Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Don't forget, FX effect is a very important component in total returns...

As highlighted by Jeroen Blokland, while the SP500 Index is close to a record high in US dollar terms, in euro, the index is down 11% from its peak in February. The euro has reached its highest level since September 2021, which hurts euro-denominated investors. Source: Jeroen Blokland, Bloomberg

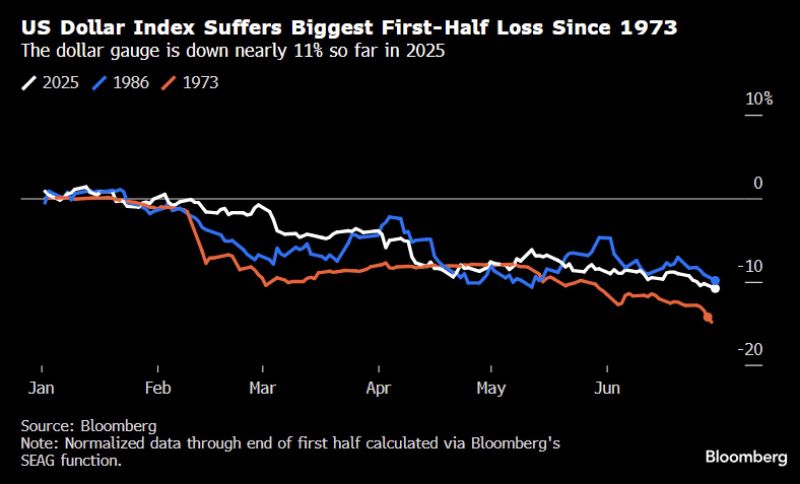

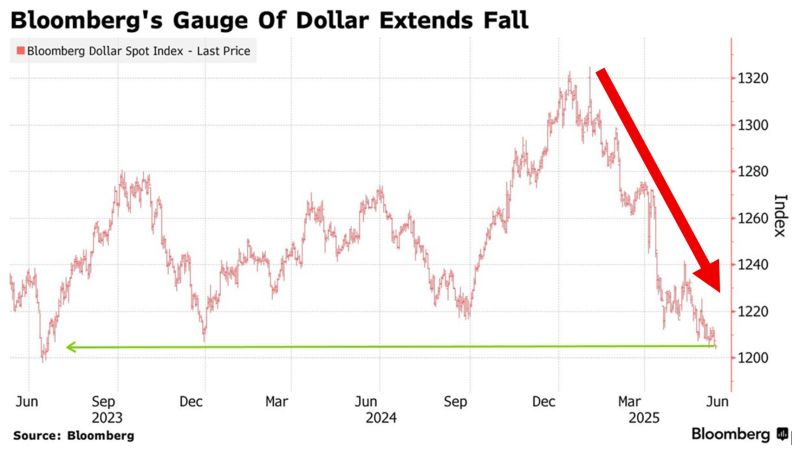

The Dollar posted its steepest first-half decline in over five decades, as erratic policy shifts and signs of slowing economic activity continue to erode confidence in the reserve currency.

The Dollar Index DXY Index fell 10.8% in H1 2025 as the Dollar weakened sharply against major developed-market currencies. The Greenback tumbled 14.4% against the Swiss franc, 13.8% against the Euro and 9.7% versus the Pound. Emerging-market currencies also rallied, delivering some of their strongest gains in years. (BBG) Source: HolgerZ, Bloomberg

The Hong Kong Monetary Authority said it used HK$9.4bn ($1.2bn) of its reserves to buy Hong Kong dollars on the open market.

It acted after the local currency dropped past HK$7.85 per US dollar, the weak end of the band within which it is allowed to trade. The move will drain liquidity from the banking system and pushed up interbank lending rates on Thursday, potentially threatening a carry trade that has allowed investors to borrow cheaply in the city’s currency before investing in higher-yielding US debt securities. Source: FT https://lnkd.in/evksjsp9

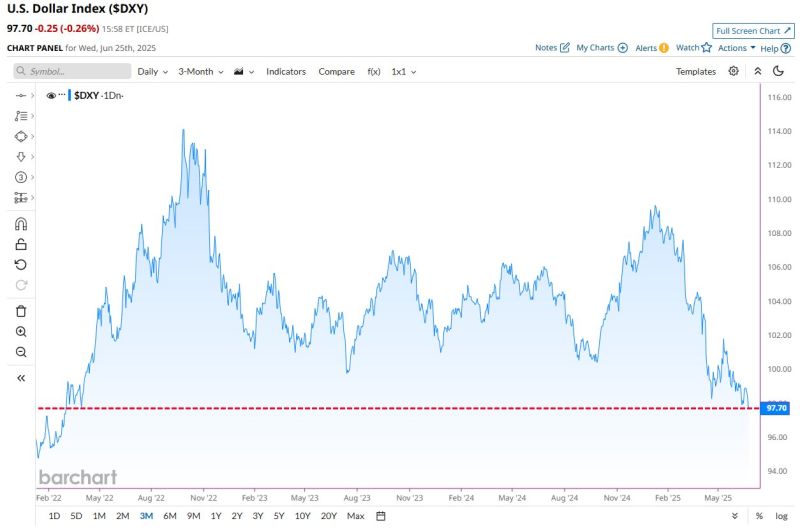

BREAKING 🚨: U.S. Dollar

The lowest close since March 2022 for the U.S. Dollar Index $DXY on track its 📉📉 Source: Barchart

