Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Another enormous climb in the Taiwanese dollar today, up almost 8% over the last two sessions against the USD, by far the biggest two-day increase on record.

▶️ So what's going on? The Taiwanese dollar (TWD) has been surging due to a combination of economic, trade, and market factors in 2025: ✔️ Easing Trade Tensions: Speculation about reduced U.S.-China trade tensions, particularly following indications that China is open to trade talks with the U.S., has boosted optimism for Taiwan’s export-driven economy. ✔️ Strong Economic Growth: Taiwan’s GDP grew at an annualized rate of 9.67% in Q1 2025, with annual growth of 5.37%, surpassing forecasts. A ✔️ Tech Sector Strength: Strong U.S. tech earnings, particularly from companies like Microsoft and Meta, have signaled sustained demand for AI and semiconductors, where Taiwan plays a critical role through companies like TSMC. This has driven foreign capital inflows and supported TWD appreciation.

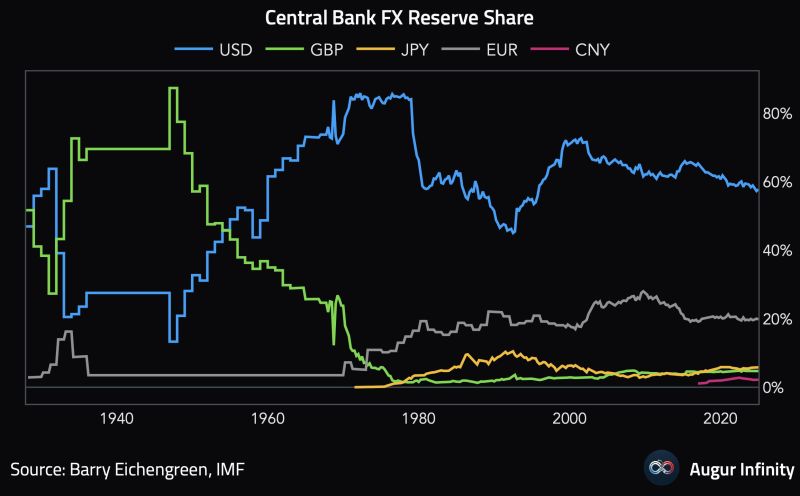

A currency's reserve status should not be taken for granted.

Just look at what happened to the pound... Source: Augur Infinity

The Market Ear

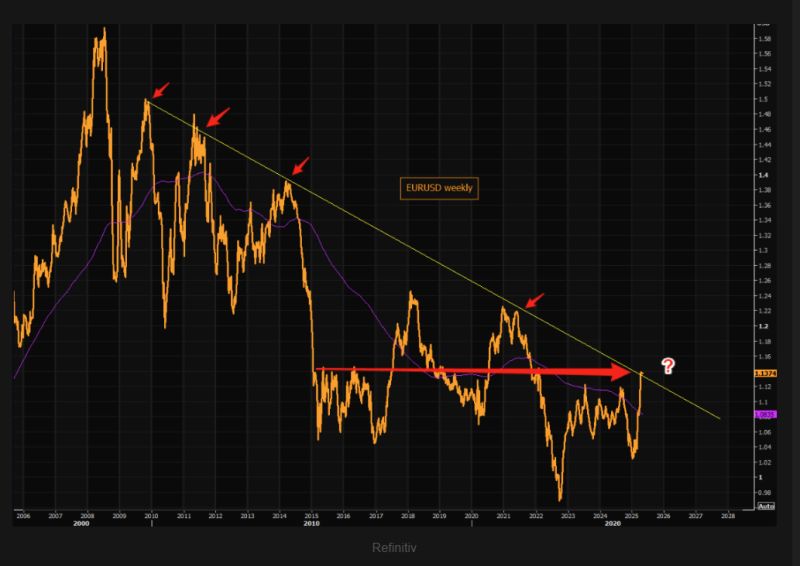

EURUSD longer term chart right at the big negative trend line. The 200 weekly moving average is sloping negatively still...and the FX pair has done nothing since 2015. FX is a relative game, but getting excited about the euro here looks like a late short term trade

