Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

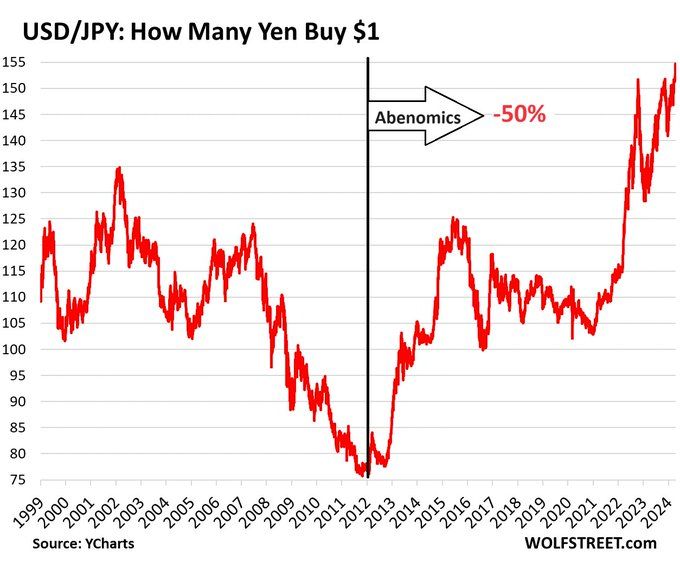

The YEN is COLLAPSING and Abenomics has taught us some lessons:

After years of money printing, Yen now trades to 155 against USD: -32% against USD since 2021, -50% since 2012 The Bank of Japan has been buying over half of the national debt with freshly created yen, plus a bunch of other securities. But there is a price to pay after all: the destruction of the currency: Source Wolfstreet

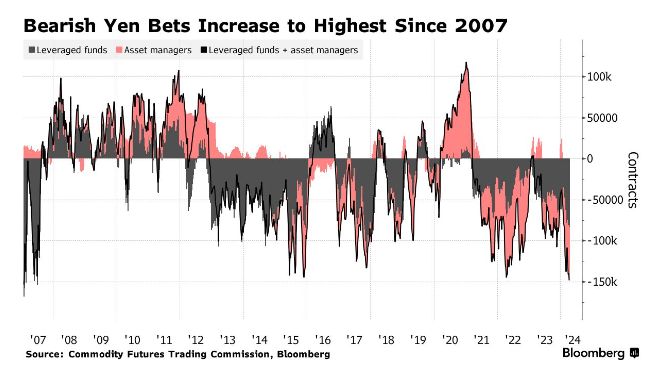

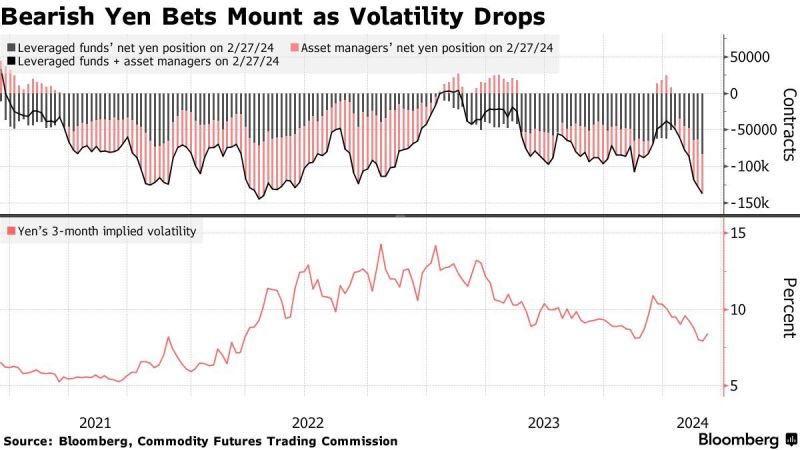

If technical analysis works on this chart, the yen might see considerable more weakness againt dollar in the coming weeks...

Source: Ole S Hansen

SNB cut rates against market expectations

Swiss National Bank cut the policy rate by 25 BPS to 1.50%. USDCHF and EURCHF both jumped by more than one figure to 0.8970 and 0.9780 respectively. Market was only pricing in a 35% probability of this cut.

FED holds benchmark rate, May cut remains unlikely

The US Federal reserve holds benchmark rate in 5.25-5.5% target range. Jerome Powell prepared remarks and Q&A answers were more dovish than during the January meeting. FOMC median forecast remains at 75 BPS rate cuts for 2024, but the forecast increased from 3.6% to 3.9% in 2025.

Gold reacted to Powell's dovish tone by jumping to a new record high and breaking the 2200 level.

Source: Bloomberg

Nice one by Barclays...

The CNY's share of cross-border payments has overtaken the USD Source: Ronnie Stoeferle, Barclays, Bloomberg

Japan | Yen Gains With Bank Stocks as Wages, BOJ Remarks Boost Hike Bets – Bloomberg

The yen climbed to a one-month high and Japanese bank shares rose after wage data and a Bank of Japan board member’s remarks bolstered speculation the authority will raise interest rates this month. Japanese government bonds extended their drop as data from an auction of 30-year debt indicated weak investor demand for long-maturity securities ahead of the expected BOJ shift. Policy-sensitive two-year notes also fell, with their yield climbing to 0.195%, the highest level since 2011.

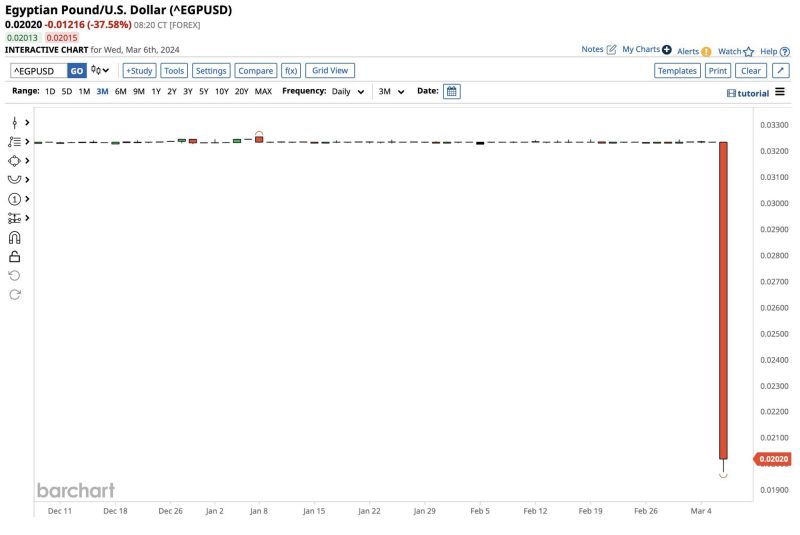

The Egyptian Pound is down 37% against the USD after switching to a flexible exchange rate

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks