Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Mighty Dollar...

The dollar index $DXY is taking out range highs, closing well above the 50 and the 100 day moving averages. We haven't seen the DXY close "properly" above the 100 day since the dollar bear started earlier this year. Not good short term news for the gold and precious metals space. Source: The Market Ear

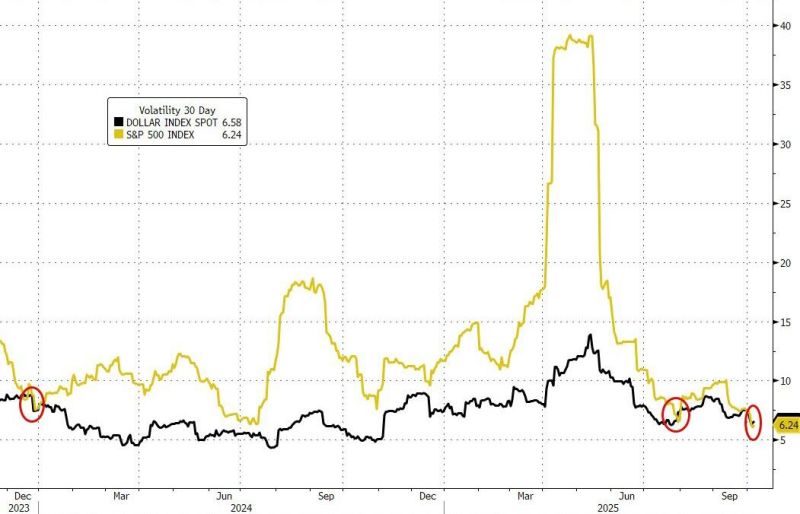

Over the last 1 month, the US dollar has been more volatile than the S&P500.

As Goldman Sachs Brian Garrett notes, this has happened twice in the last 7 years (Dec 2023 and Jul 2025)... Source: zerohedge

Dollar seasonality

Now is the time to buy the dollar, at least from a seasonality point of view Source: The Market Ear

Has the dollar bottomed?

An interesting regularity is emerging for the Dollar. Payrolls revisions (Aug 1), CPI (Aug 12) and Powell's Jackson Hole speech drag the Dollar down, but each low after one of these hits is higher than the one before and the Dollar then resumes its rise. Source: Robin Brooks

Investing with intelligence

Our latest research, commentary and market outlooks