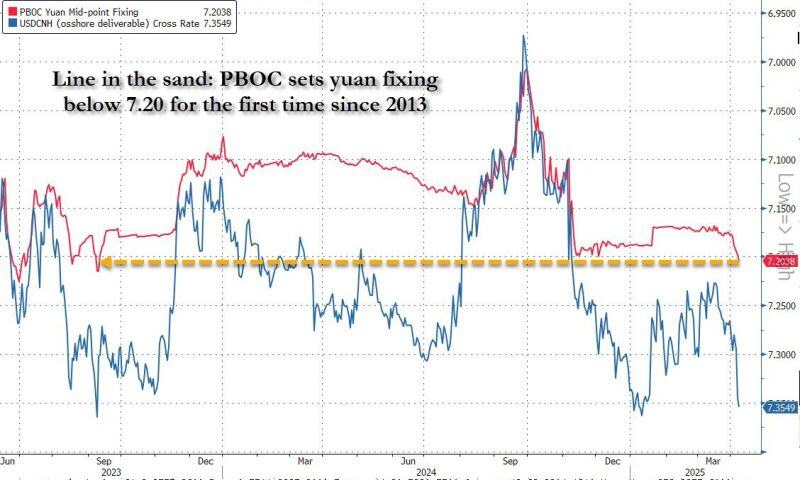

Beijing just crossed a line in the sand. The PBOC fixing was on the other side of the closely watched 7.20 "devaluation" line, first time since 2023. Offshore yuan tumbles and is about to hit a record low against the USD. Source: zerohedge

Here's another retaliation from China...

Beijing just crossed a line in the sand. The PBOC fixing was on the other side of the closely watched 7.20 "devaluation" line, first time since 2023. Offshore yuan tumbles and is about to hit a record low against the USD. Source: zerohedge

“‘The dollar has lost 96% of its purchasing power over the last century’ is the most misleading claim in all of finance,” says Riholtz in his new book.

As long as spend or you invest (instead of sitting on cash), you should be ok. Source: Eric Balchunas on X

Investing with intelligence

Our latest research, commentary and market outlooks