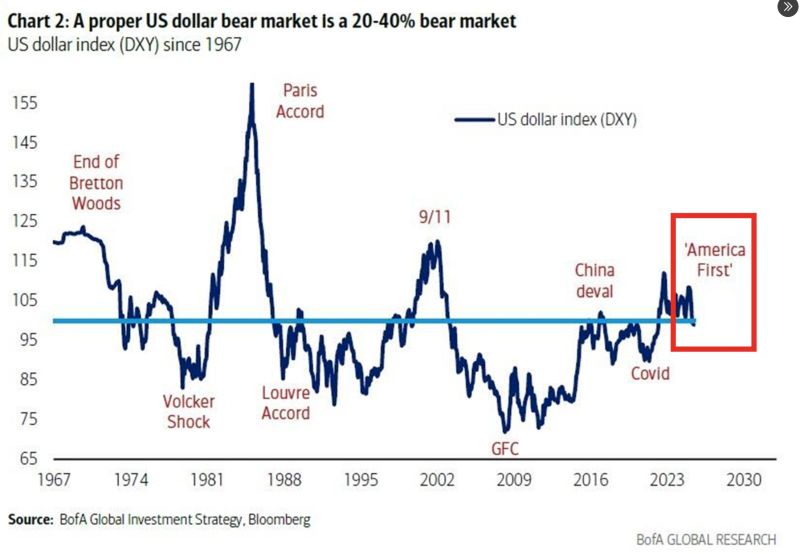

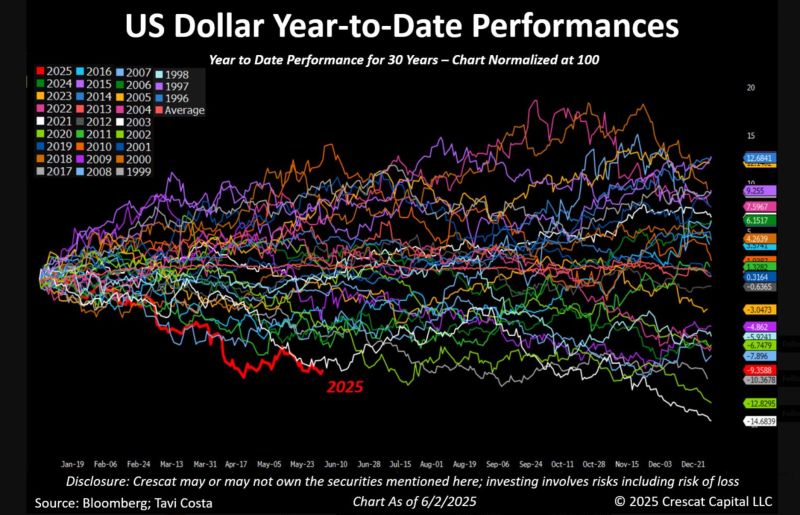

⚠️True US Dollar bear markets are usually 20-40%:

1970s (-30%) - End of Bretton Woods (USD delinked from gold) 1980s (-40%) - Plaza Accord (G7 nations devalued USD to reduce trade deficits) 2000s (-30%) - Post-9/11 policy shifts, Fed rate cuts The US Dollar is down 9% YTD.

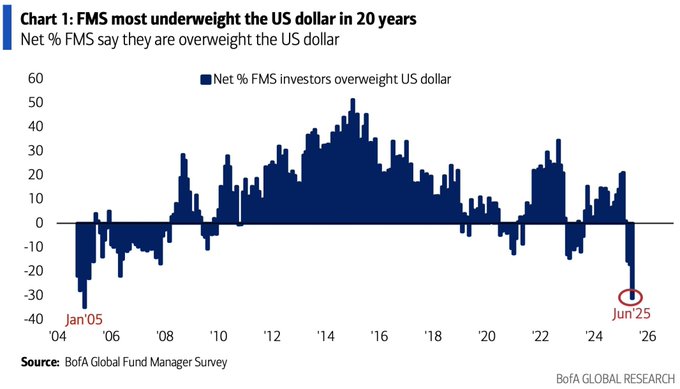

According to Bank of America's Fund Manager Survey, investors are more underweight on the US dollar than at any point in the past 20 years.

Source: @Schuldensuehner @BankofAmerica

The US Dollar decline has been truly remarkable:

The Bloomberg US Dollar Index just dropped to its lowest level since mid-2023. The dollar has fallen over 8% in 2025 and erased nearly all of its gains from the past year. This comes as foreigners are bringing money back home... Source: Global Markets, Bloomberg

The US dollar is on track for its worst performance in three decades

Resource stocks, emerging and other developed markets, and foreign currencies are beginning to perform well. Source: Crescat Capital, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks