Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

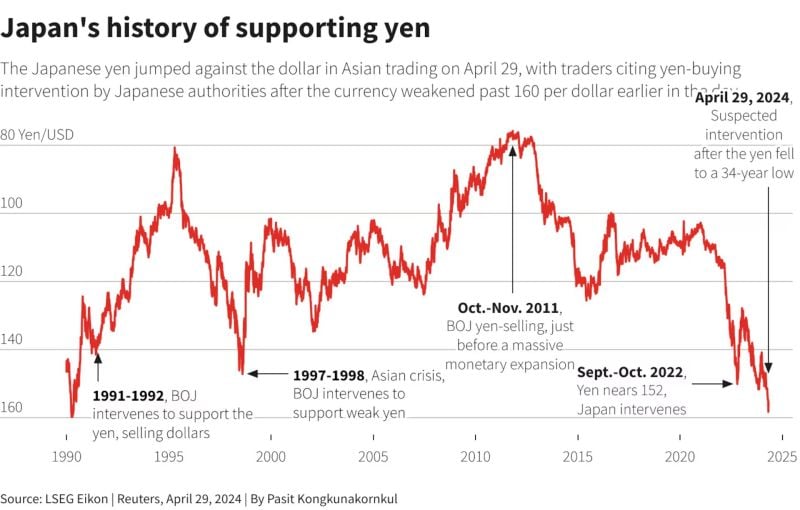

It's clear, Japan is intervening to support the Yen:

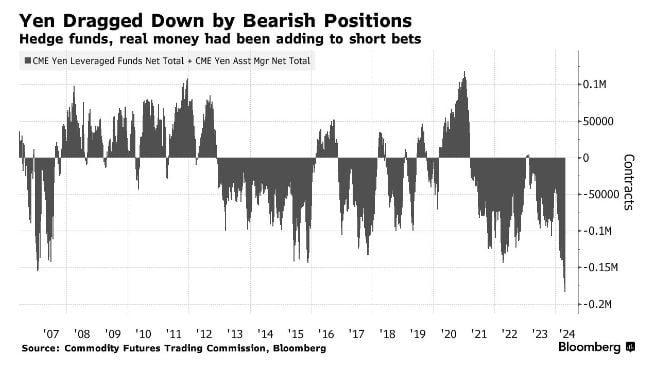

Twice this week, we saw the Yen fall to its weakest point against the US Dollar since 1990. This was the first time in 34 years that 1 US Dollar converted to 160 Yen. Immediately after the Yen neared 160 twice this week, we saw a steep drop in the conversion rate, strengthening the Yen. The BOJ reported Tuesday that its current account will fall 7.56 TRILLION YEN, or $48.2 billion USD. This was clearly due to intervention equating to 5.5 trillion Yen, which we last saw in 2022 and 2011. The third largest currency in the world is in trouble. Source: The Kobeissi Letter

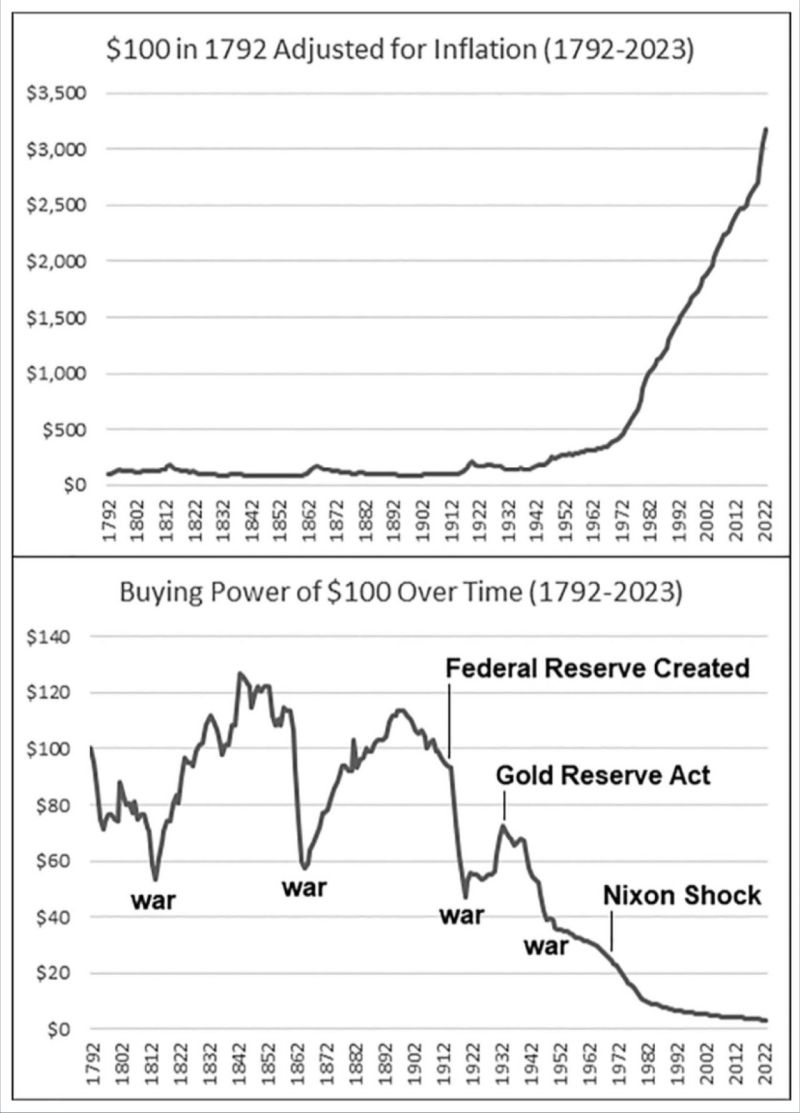

This is money debasement and loss of purchasing power looks like.

