Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- performance

- gold

- tech

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- banking

- oil

- Volatility

- china

- magnificent-7

- nasdaq

- apple

- emerging-markets

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- amazon

- microsoft

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

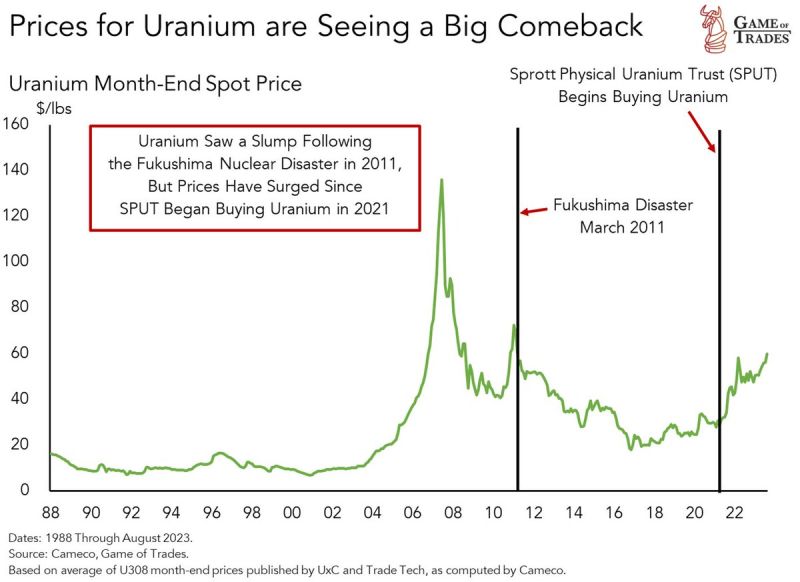

Uranium is back

The massive deficit + price insensitivity should be a solid tailwind Source: Game of trades

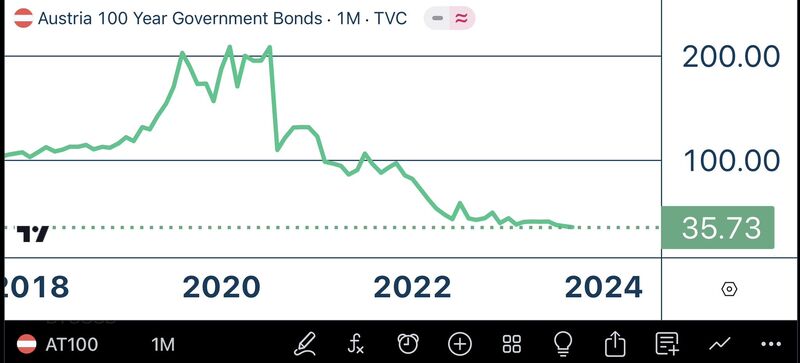

The Power of Duration! This is not the chart of an altcoin, this is the chart of Austria’s 100-year bond, down 82% from its 2021 peak!

Source: Jeroen Blokland

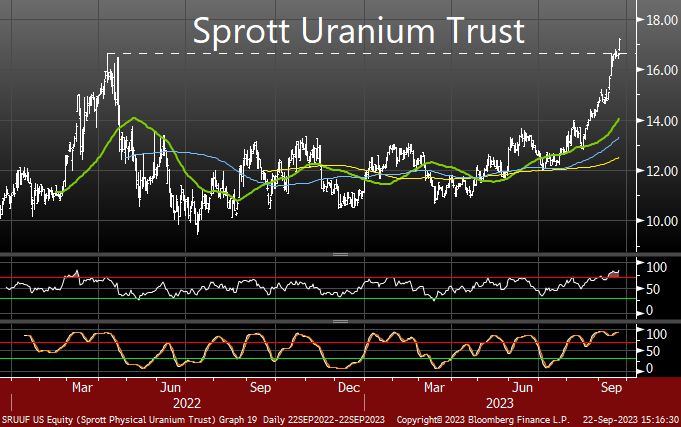

There is always a bull market somewhere... The Sprott Uranium Trust just broke a huge resistance

Source: Tony Greer

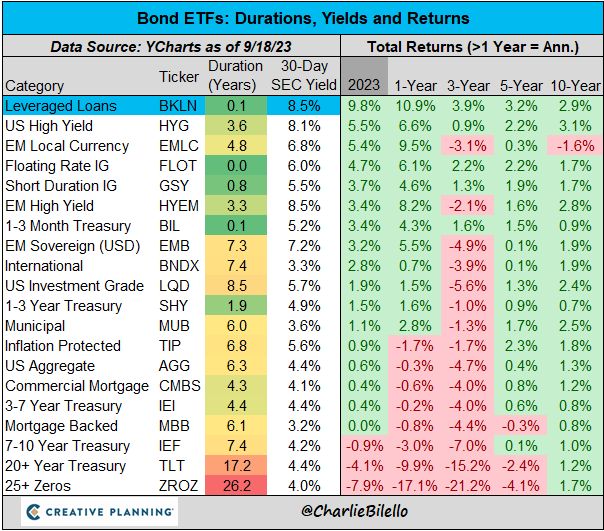

The best performing segment of the bond market this year? Leveraged Loans, up close to 10%. $BKLN

