Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

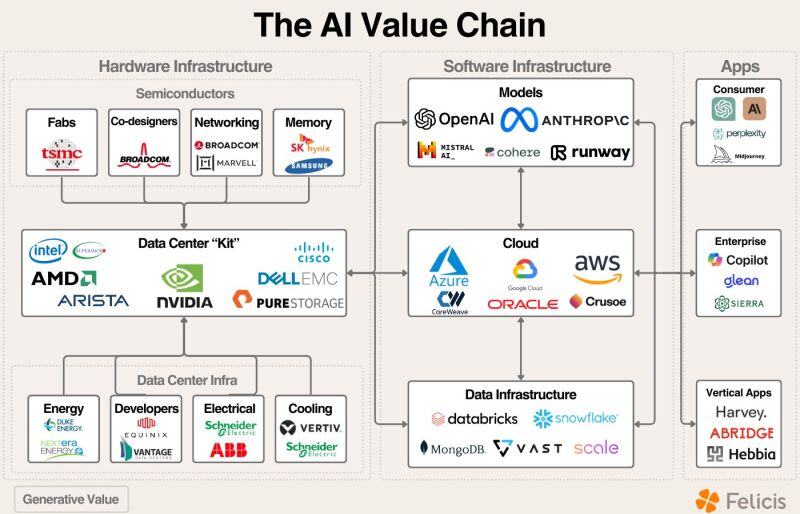

Mapping out the current state of AI markets by :

"Most value has accrued to the semiconductor ecosystem ($130B+ in revenue this year from AI) and the data center buildout (number of US data centers is expected to double in the next four years). Energy is a legitimate bottleneck to the data center buildout, and hyperscalers/developers are aggressively acquiring real estate with power availability. The cloud companies are at a ~$20B run rate, with Microsoft generating ~$5B of that. We’re seeing increasing interest in AI applications but little large scale value creation yet. The AI app layer will ultimately determine the value of the industry as the current infrastructure buildout will become a bubble without value creation on the back end". Source: @EricFlaningam, Felicis