Below you can see the change in purchasing power of the U.S. dollar as measured by aggregate price inflation, including impactful historic events. Anyone who has attempted to save in dollars since the inception of the Federal Reserve until now has been robbed of their purchasing power. Source: Figure-7D, Broken Money thru Reese M.

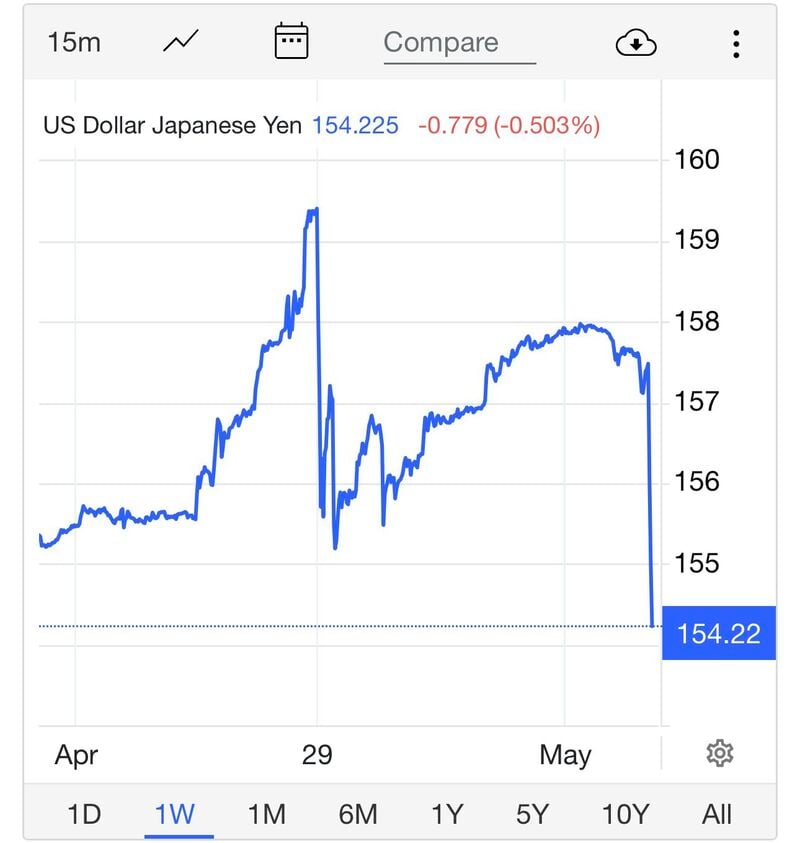

Intervention? At 9:30 PM ET, the Japanese Yen weakened to 160 against the US Dollar for the first time since 1990.

Exactly 2.5 hours after the headlines came out, the ratio just crashed from 160.20 to 156.50. That's a ~2.5% swing in one of the biggest currencies in the world in a matter of minutes. Clearly, something is happening here and it comes just days after the Bank of Japan left rates unchanged. Did someone just intervene? Source: The Kobeissi Letter

Japan's currency official declined to comment regarding possible intervention

Japan's Masato Kanda says "No comment for now" when asked whether Tokyo had intervened in the currency market Today following a sharp move in the market that sliced more than 2% off the dollar-yen exchange rate shortly after the Japanese currency went over 160.

Source: Bloomberg

The yen briefly topped 155.50.

Expected volatility over the next 24 hours is now at the highest level of the year. Source: David Ingles, FT

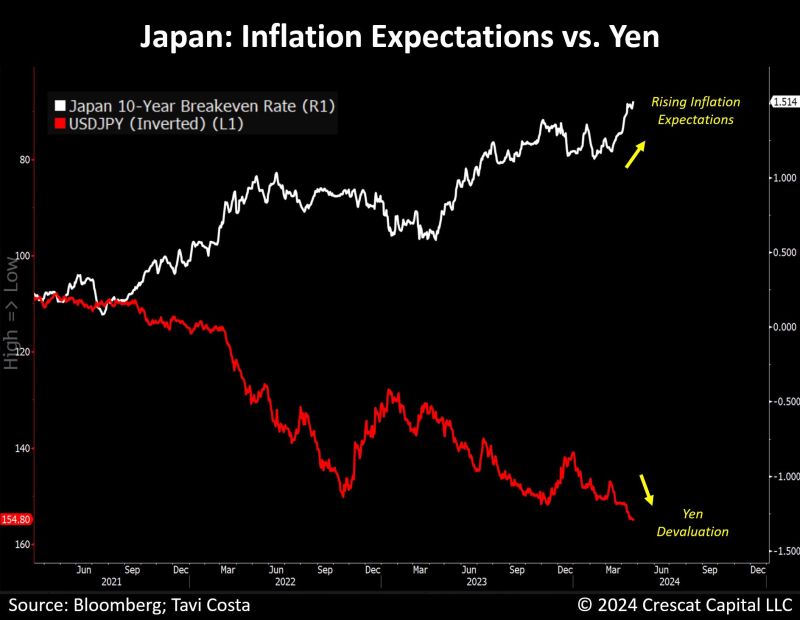

Excellent tweet by Otavio (Tavi) Costa on how money debasement looks like and why the BoJ is "trapped” in one chart.

"Japan is experiencing increasing inflation expectations alongside a continuous devaluation of the yen, exhibiting an almost perfectly negative correlation. This reflects the dilemma of an economy burdened by excessive debt, necessitating continuous accommodative monetary policies in the face of structural inflationary pressures. While this might be more pronounced in Japan, this trend is reflective of a global fiat debasement phenomenon". Source: Crescat Capital, Tavi Costa

Investing with intelligence

Our latest research, commentary and market outlooks

%203%202024-04-29%2010-25-14.jpg)