Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

U.S. Dollar Index $DXY now on a 4-day winning streak and is at its highest level in more than 1 month 📈📈

Source: barchart

The Euro suffered its steepest one-day drop against the dollar since May on Monday, as Germany and France voiced fears that the long-awaited EU-US trade deal would hurt the European economy.

The single currency was down more than 1 per cent against the dollar and weakened by 0.8 per cent against the pound, following the announcement on Sunday that the US would impose 15 per cent tariffs on most imports from the EU. The agreement, hailed by European Commission president Ursula von der Leyen as “the biggest trade deal ever” and covering nearly 44 per cent of global GDP, averted a possible transatlantic trade war. But German chancellor Friedrich Merz said on Monday that the tariffs would cause “considerable damage” to his country’s economy, Europe and the US itself. “Not only will there be a higher inflation rate, but it will also affect transatlantic trade overall,” he said. “This result cannot satisfy us. But it was the best result achievable in a given situation.” French Prime Minister François Bayrou said the trade deal marked a “dark day”, adding that the EU had “resigned itself into submission”. Source: FT

U.S. Dollar Index $DXY on track to get a Death Cross ☠️ on the weekly chart for the first time since January 2021

🚨 The last 2 weekly Death Crosses marked the bottom 📈 Source: Barchart

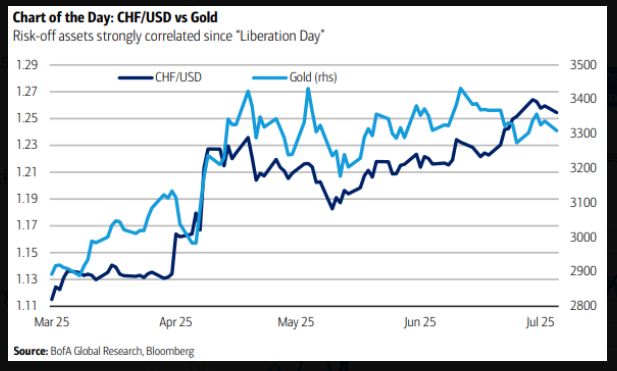

BofA argues that CHF is now behaving more like gold:

A liquid, neutral hedge against long-term fiscal uncertainty in a world that doesn't have many G10 alternatives, not short-term market stress. Source: Patrick Saner

BREAKING: U.S. Dollar

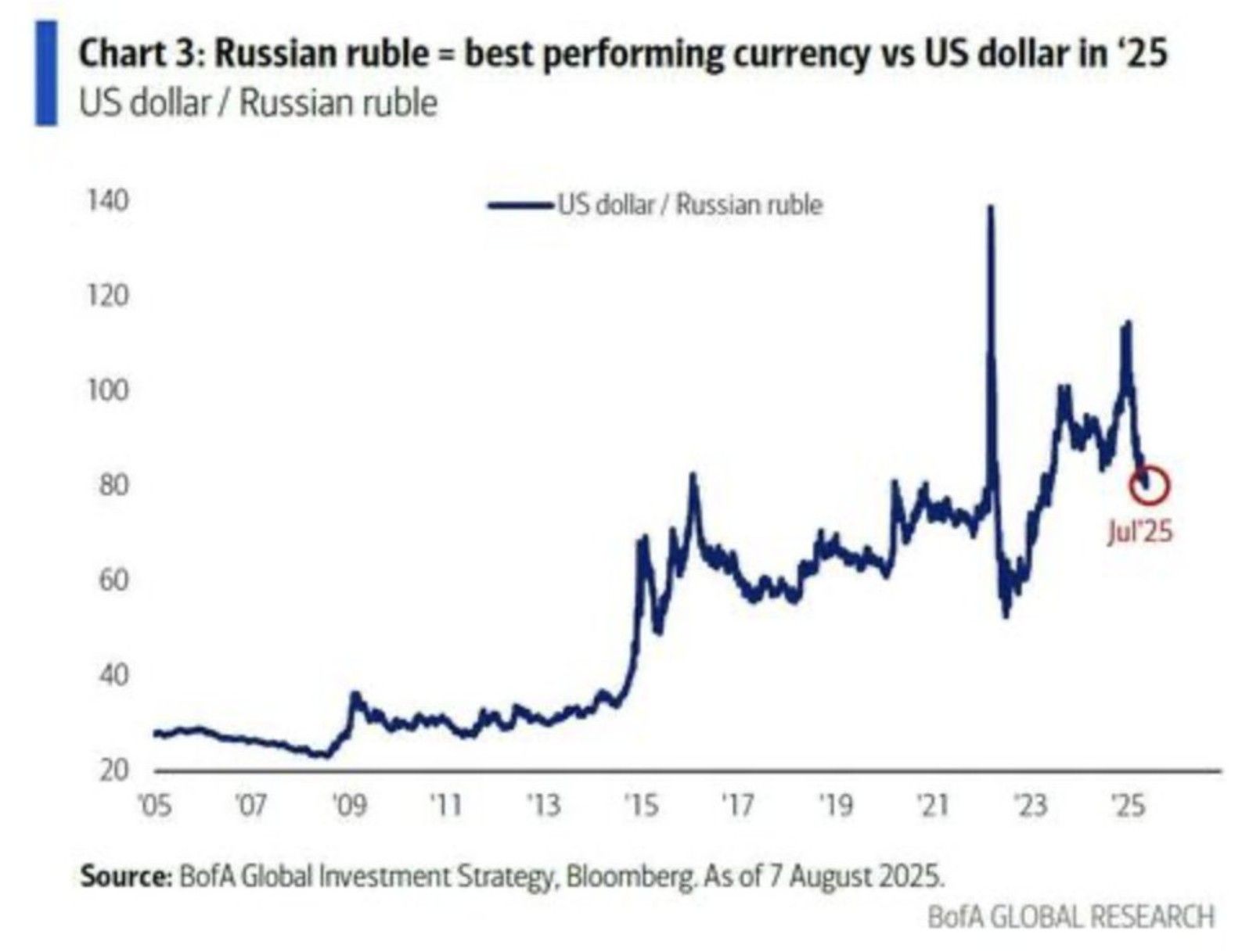

U.S. dollar Index $DXY is now trading below its 200 Day Moving Average by the largest margin in 21 years. Source: Bloomberg

Does this chart signal a breakdown in the dollar, or is it preparing the ground for one of the most violent reversals in recent history?

$DXY is testing the lower bound of a multi-decade ascending channel, a level that has repeatedly marked inflection. Source: barchart

The swissie has appreciated nearly 50% over the last 20 years.

A stronger CHF poses significant challenges for Swiss firms, particularly exporters, as it erodes their pricing power on the global stage. This could pressure corporate margins and economic growth in Switzerland. Note that the August 2011 high at 1.3125 is not too far away. What will the SNB do in case of breakout? Heavy use of its balance sheet (at the risk of being pointed out by Trump as a currency manipulator) and/or negative interest rates?

Investing with intelligence

Our latest research, commentary and market outlooks