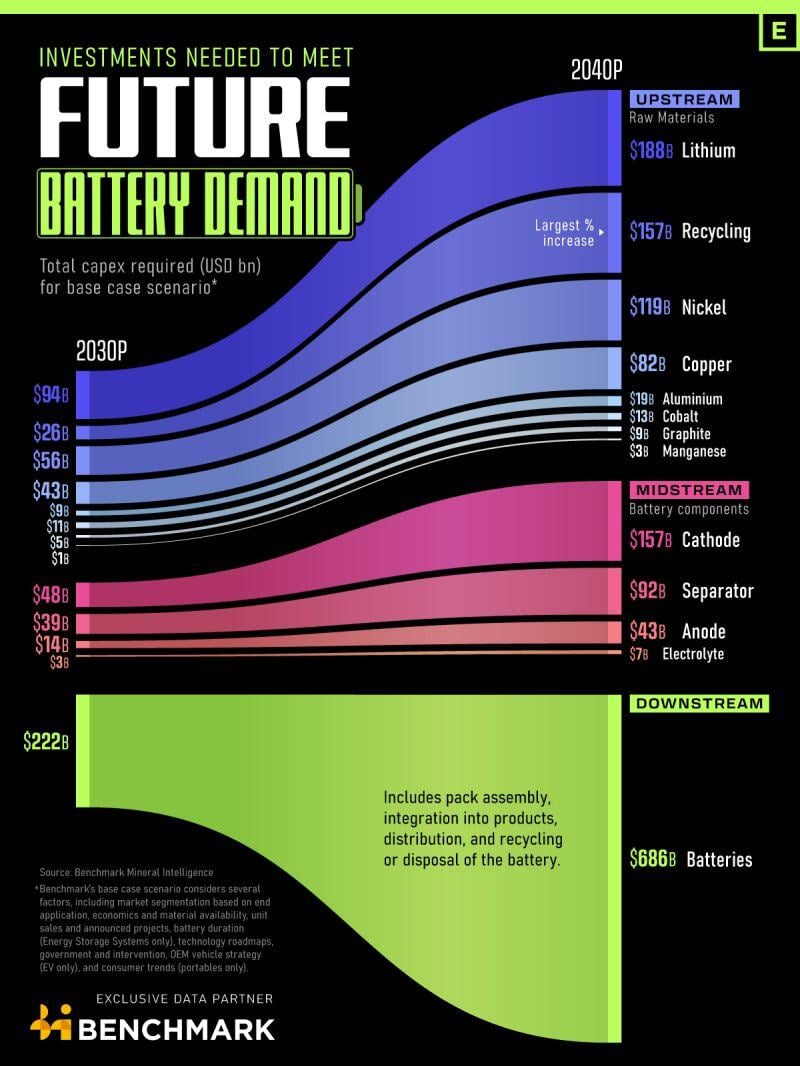

Estimated investments needed to meet battery demand

Source: Visual Capitalist

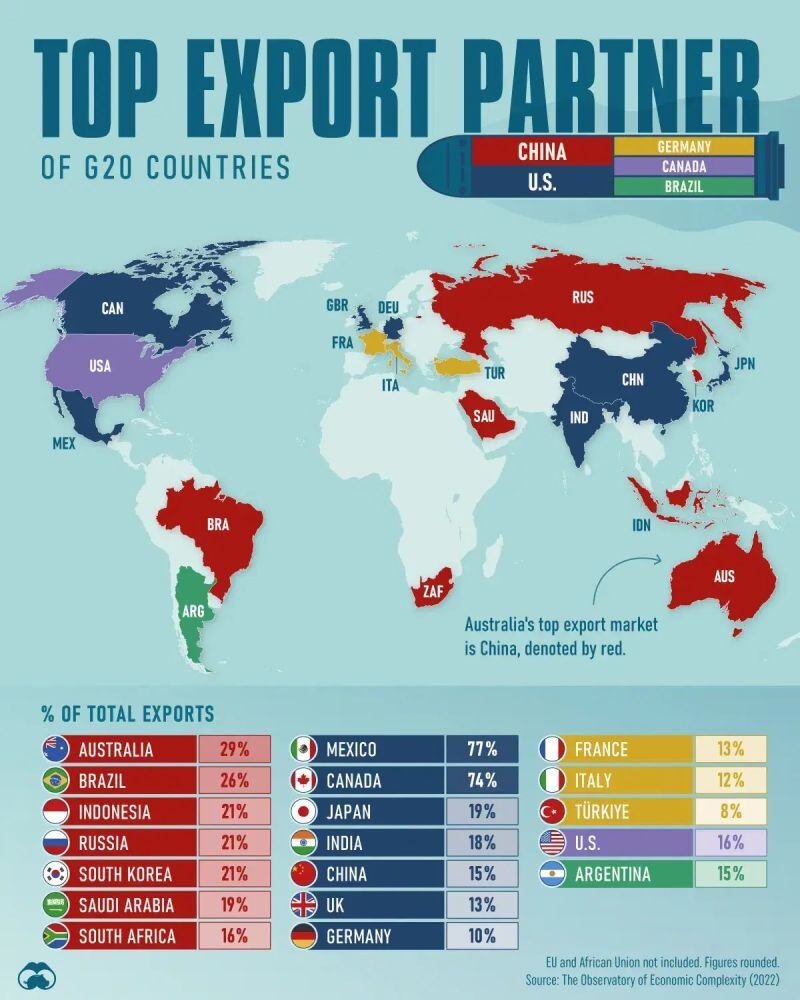

This Visual Capitalist graphic shows largest export market for each G20 member, based on share of goods exported;

data sourced from @OECtoday as of 2022 Key Takeaways •U.S. and China are primary export destinations for an equal number of G20 countries (7 each) •While U.S. is China’s top export market, reverse is not true, with U.S. sending its largest share (16% of its exports) to Canada Source: Liz Ann Sonders, Visual Capitalist

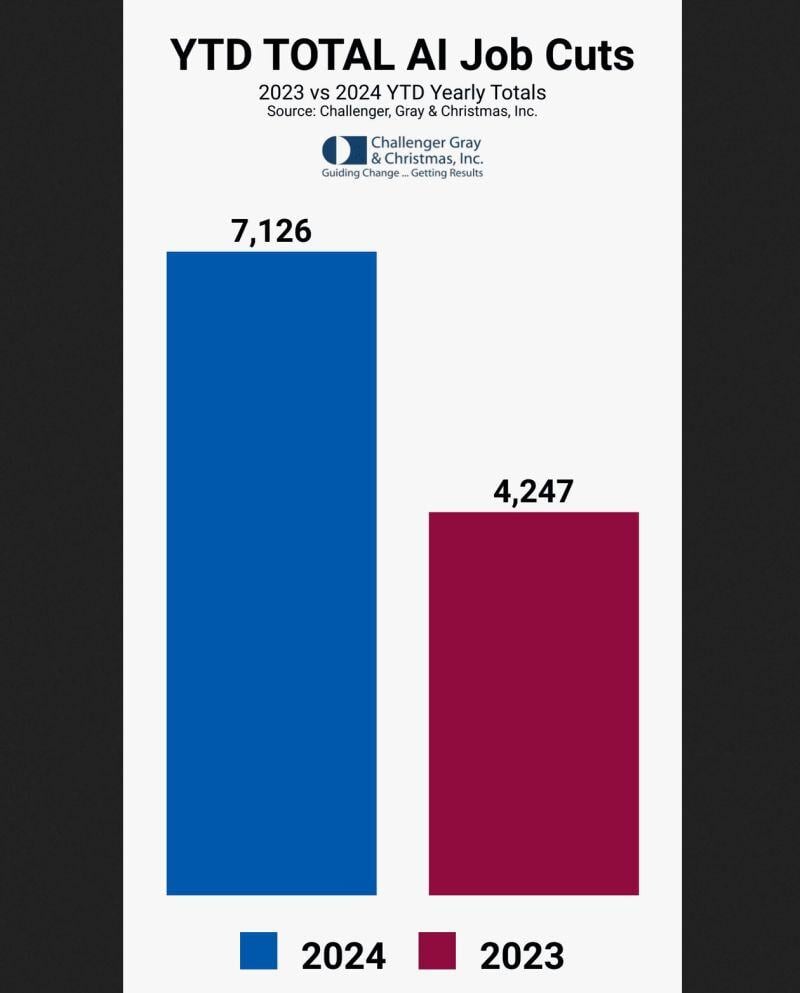

An increasing number of job cuts are also being attributed to AI in 2024 vs 2023

Source: Markets & Mayhem

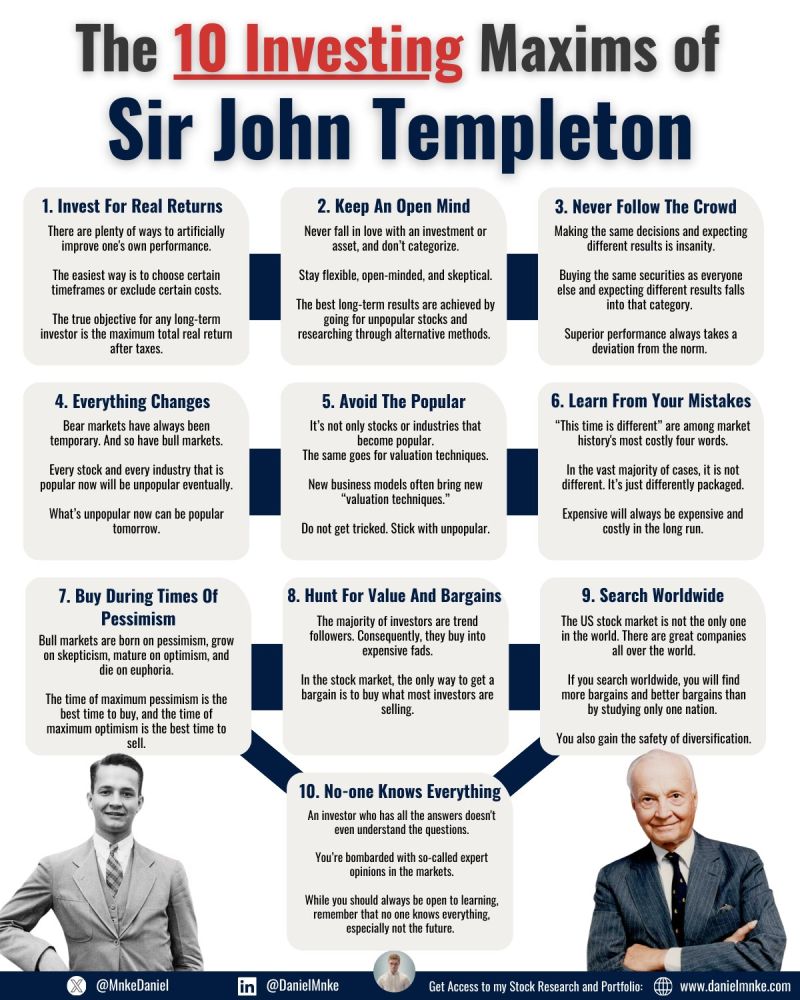

Sir John Templeton has been one of the most successful investors ever.

His investing career ranged over half a century. These were the 10 Maxims he invested by: Source: @MnkeDaniel on X

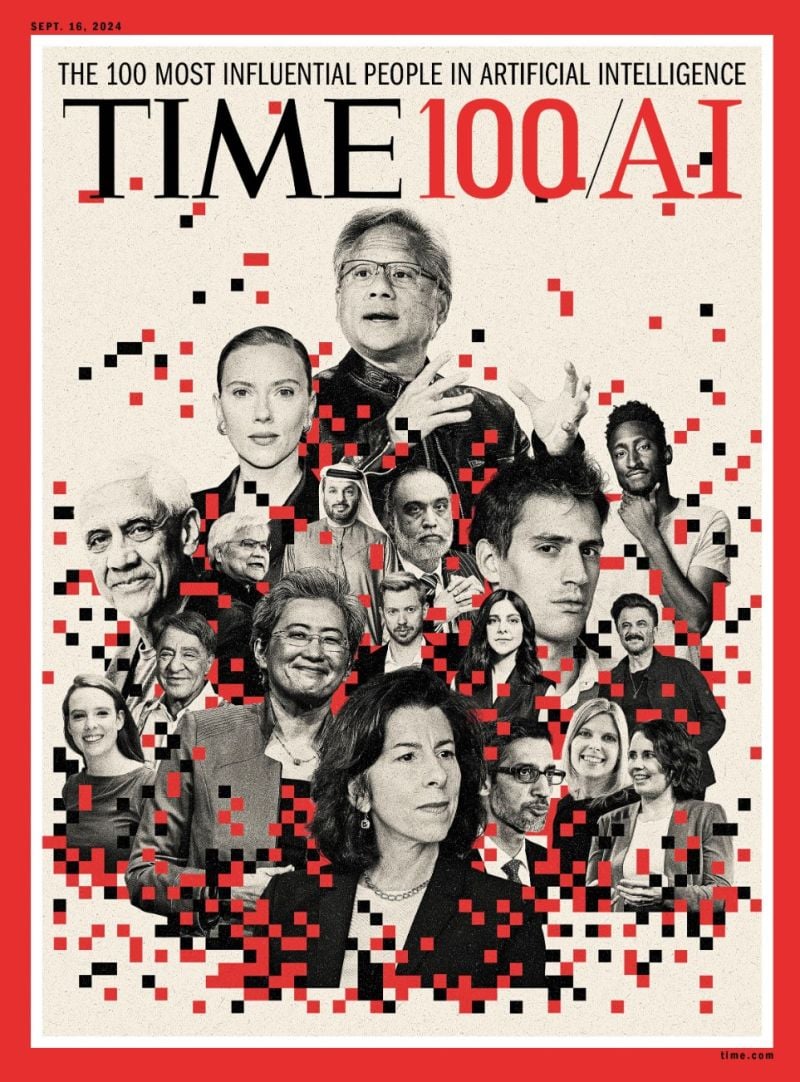

TIME's new cover: The 100 most influential people in AI

Note that Elon Musk is missing on this cover page while Scarlett Johansson appears nearby the CEO of Nvidia. Indeed, according to TIME, Scarlett Johansson is more influential in AI than Elon Musk...

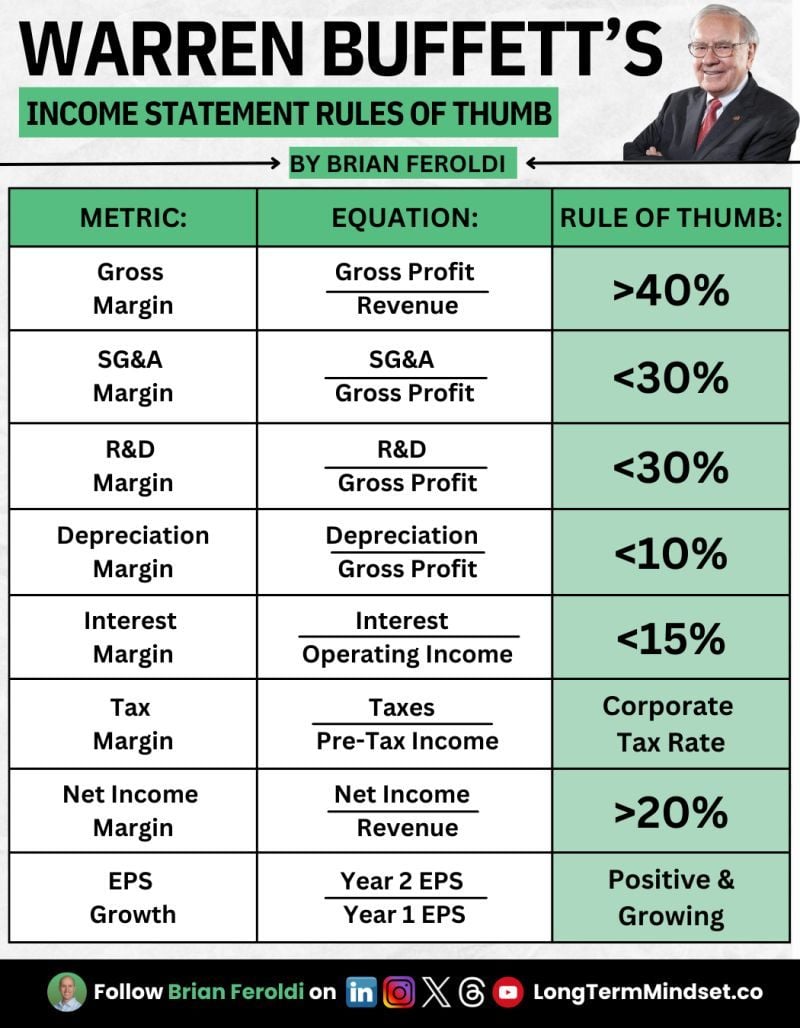

Warren Buffett’s Income Statement Rules of Thumb by Brian Feroldi

.

Investing with intelligence

Our latest research, commentary and market outlooks