Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

A carry trade unwinding time bomb? Watching the JPY appreciating is nice but note the strong correlation between the JPY and the VIX

Source: TME

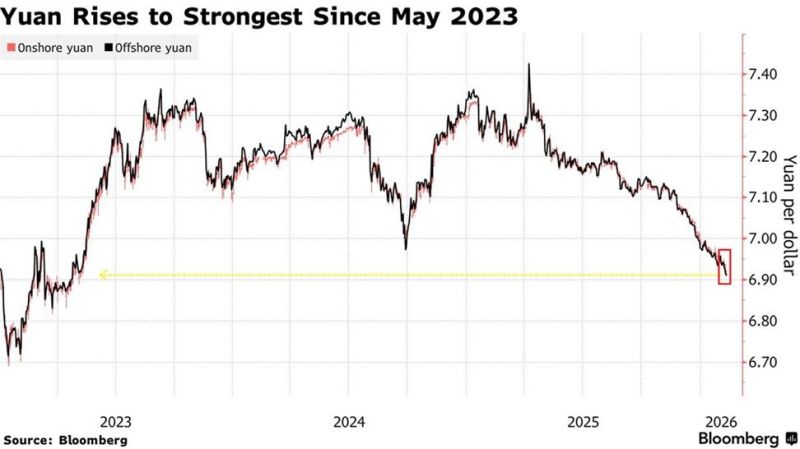

The Chinese Yuan has strengthened to 6.91 against the US Dollar, the strongest since May 2023.

The Yuan is now on track for its 7th consecutive monthly gain, the longest streak since 2020-2021, up+5% since 2025. It has also been the 3rd-best-performing currency in Asia since September. The most recent move comes after Chinese regulators advised banks to limit purchases of US Treasuries and instructed those with high exposure to pare down positions. China is benefiting from the US Dollar's weakness. Source: The Kobeissi Letter, Bloomberg

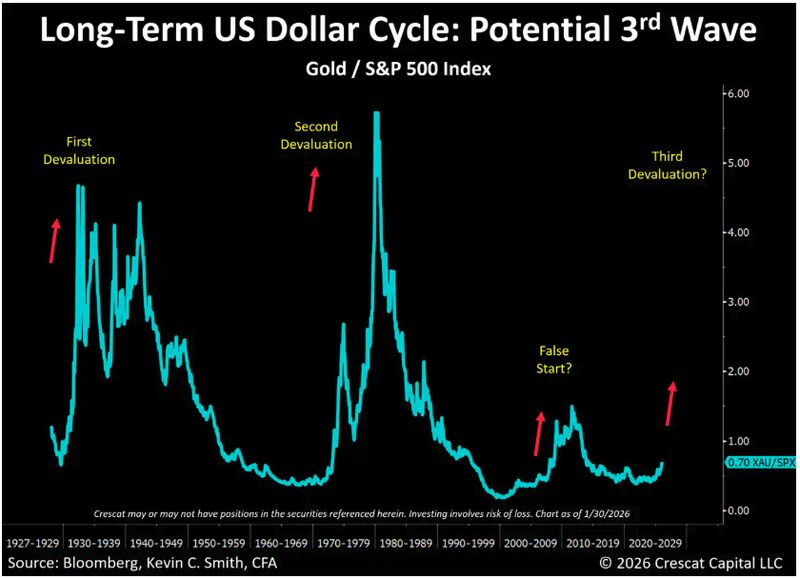

THIRD WAVE OF THE US DOLLAR CYCLE

Interesting comment by Crescat Capital: ‘We think the gold panic on Friday on the announcement of Kevin Warsh as the new Fed Chair caused a healthy pullback from short-term overbought conditions in the precious metals markets. While Warsh may appear the least dovish among President Trump’s candidates, we believe he is indeed in favor of lowering interest rates in 2026, as the President has also affirmed. Investors in Crescat’s portfolio of undervalued precious and critical metals miners should not be too concerned. Our activist mining portfolio outperformed gold, silver, and the gold equity benchmarks, both on Friday and cumulatively for the month of January. Still, the gold correction was no small matter. We think it presents a buying opportunity. In fact, now, as much as ever, is the time for gold investors not to panic but to step back and look at the big picture’. Source: Crescat Capital

Did someone front run Trump's dollar announcement by going all-in gold?

At exactly 3pm, a large block of gold‑linked call (GLD) trading went through, coinciding with the sharp move higher in spot gold. In over‑the‑counter equivalent terms, a trader rolled 250k deltas out of an in‑the‑money 4,950/5,050 call spread, and into a Feb. 20 5,250/5,400 call spread, representing 1.1 mm ounces of gold exposure ($5.1BN). The client paid $30MM in net premium to implement the new structure. Source: zerohedge

While the world watches the US Dollar and Yen with bated breath, the "Swissie" just hit its strongest level in over a decade.

Here is why the global markets are shaking: 🚀 The "Gold Nugget" Effect Investors are fleeing to safety. With Gold crossing $5,000/oz and political volatility rocking major powers, the Swiss Franc has become the ultimate "reliable" haven. It’s up 3% this year, following a massive 14% gain last year. 📉 The SNB's Impossible Choice A currency this strong is a double-edged sword. It keeps inflation low (currently at 0.1%), but it puts a massive squeeze on Swiss exporters. The Swiss National Bank (SNB) is now stuck between a rock and a hard place: Cut rates? They are already at 0%. Going negative again is a move they want to avoid. Intervene? Direct intervention risks the "currency manipulator" label and diplomatic friction. 🌍 The Bigger Picture When the "linchpin" of the global economy (the USD) feels erratic, capital doesn't just disappear—it migrates. We are seeing a fundamental shift in where the world stores The Lesson: In a world of volatility, stability is the most expensive luxury on the market. Source: FT

"US flip from exceptionalism to expansionism is best case for a contrarian US dollar long" (BofA Hartnett)

Source: TME

Investing with intelligence

Our latest research, commentary and market outlooks