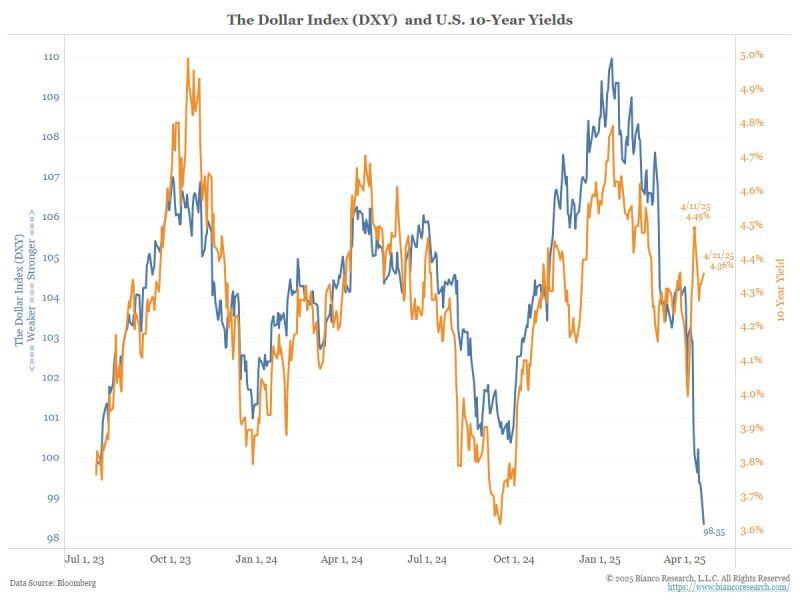

Dollar Crashes On Powell Removal Speculation, Gold Soars To All Time High And Bitcoin Suddenly Spikes

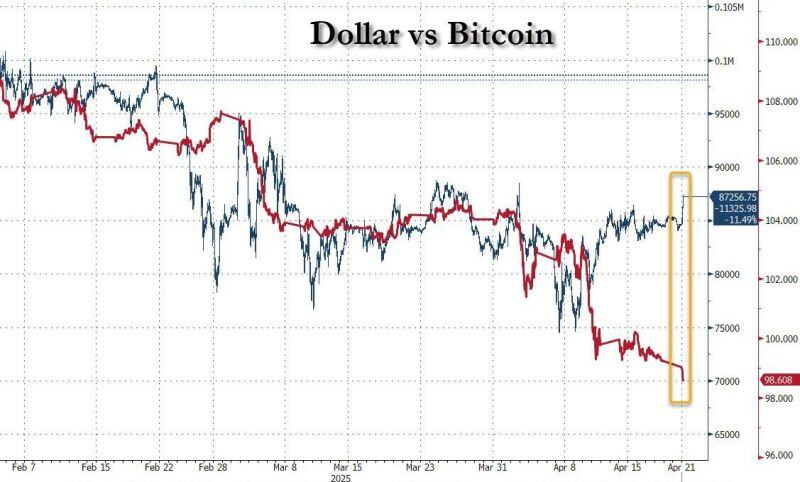

The result is that while bitcoin had generally tracked the DXY Dollar index lower for much of 2025, the last few weeks - and certainly Sunday night - have seen a very tangible snap in this relationship. Source: zerohedge, Bloomberg

BREAKING: U.S. Dollar

U.S. Dollar Index $DXY plunging to its lowest level since March 2022 Source: Barchart

Is it a memecoin?

- 36 trillion supply - No supply cap - 1 node - 25% of supply minted in the last 6 months - 1% of holders own 30% - Backed by the U.S. government Source: Not Jerome Powell on X

Investing with intelligence

Our latest research, commentary and market outlooks