Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

U.S. Dollar Index $DXY heating up, now above 99 for the first time in 1 month

Source: Barchart

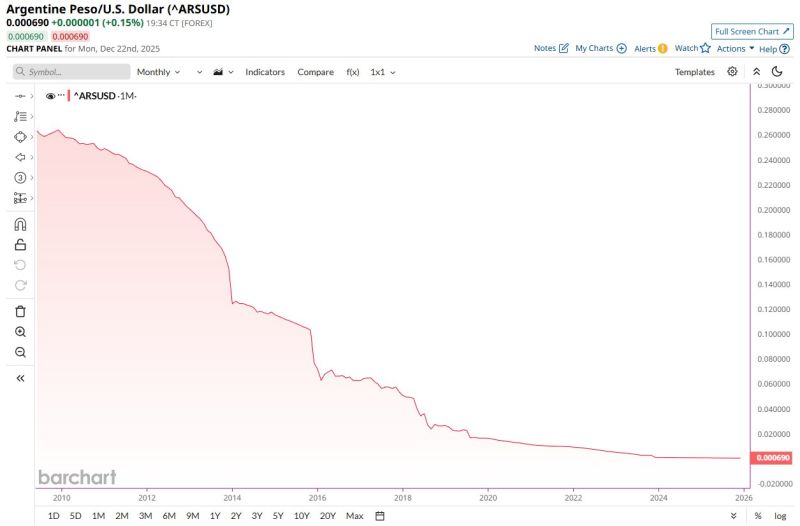

BREAKING 🚨: Argentina

Argentina's Peso has now collapsed 99.8% against the U.S. Dollar since 2009 📉📉 Source: Barchart

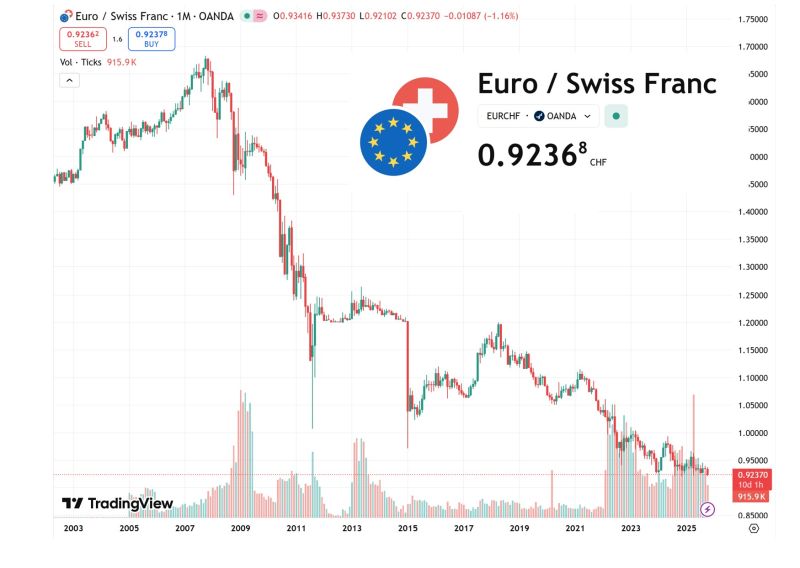

Although the Swiss Franc has been the strongest currency in the world, the purchasing power degradation in ‘real’/’hard’/gold terms over the last 20 years has been massive

Chart below shows Gold price in Swiss Francs – the “hardest” fiat currency in the world has lost 80%+ of its purchasing power !) Source: Goldman Sachs, zerohedge

Japan's government says it may "intervene" before the Japanese Yen to US Dollar ratio reaches 160.

Over the last 2 months, the Yen has gone from 145 to 157 as a $110B+ stimulus package is coming. We are ~2% away from "intervention." Source: The Kobeissi Letter @KobeissiLetter

Japanese Yen hits weakest level against the U.S. Dollar in more than 8 months

Source: Barchart

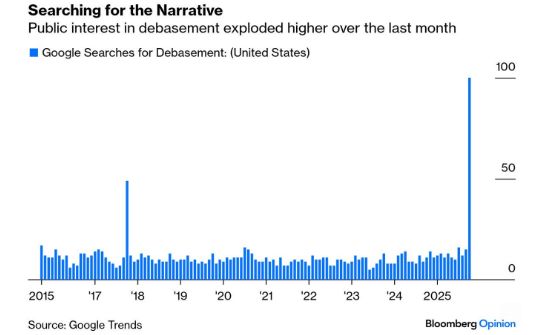

Google Searches for Dollar "Debasement" soar to highest level in history 🚨🚨🚨

Source: Barchart

The U.S. just finalized a $20 billion currency swap deal with Argentina and is now directly buying Argentine pesos to help stabilize the collapsing currency.

This comes just a day after Argentina’s short-term yields exploded to 87% as President Milei burned through reserves to defend the peso before the October 26 elections. The new U.S. support marks a dramatic intervention aimed at restoring liquidity and easing pressure on Argentina’s financial system, which has been teetering on the edge after weeks of heavy dollar sales and record borrowing costs. Source: StockMarket.news

Investing with intelligence

Our latest research, commentary and market outlooks