Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- performance

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- magnificent-7

- Volatility

- nasdaq

- apple

- emerging-markets

- energy

- china

- Alternatives

- switzerland

- tesla

- trading

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

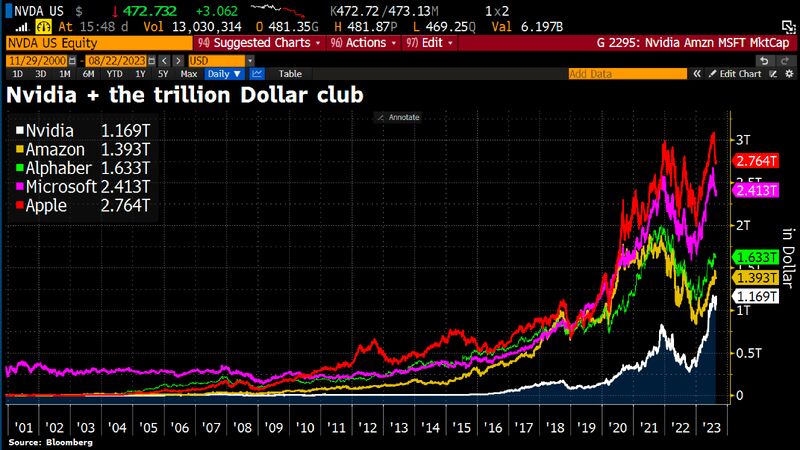

Hedge funds exposure to mega cap tech stocks reaches highest level EVER RECORDED

Source: Barchart, Bloomberg

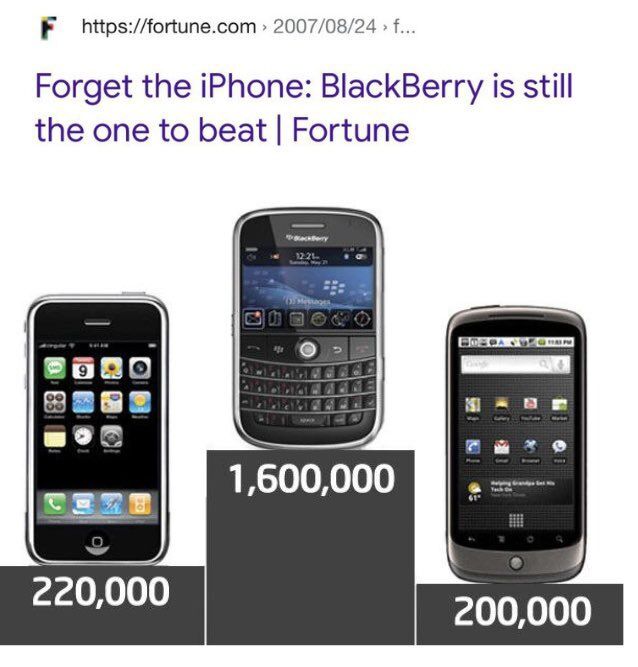

Nvidia establishes itself in the $1 trillion club. But expectations for Wednesday's numbers are immense

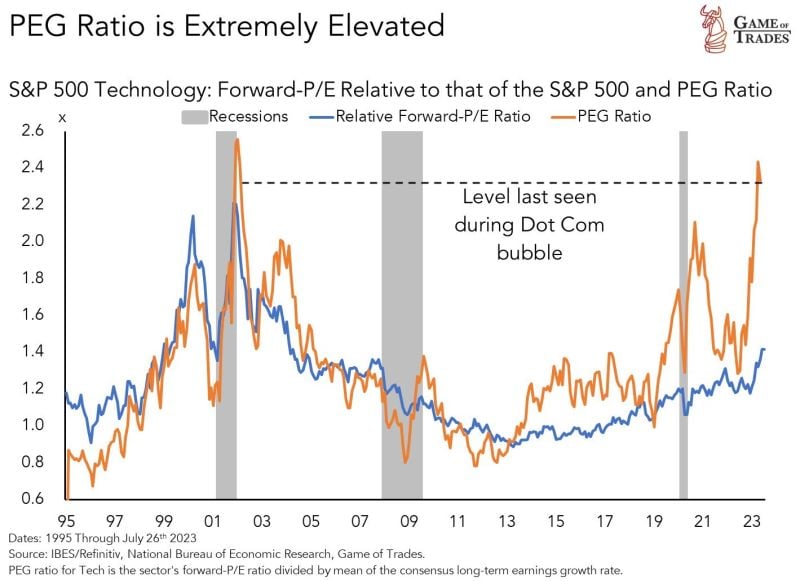

In Q1, Nvidia $NVDA crushed analysts’ revenue estimates by 10.4% as revenues rose 19% QoQ to $7.19 billion. The strong sequential growth was led by record data center revenue, primarily helped by accelerated computing as generative AI drove high demand for Nvidia’s products. For Q2, Nvidia is projecting revenues of $11B, up 68% QoQ, with a 400 bp increase in gross margins as AI takes center stage. The AI-hype has driven some stocks valuations to extreme levels. Nvidia is the most emblematic one among large-caps is with a P/E ratio which went from under 50x to 224x in just 8 months. Source: Bloomberg

‘SPDR S&P Semiconductor ETF’ has the highest 10-year returns at 24%.

They are closely followed by BlackRock’s 'iShares Semiconductor ETF’ at 23.3%. There is a clear pattern here where semiconductor and technology ETFs have achieved the highest returns over the last 10 years. Source: Genuine Impact

Investing with intelligence

Our latest research, commentary and market outlooks