Source: Charlie Bilello

Heat map of the S&P 500's $SPY performance so far in 2023

Source: Evan, Bloomberg

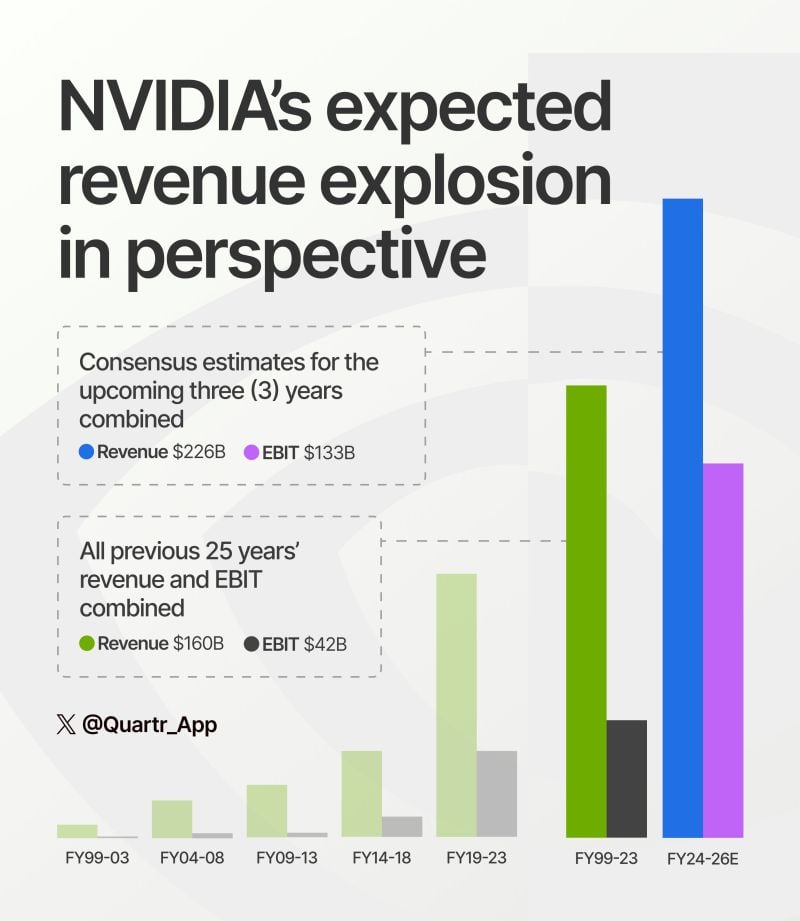

If analysts are correct, $NVDA will generate more revenue & EBIT over the upcoming three (3) years than in ALL its previous 25 years COMBINED.

Source: Quartr

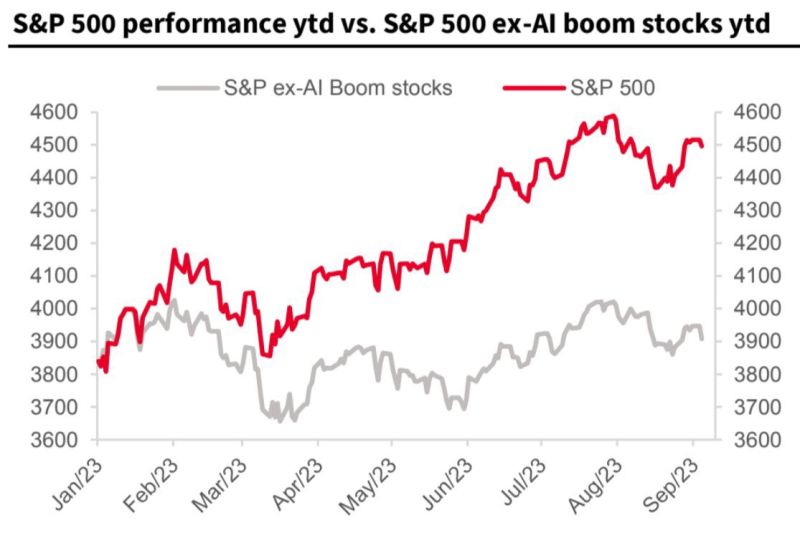

All S&P 500 gains this year came from the AI boom/mania, all other stocks are flat reflecting concerns about global economic slowdown

Source: Michael A. Arouet

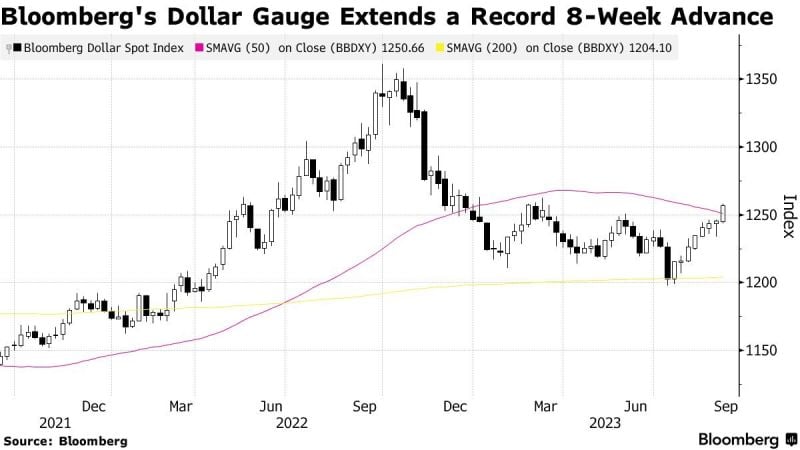

Bloomberg's Dollar Spot Index is on track for its 8th consecutive green week, its longest winning streak in history (with data going back to 2005)

Source: Barchart, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks